South Africa Healthcare Logistics Market Overview

- The South Africa Healthcare Logistics Market is valued at USD 2.1 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for efficient healthcare delivery systems, the rise in chronic diseases, and the expansion of the pharmaceutical and biopharmaceutical sectors. The logistics sector is crucial for ensuring timely and safe delivery of medical supplies, with heightened importance following the COVID-19 pandemic and the ongoing need for robust cold chain solutions and digital supply chain management .

- Key cities such as Johannesburg, Cape Town, and Durban dominate the South Africa Healthcare Logistics Market due to their well-established transport and warehousing infrastructure, proximity to major healthcare facilities, and concentration of pharmaceutical and medical device companies. These urban centers serve as critical logistical hubs, enabling efficient distribution networks for both domestic and international supply chains .

- In 2023, the South African government enacted the National Health Insurance (NHI) Bill, aimed at providing universal health coverage. This regulation underscores the need for efficient healthcare logistics to ensure equitable access to medical supplies and services across the country, further strengthening the role of logistics providers in supporting the national healthcare system .

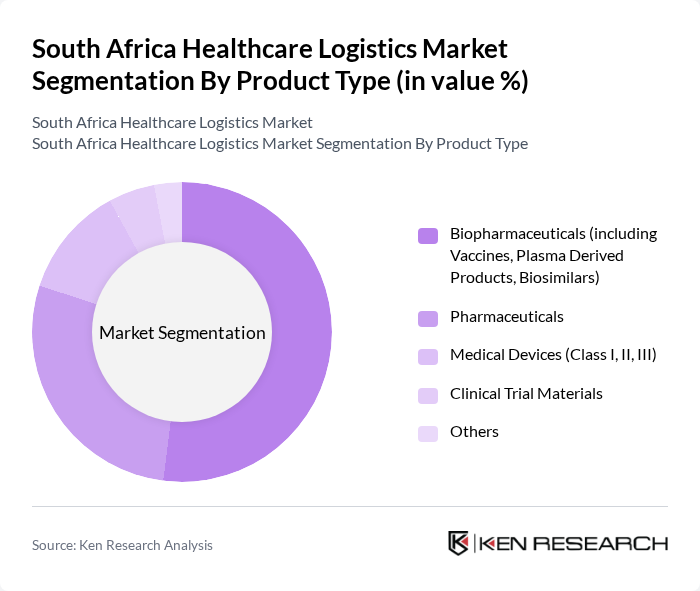

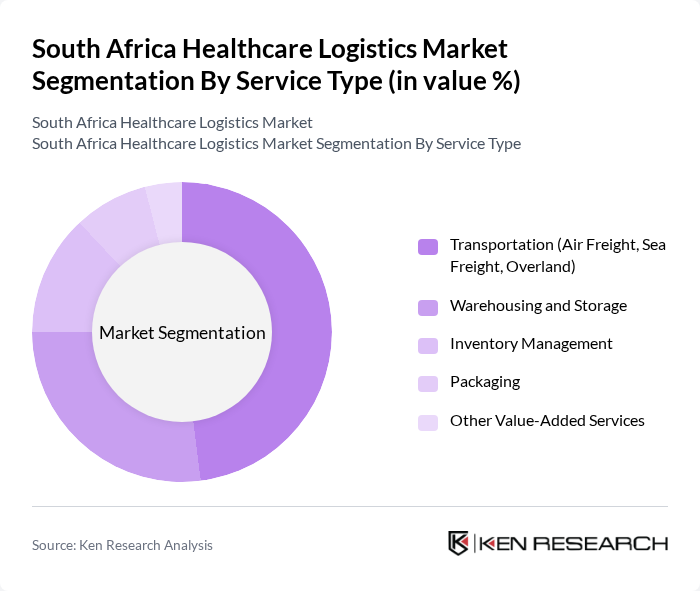

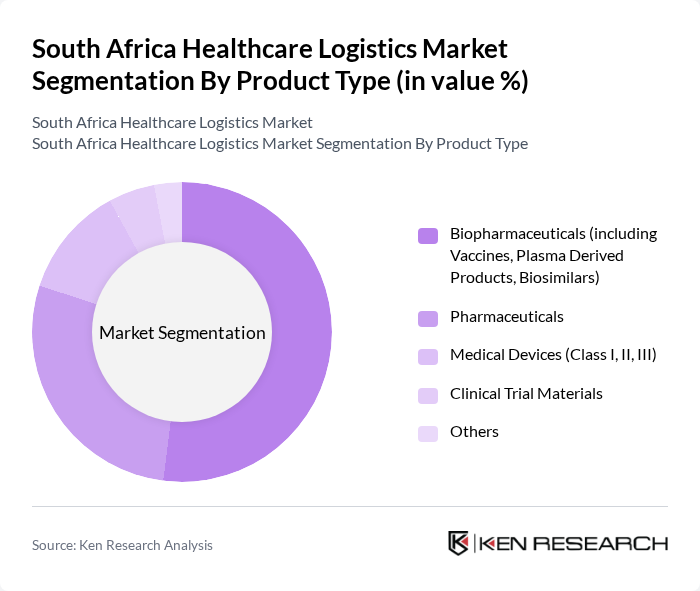

South Africa Healthcare Logistics Market Segmentation

By Product Type:The product type segmentation includes Biopharmaceuticals (including Vaccines, Plasma Derived Products, Biosimilars), Pharmaceuticals, Medical Devices (Class I, II, III), Clinical Trial Materials, and Others. Biopharmaceuticals currently lead the market, driven by the increasing demand for vaccines, plasma-derived products, and biosimilars, especially in response to public health challenges and the growing need for advanced therapies. The sector is further supported by the rise in chronic diseases and a shift toward personalized medicine .

By Service Type:The service type segmentation covers Transportation (Air Freight, Sea Freight, Overland), Warehousing and Storage, Inventory Management, Packaging, and Other Value-Added Services. Transportation services represent the largest segment, propelled by the need for timely delivery of temperature-sensitive and high-value medical products, and the increasing reliance on air and cold chain logistics for urgent and specialty shipments. The growth of e-commerce and digital healthcare channels is also expanding the demand for advanced logistics services in the sector .

South Africa Healthcare Logistics Market Competitive Landscape

The South Africa Healthcare Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Imperial Logistics, Bidvest International Logistics, DHL Supply Chain South Africa, Kuehne + Nagel South Africa, Medlog South Africa, Transnet Freight Rail, Pharmalex, Life Healthcare, Netcare, Aspen Pharmacare, Adcock Ingram, Clicks Group, Dis-Chem Pharmacies, MediRite, and DSV South Africa contribute to innovation, geographic expansion, and service delivery in this space.

South Africa Healthcare Logistics Market Industry Analysis

Growth Drivers

- Increasing Demand for Healthcare Services:The South African healthcare sector is experiencing a significant surge in demand, driven by a population of approximately 60 million people and a growing prevalence of chronic diseases. In future, healthcare expenditure is projected to reach ZAR 550 billion, reflecting a 10% increase from the previous year. This rising demand necessitates efficient logistics solutions to ensure timely delivery of medical supplies and pharmaceuticals, thereby propelling the healthcare logistics market forward.

- Technological Advancements in Logistics:The integration of advanced technologies such as IoT and AI in logistics operations is transforming the healthcare supply chain in South Africa. In future, investments in logistics technology are expected to exceed ZAR 2.2 billion, enhancing tracking, inventory management, and operational efficiency. These advancements facilitate real-time monitoring of shipments, ensuring that healthcare providers receive critical supplies promptly, thus driving market growth in the logistics sector.

- Government Initiatives for Healthcare Improvement:The South African government is actively investing in healthcare infrastructure, with a budget allocation of ZAR 220 billion for health services in future. Initiatives such as the National Health Insurance aim to improve access to healthcare, which in turn increases the demand for efficient logistics services. This government support is crucial for enhancing the overall healthcare logistics framework, fostering growth in the sector.

Market Challenges

- Infrastructure Limitations:South Africa's logistics infrastructure faces significant challenges, including inadequate road networks and limited cold chain facilities. In future, it is estimated that only 35% of the required cold chain infrastructure is operational, leading to inefficiencies in the distribution of temperature-sensitive pharmaceuticals. These limitations hinder the ability to meet the growing demand for healthcare logistics services, posing a substantial challenge to market growth.

- Regulatory Compliance Issues:The healthcare logistics sector in South Africa is subject to stringent regulations, including the Medicines and Related Substances Act. Compliance costs are projected to rise to ZAR 1.1 billion in future, creating a financial burden for logistics providers. Navigating these complex regulatory landscapes can lead to delays and increased operational costs, which may deter investment and hinder market expansion.

South Africa Healthcare Logistics Market Future Outlook

The South African healthcare logistics market is poised for transformative growth, driven by technological innovations and increased government support. As telehealth services expand, logistics providers will need to adapt to new delivery models, enhancing their operational capabilities. Additionally, the focus on sustainable practices will shape logistics strategies, promoting eco-friendly solutions. The integration of data analytics and automation will further streamline operations, ensuring that healthcare providers can meet the rising demand for efficient and reliable logistics services.

Market Opportunities

- Expansion of Telehealth Services:The rise of telehealth services presents a unique opportunity for logistics providers to develop specialized delivery solutions. With an estimated 6 million telehealth consultations expected in future, logistics companies can capitalize on this trend by offering tailored services that ensure timely delivery of medical supplies and prescriptions to patients' homes.

- Growth in Cold Chain Logistics:The increasing demand for temperature-sensitive pharmaceuticals creates a significant opportunity for cold chain logistics. With the market for cold chain logistics projected to grow to ZAR 12 billion by future, logistics providers can invest in advanced cold storage and transportation solutions to meet the stringent requirements of the pharmaceutical industry, enhancing their service offerings.