Region:Asia

Author(s):Shubham

Product Code:KRAA0996

Pages:86

Published On:August 2025

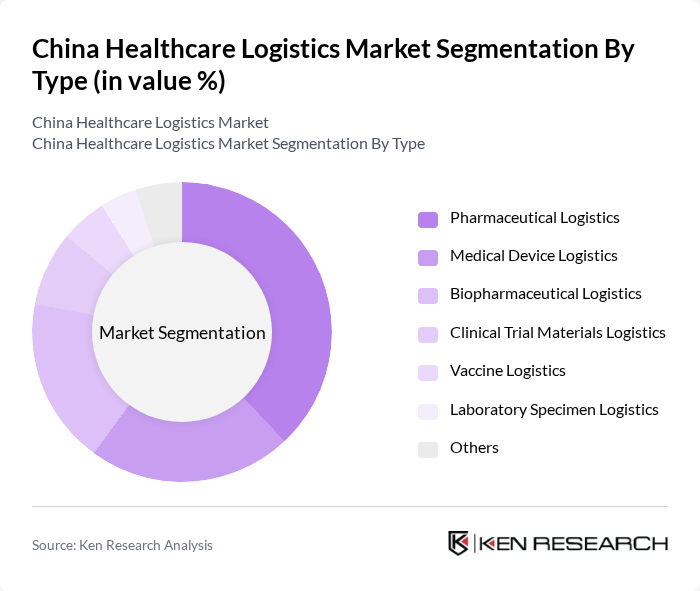

By Type:The market is segmented into Pharmaceutical Logistics, Medical Device Logistics, Biopharmaceutical Logistics, Clinical Trial Materials Logistics, Vaccine Logistics, Laboratory Specimen Logistics, and Others. Among these, Pharmaceutical Logistics is the most significant segment, driven by the increasing demand for prescription medications and over-the-counter drugs. The rise in chronic diseases and an aging population have further fueled the need for efficient pharmaceutical distribution .

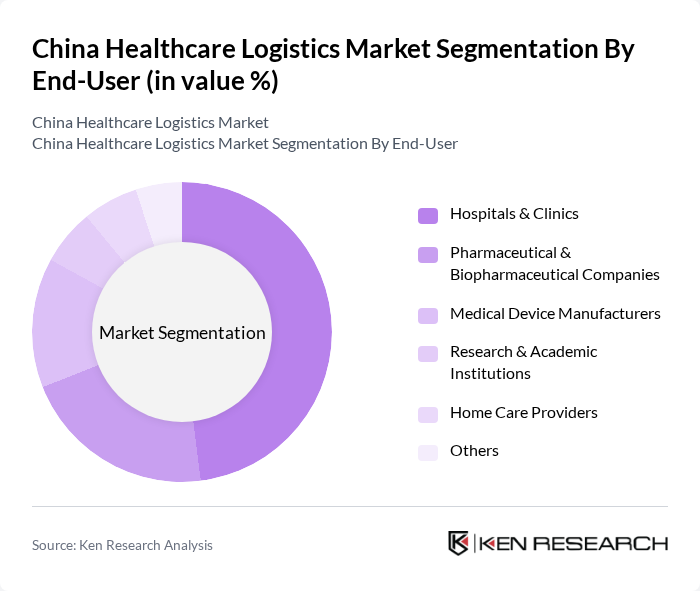

By End-User:The end-user segmentation includes Hospitals & Clinics, Pharmaceutical & Biopharmaceutical Companies, Medical Device Manufacturers, Research & Academic Institutions, Home Care Providers, and Others. Hospitals & Clinics represent the largest segment, as they require a constant supply of medical products and pharmaceuticals to provide effective patient care. The increasing number of healthcare facilities and the growing focus on patient-centric services are driving this segment's growth .

The China Healthcare Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sinotrans Limited, China National Pharmaceutical Group (Sinopharm Logistics), Shanghai Pharmaceuticals Holding Co., Ltd., YTO Express Group Co., Ltd., JD Logistics, SF Express, DHL Supply Chain (China), Kuehne + Nagel (China), DB Schenker (China), UPS Healthcare (China), CEVA Logistics (China), Kerry Logistics Network, China Post Express Logistics, Nippon Express (China), Geodis (China) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the China healthcare logistics market appears promising, driven by ongoing technological advancements and increasing healthcare demands. As the sector embraces automation and AI integration, operational efficiencies are expected to improve significantly. Additionally, the focus on sustainability will likely shape logistics practices, with companies adopting eco-friendly solutions. These trends indicate a robust evolution in logistics strategies, positioning the market for substantial growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Pharmaceutical Logistics Medical Device Logistics Biopharmaceutical Logistics Clinical Trial Materials Logistics Vaccine Logistics Laboratory Specimen Logistics Others |

| By End-User | Hospitals & Clinics Pharmaceutical & Biopharmaceutical Companies Medical Device Manufacturers Research & Academic Institutions Home Care Providers Others |

| By Distribution Mode | Road Transportation Air Transportation Rail Transportation Sea Transportation Last-Mile Delivery Others |

| By Service Type | Warehousing & Storage Services Transportation & Distribution Services Value-Added Services (Packaging, Labeling, Kitting) Cold Chain Services Inventory Management Others |

| By Packaging Type | Temperature-Controlled Packaging Ambient Packaging Custom Packaging Others |

| By Payment Model | Fee-for-Service Subscription-Based Pay-Per-Use Others |

| By Technology Integration | IoT-Enabled Logistics Blockchain in Logistics AI and Machine Learning Applications Automation & Robotics Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Supply Chain Management | 60 | Logistics Managers, Supply Chain Directors |

| Pharmaceutical Distribution Logistics | 50 | Operations Managers, Compliance Officers |

| Medical Device Logistics | 40 | Procurement Officers, Warehouse Managers |

| Healthcare Waste Management | 40 | Sustainability Officers, Facility Managers |

| Telehealth Supply Chain Integration | 45 | eHealth Managers, IT Logistics Coordinators |

The China Healthcare Logistics Market is valued at approximately USD 12 billion, reflecting a five-year historical analysis of the healthcare third-party logistics sector, driven by increasing demand for efficient healthcare services and the expansion of healthcare infrastructure.