Region:Middle East

Author(s):Shubham

Product Code:KRAA0844

Pages:95

Published On:August 2025

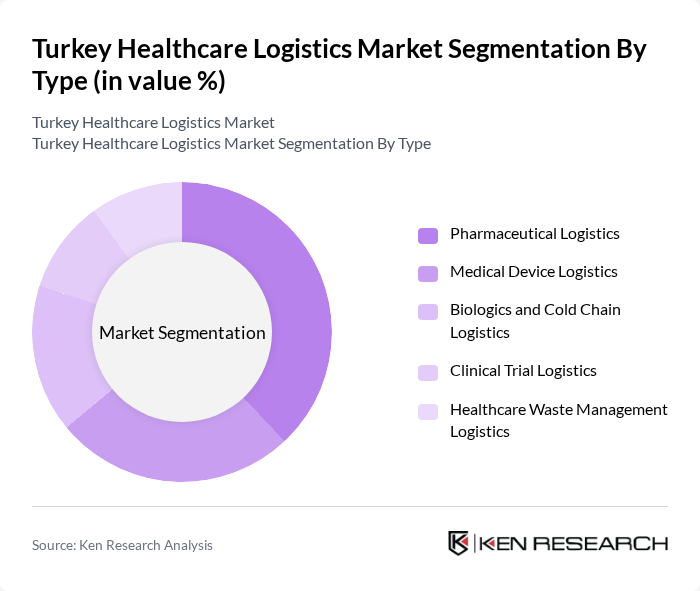

By Type:The Turkey Healthcare Logistics Market is segmented into Pharmaceutical Logistics, Medical Device Logistics, Biologics and Cold Chain Logistics, Clinical Trial Logistics, and Healthcare Waste Management Logistics. Pharmaceutical Logistics remains the most significant segment, driven by the increasing demand for pharmaceuticals, the rise in chronic diseases, and the need for robust, temperature-controlled distribution networks to ensure timely and safe delivery to healthcare providers. Cold chain logistics is also expanding rapidly due to the growing importance of biologics and vaccines .

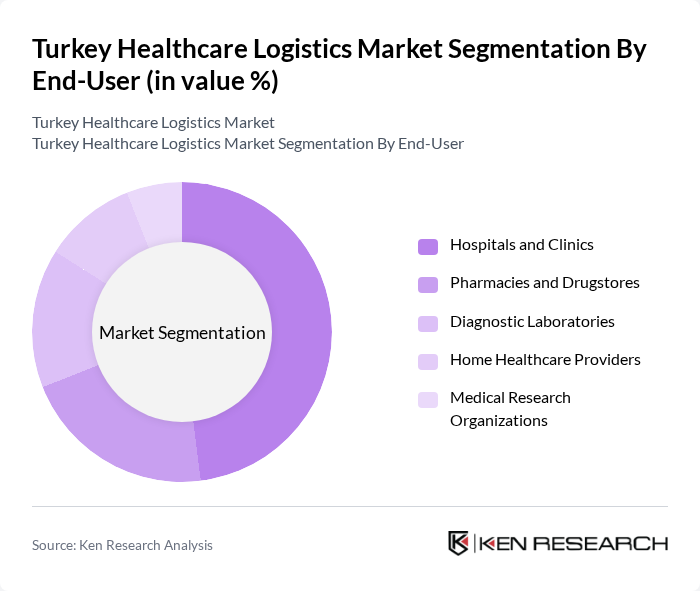

By End-User:The market is also segmented by end-users, including Hospitals and Clinics, Pharmacies and Drugstores, Diagnostic Laboratories, Home Healthcare Providers, and Medical Research Organizations. Hospitals and Clinics represent the largest end-user segment, supported by the growing number of healthcare facilities, increased patient volumes, and the need for efficient logistics solutions to manage complex supply chains. Pharmacies and drugstores are also significant due to the expansion of retail healthcare and direct-to-patient delivery models .

The Turkey Healthcare Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain Turkey, Kuehne + Nagel Turkey, DB Schenker Arkas, CEVA Logistics Turkey, Borusan Lojistik, Ekol Logistics, Mars Logistics, UPS Healthcare Turkey, Horoz Logistics, Al??an Logistics, Barsan Global Logistics, Yusen Logistics Turkey, DSV Solutions Turkey, Medlog Logistics, Arvato Supply Chain Solutions Turkey contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Turkey healthcare logistics market appears promising, driven by ongoing technological advancements and government support. As telemedicine services expand, logistics providers will need to adapt to new delivery models, ensuring efficient supply chains. Additionally, the growth of biopharmaceutical logistics will create new opportunities for specialized transportation and storage solutions. The focus on patient-centric logistics will further enhance service delivery, making the sector more responsive to healthcare needs in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Pharmaceutical Logistics Medical Device Logistics Biologics and Cold Chain Logistics Clinical Trial Logistics Healthcare Waste Management Logistics |

| By End-User | Hospitals and Clinics Pharmacies and Drugstores Diagnostic Laboratories Home Healthcare Providers Medical Research Organizations |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) E-commerce and Online Platforms Wholesale Distribution |

| By Service Type | Transportation (Road, Air, Sea, Rail) Warehousing and Storage Inventory and Order Management Value-Added Services (Packaging, Labelling, Kitting) |

| By Packaging Type | Standard Packaging Temperature-Controlled Packaging Hazardous Material Packaging Tamper-Evident Packaging |

| By Payment Method | Cash on Delivery Credit/Debit Cards Online Payment Systems Bank Transfers |

| By Regulatory Compliance | ISO Certification Good Distribution Practice (GDP) Good Manufacturing Practice (GMP) Hazard Analysis and Critical Control Points (HACCP) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Logistics Management | 60 | Logistics Managers, Supply Chain Coordinators |

| Pharmaceutical Distribution | 50 | Distribution Managers, Operations Directors |

| Medical Equipment Supply Chain | 40 | Procurement Officers, Inventory Managers |

| Healthcare Waste Management | 40 | Sustainability Officers, Compliance Managers |

| Telehealth Logistics Solutions | 50 | eHealth Managers, Technology Officers |

The Turkey Healthcare Logistics Market is valued at approximately USD 2.3 billion, driven by the increasing demand for efficient supply chain solutions in the healthcare sector, particularly due to the rise in chronic diseases and the expansion of pharmaceutical distribution.