Region:Central and South America

Author(s):Shubham

Product Code:KRAA0755

Pages:92

Published On:August 2025

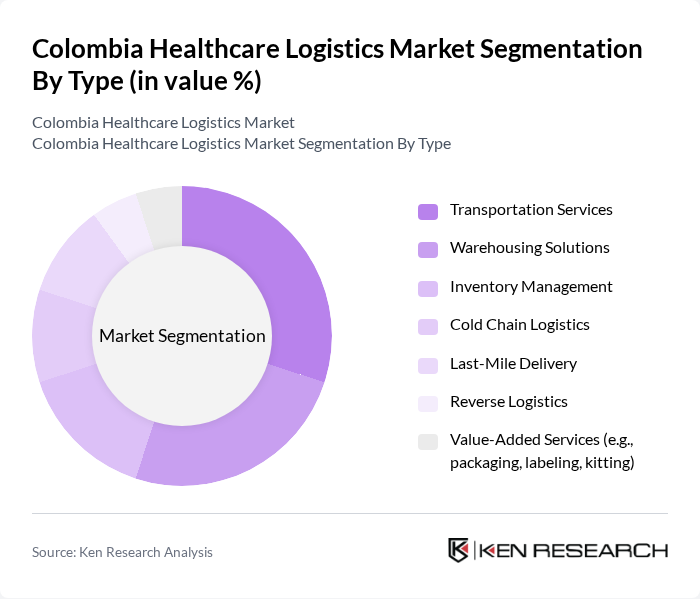

By Type:The healthcare logistics market in Colombia is segmented into transportation services, warehousing solutions, inventory management, cold chain logistics, last-mile delivery, reverse logistics, and value-added services. Transportation services encompass road, air, and specialized medical transport. Warehousing solutions include temperature-controlled and general storage, while inventory management focuses on real-time tracking and stock optimization. Cold chain logistics is critical for pharmaceuticals, vaccines, and biologics, ensuring temperature-sensitive products maintain quality. Last-mile delivery addresses the final leg of distribution to hospitals, clinics, and patients. Reverse logistics manages the return and safe disposal of expired or recalled products. Value-added services include packaging, labeling, and kitting tailored to healthcare requirements .

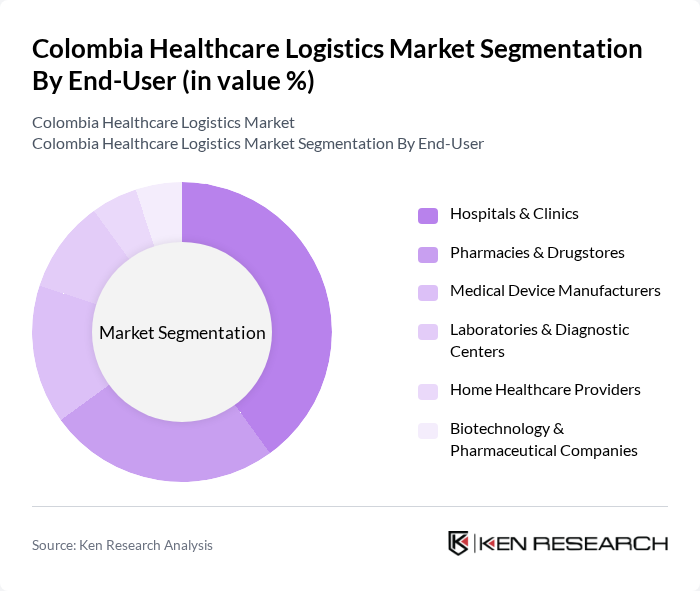

By End-User:End-users in the Colombian healthcare logistics market include hospitals & clinics, pharmacies & drugstores, medical device manufacturers, laboratories & diagnostic centers, home healthcare providers, and biotechnology & pharmaceutical companies. Hospitals and clinics require reliable supply chains for pharmaceuticals, devices, and consumables. Pharmacies and drugstores depend on frequent, timely deliveries to meet patient needs. Medical device manufacturers and laboratories require specialized handling and regulatory compliance. Home healthcare providers increasingly demand direct-to-patient delivery, while biotechnology and pharmaceutical companies need robust cold chain and distribution solutions for sensitive products .

The Colombia Healthcare Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grupo Logístico Andreani Colombia, DHL Supply Chain Colombia, TCC S.A., Servientrega, Coordinadora Mercantil, Logística de Salud S.A.S., Farmalogística S.A.S., FedEx Express Colombia, UPS Colombia, Interrapidísimo, Pharma Logistics Group, Logística y Distribución de Medicamentos S.A.S., Grupo Senda, APM Terminals Colombia, and Envía Colvanes contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Colombian healthcare logistics market appears promising, driven by ongoing investments in technology and infrastructure. As the government continues to prioritize healthcare improvements, logistics providers are likely to adopt integrated solutions that enhance efficiency. Additionally, the rise of telehealth services is expected to create new logistics demands, necessitating innovative delivery models. These trends will likely foster a more resilient and responsive healthcare logistics ecosystem, ultimately improving patient outcomes and operational effectiveness.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Services Warehousing Solutions Inventory Management Cold Chain Logistics Last-Mile Delivery Reverse Logistics Value-Added Services (e.g., packaging, labeling, kitting) |

| By End-User | Hospitals & Clinics Pharmacies & Drugstores Medical Device Manufacturers Laboratories & Diagnostic Centers Home Healthcare Providers Biotechnology & Pharmaceutical Companies |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) E-commerce & Direct-to-Patient Delivery Hybrid Models |

| By Service Type | Freight Transportation (Road, Air, Sea) Supply Chain Management Consulting & Compliance Services Cold Chain Monitoring & Validation |

| By Packaging Type | Standard Packaging Temperature-Controlled Packaging Custom & Specialized Packaging Sustainable Packaging |

| By Payment Method | Credit/Debit Cards Bank Transfers Mobile Payments Invoice/Billing Agreements |

| By Policy Support | Subsidies for Logistics Providers Tax Incentives for Healthcare Logistics Regulatory Support for Innovation Public-Private Partnerships |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Distribution Logistics | 100 | Logistics Managers, Supply Chain Coordinators |

| Medical Equipment Supply Chain | 80 | Operations Directors, Procurement Managers |

| Hospital Logistics Management | 70 | Facility Managers, Inventory Control Specialists |

| Healthcare Waste Management | 50 | Environmental Health Officers, Compliance Managers |

| Telehealth Logistics Support | 40 | IT Managers, Telehealth Coordinators |

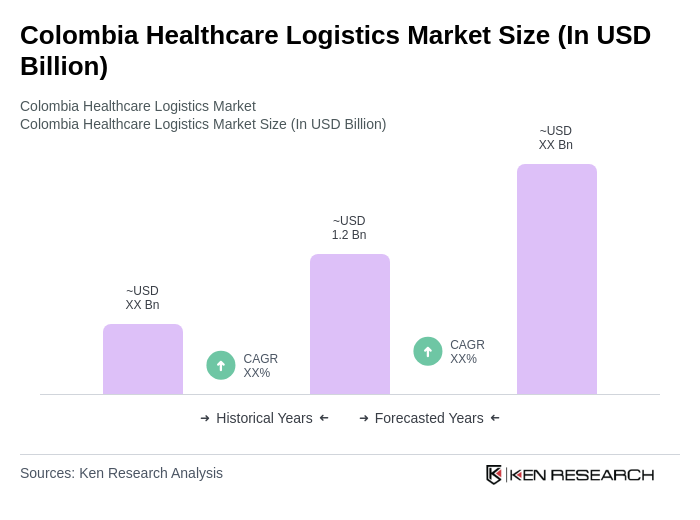

The Colombia Healthcare Logistics Market is valued at approximately USD 1.2 billion, driven by increasing demand for efficient healthcare services, the rise in chronic diseases, and the expansion of the pharmaceutical and medical device sectors.