Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA1943

Pages:95

Published On:August 2025

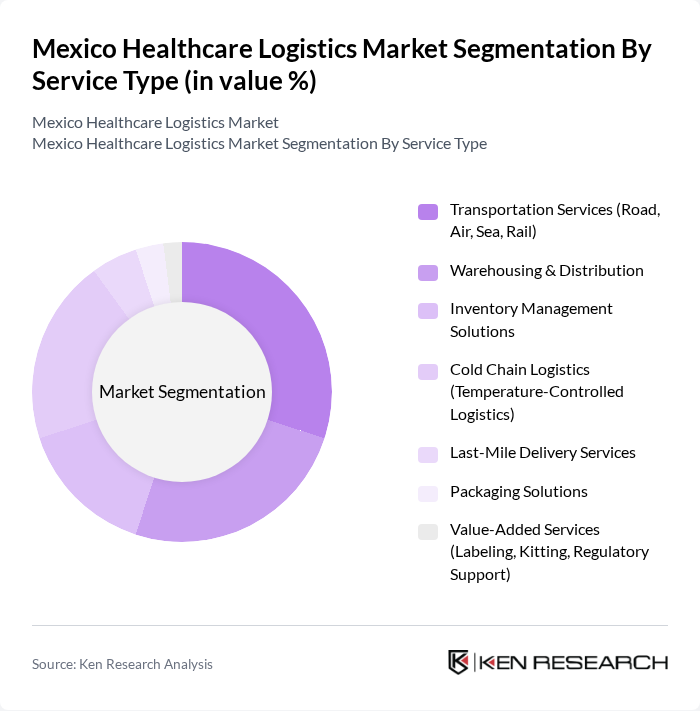

By Service Type:The service type segmentation includes a comprehensive range of logistics services tailored to the healthcare sector. The primary subsegments are Transportation Services (Road, Air, Sea, Rail), Warehousing & Distribution, Inventory Management Solutions, Cold Chain Logistics (Temperature-Controlled Logistics), Last-Mile Delivery Services, Packaging Solutions, and Value-Added Services (Labeling, Kitting, Regulatory Support). Each service is essential for maintaining product integrity, regulatory compliance, and efficient delivery to healthcare providers and patients .

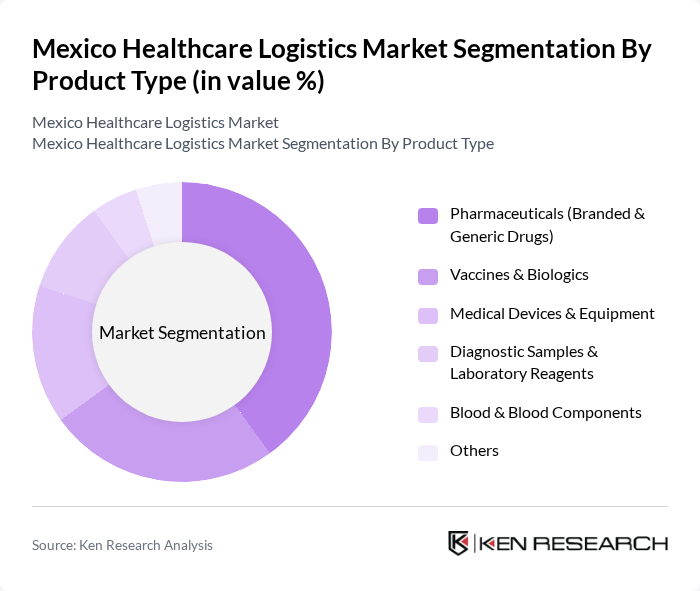

By Product Type:The product type segmentation covers a wide spectrum of healthcare products requiring specialized logistics. Subsegments include Pharmaceuticals (Branded & Generic Drugs), Vaccines & Biologics, Medical Devices & Equipment, Diagnostic Samples & Laboratory Reagents, Blood & Blood Components, and Others. Each category demands tailored handling, temperature management, and security protocols to maintain product safety and efficacy throughout the supply chain .

The Mexico Healthcare Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain Mexico, FedEx Express México, UPS Healthcare México, Kuehne + Nagel México, DB Schenker México, XPO Logistics México, Cardinal Health México, Medline Industries México, Owens & Minor México, AmerisourceBergen México, McKesson México, Farmacias del Ahorro (Grupo Comercial e Industrial Marzam, S.A. de C.V.), Grupo Casa Saba, S.A. de C.V., Nadro, S.A.P.I. de C.V., and Farmacias Guadalajara contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Mexico healthcare logistics market appears promising, driven by ongoing technological advancements and government support. As the demand for integrated logistics solutions increases, providers are likely to adopt AI and automation to enhance efficiency. Additionally, the emphasis on sustainability practices will shape logistics strategies, ensuring environmentally friendly operations. The growth of last-mile delivery services will also play a crucial role in improving access to healthcare, particularly in underserved areas, thereby enhancing overall service delivery.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Transportation Services (Road, Air, Sea, Rail) Warehousing & Distribution Inventory Management Solutions Cold Chain Logistics (Temperature-Controlled Logistics) Last-Mile Delivery Services Packaging Solutions Value-Added Services (Labeling, Kitting, Regulatory Support) |

| By Product Type | Pharmaceuticals (Branded & Generic Drugs) Vaccines & Biologics Medical Devices & Equipment Diagnostic Samples & Laboratory Reagents Blood & Blood Components Others |

| By End-User | Hospitals & Clinics Pharmacies & Drug Stores Biopharmaceutical Companies Medical Device Manufacturers Research Institutions & Laboratories Home Healthcare Providers Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL/4PL) E-commerce Platforms Retail Distribution Others |

| By Packaging Type | Temperature-Controlled Packaging Standard Packaging Custom Packaging Solutions Sustainable/Eco-Friendly Packaging Others |

| By Compliance Type | Regulatory Compliance (COFEPRIS, NOM, GDP, GSP) Quality Assurance Compliance Safety Compliance Others |

| By Application | Medicine Vaccines Blood Products Medical Devices Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Distribution Logistics | 100 | Logistics Managers, Supply Chain Directors |

| Medical Equipment Supply Chain | 60 | Operations Managers, Procurement Officers |

| Hospital Supply Chain Management | 50 | Healthcare Administrators, Supply Chain Analysts |

| Home Healthcare Delivery Systems | 40 | Logistics Coordinators, Healthcare Providers |

| Telehealth Logistics Support | 40 | IT Managers, Telehealth Coordinators |

The Mexico Healthcare Logistics Market is valued at approximately USD 2.2 billion, driven by increasing demand for efficient healthcare services, a rise in chronic diseases, and the expansion of the pharmaceutical sector.