Region:Asia

Author(s):Dev

Product Code:KRAA0487

Pages:91

Published On:August 2025

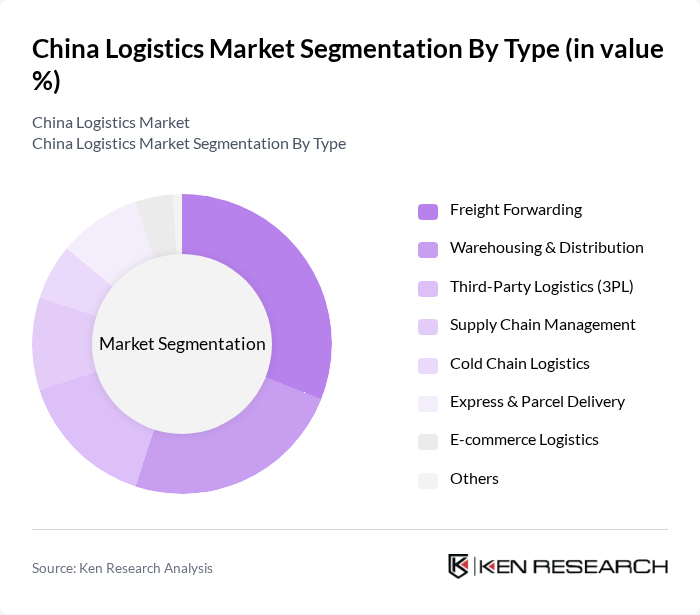

By Type:The logistics market can be segmented into various types, including Freight Forwarding, Warehousing & Distribution, Third-Party Logistics (3PL), Supply Chain Management, Cold Chain Logistics, Express & Parcel Delivery, E-commerce Logistics, and Others. Among these, Freight Forwarding is a significant segment due to the increasing globalization of trade and the need for efficient transportation solutions. Warehousing & Distribution also plays a crucial role, driven by the rise of e-commerce and the demand for quick delivery services .

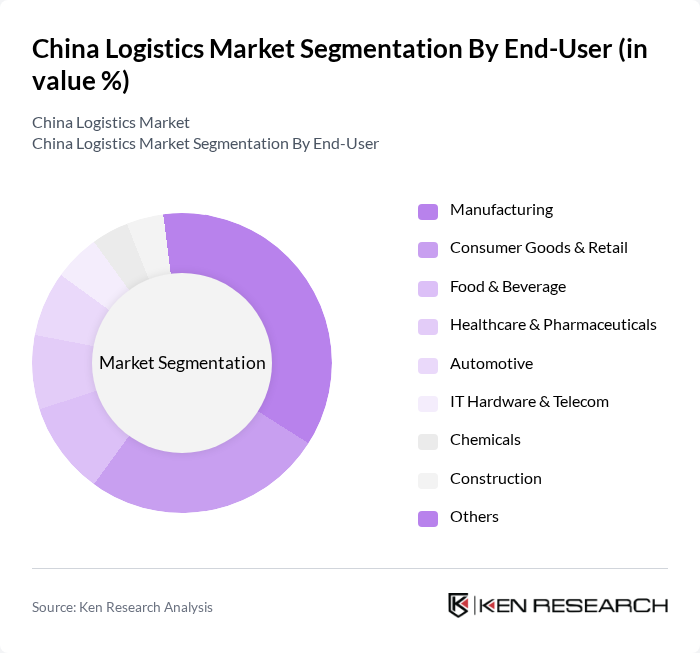

By End-User:The logistics market serves various end-users, including Manufacturing, Consumer Goods & Retail, Food & Beverage, Healthcare & Pharmaceuticals, Automotive, IT Hardware & Telecom, Chemicals, Construction, and Others. The Manufacturing sector is a dominant end-user, as it requires extensive logistics support for raw materials and finished goods. The Consumer Goods & Retail segment is also significant, driven by the increasing demand for fast and reliable delivery services .

The China Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as China COSCO Shipping Corporation, Sinotrans Limited, JD Logistics, SF Express, ZTO Express, YTO Express, Best Inc., Deppon Logistics, STO Express, DHL Supply Chain China, Kuehne + Nagel, DB Schenker, CEVA Logistics, Nippon Express, UPS Supply Chain Solutions contribute to innovation, geographic expansion, and service delivery in this space.

The future of the China logistics market appears promising, driven by ongoing technological integration and the expansion of e-commerce. As urbanization continues, logistics companies will increasingly adopt smart technologies to enhance efficiency and customer satisfaction. Additionally, the focus on sustainability will likely lead to the adoption of green logistics practices, aligning with global environmental goals. Overall, the market is poised for significant transformation, adapting to the evolving needs of consumers and businesses alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Forwarding Warehousing & Distribution Third-Party Logistics (3PL) Supply Chain Management Cold Chain Logistics Express & Parcel Delivery E-commerce Logistics Others |

| By End-User | Manufacturing Consumer Goods & Retail Food & Beverage Healthcare & Pharmaceuticals Automotive IT Hardware & Telecom Chemicals Construction Others |

| By Service Type | Transportation Warehousing Value-Added Services Freight Forwarding Customs Brokerage Supply Chain Solutions Others |

| By Mode of Transport | Roadways Railways Airways Seaways Intermodal Others |

| By Technology Adoption | Automation IoT Integration Blockchain Technology AI and Machine Learning Data Analytics Cloud Logistics Others |

| By Customer Type | B2B B2C Government Others |

| By Geographic Coverage | North China South China East China West China Central China Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics Infrastructure Development | 60 | Urban Planners, Logistics Executives |

| E-commerce Logistics Solutions | 90 | E-commerce Operations Managers, Supply Chain Analysts |

| Cold Chain Logistics | 50 | Cold Chain Managers, Quality Assurance Officers |

| Last-Mile Delivery Services | 70 | Last-Mile Delivery Coordinators, Fleet Managers |

| Freight Forwarding and Customs Brokerage | 40 | Freight Forwarders, Customs Compliance Officers |

The China Logistics Market is valued at approximately USD 2.4 trillion, reflecting significant growth driven by e-commerce expansion, demand for efficient supply chain solutions, and infrastructure investments.