North America Logistics Market Overview

- The North America Logistics Market is valued at USD 1.5 trillion, based on a five-year historical analysis. This growth is primarily driven by the surge in e-commerce, advancements in automation and artificial intelligence, rising demand for faster delivery, and significant investments in infrastructure and technology that enhance logistics operations. The market has seen increased adoption of real-time tracking, IoT-enabled supply chain solutions, and digital platforms, further propelling its expansion .

- The United States and Canada dominate the North America Logistics Market due to their robust infrastructure, strategic geographic locations, and high levels of consumer spending. Major cities such as New York, Los Angeles, and Chicago serve as critical logistics hubs, facilitating efficient transportation and distribution networks. The presence of leading logistics companies, a strong manufacturing base, and a highly integrated supply chain network also contribute to their dominance .

- In 2023, the U.S. government implemented the Infrastructure Investment and Jobs Act, which allocates USD 1.2 trillion to improve transportation infrastructure. This includes funding for roads, bridges, and ports, aimed at enhancing the efficiency of logistics operations across the country. The initiative is expected to significantly impact the logistics sector by reducing transit times and improving supply chain reliability .

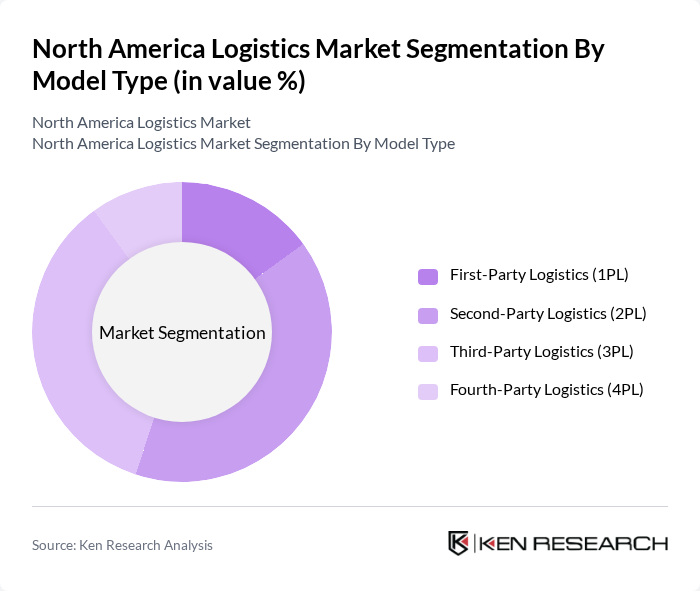

North America Logistics Market Segmentation

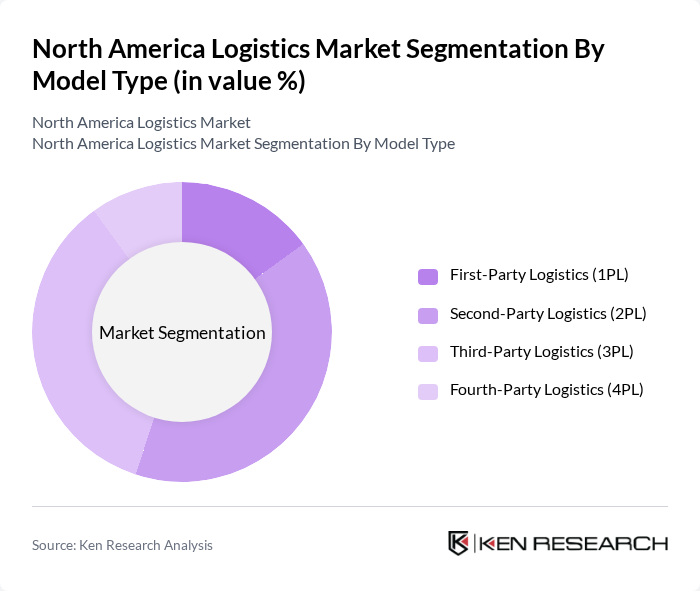

By Model Type:The logistics market can be segmented into four model types: First-Party Logistics (1PL), Second-Party Logistics (2PL), Third-Party Logistics (3PL), and Fourth-Party Logistics (4PL). Second-Party Logistics (2PL) is currently the most dominant segment, driven by the increasing outsourcing of logistics operations to specialized service providers who offer cost savings, industry expertise, and established networks. The trend towards e-commerce and the need for customized, flexible logistics solutions have also fueled demand for both 2PL and 3PL services, as businesses seek efficient and scalable supply chain management .

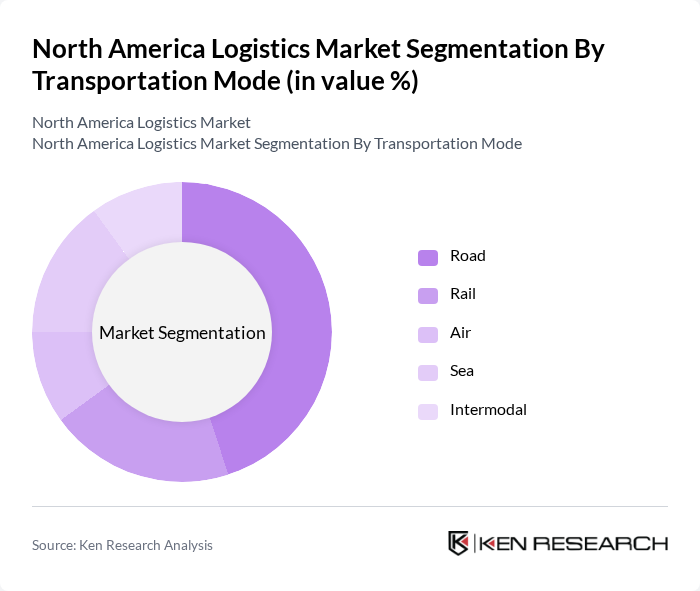

By Transportation Mode:The logistics market can also be segmented by transportation mode, which includes Road, Rail, Air, Sea, and Intermodal. The Road transportation mode is the most significant segment, accounting for a substantial portion of logistics activities. This dominance is attributed to the flexibility and efficiency of road transport in reaching various destinations, especially in urban and suburban areas. The rise of e-commerce and the need for last-mile delivery solutions have further increased reliance on road transportation. Rail and intermodal transport are also growing, supported by investments in infrastructure and the need for cost-effective long-haul solutions .

North America Logistics Market Competitive Landscape

The North America Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as FedEx Corporation, UPS (United Parcel Service), XPO Logistics, J.B. Hunt Transport Services, C.H. Robinson Worldwide, DHL Supply Chain, Schneider National, Ryder System, Inc., Kuehne + Nagel, DB Schenker, Penske Logistics, TQL (Total Quality Logistics), Echo Global Logistics, Coyote Logistics, Transplace, Expeditors International of Washington, Landstar System, CEVA Logistics, Hub Group, Purolator contribute to innovation, geographic expansion, and service delivery in this space.

North America Logistics Market Industry Analysis

Growth Drivers

- E-commerce Growth:The North American e-commerce sector is projected to reach $1.1 trillion in future, driven by a 15% annual increase in online sales. This surge necessitates efficient logistics solutions to handle increased order volumes and rapid delivery expectations. Companies are investing heavily in logistics infrastructure, with Amazon alone planning to open 100 new fulfillment centers, enhancing their distribution capabilities and meeting consumer demand for faster shipping.

- Technological Advancements:The logistics industry is increasingly adopting technologies such as AI and IoT, with an estimated investment of $30 billion in logistics technology in future. These advancements improve operational efficiency, reduce costs, and enhance tracking capabilities. For instance, AI-driven route optimization can reduce delivery times by up to 20%, significantly impacting customer satisfaction and operational performance across the logistics sector.

- Demand for Supply Chain Optimization:In future, 70% of North American companies are expected to prioritize supply chain optimization, driven by the need for resilience and efficiency. This trend is supported by a projected 25% increase in demand for third-party logistics services, as businesses seek to streamline operations and reduce costs. Enhanced visibility and control over supply chains are critical for maintaining competitiveness in a rapidly evolving market landscape.

Market Challenges

- Rising Fuel Costs:Fuel prices in North America are projected to average $3.80 per gallon in future, a significant increase from previous years. This rise in fuel costs directly impacts logistics operations, leading to higher transportation expenses. Companies are forced to either absorb these costs or pass them on to consumers, which can affect pricing strategies and overall profitability in the logistics sector.

- Labor Shortages:The logistics industry faces a critical labor shortage, with an estimated 1.3 million positions unfilled in future. This shortage is exacerbated by an aging workforce and increased demand for skilled labor in logistics roles. Companies are struggling to attract and retain talent, leading to operational inefficiencies and increased labor costs, which can hinder growth and service delivery capabilities.

North America Logistics Market Future Outlook

The North American logistics market is poised for significant transformation, driven by technological innovations and evolving consumer expectations. As companies increasingly adopt automation and data analytics, operational efficiencies will improve, enabling faster and more reliable service. Additionally, sustainability initiatives will shape logistics strategies, with businesses focusing on reducing their carbon footprint. The integration of advanced technologies will not only enhance supply chain resilience but also create new opportunities for growth in emerging markets.

Market Opportunities

- Automation and Robotics:The logistics sector is expected to invest over $15 billion in automation technologies by future. This investment will enhance operational efficiency, reduce labor costs, and improve accuracy in order fulfillment. Robotics in warehouses can increase productivity by up to 30%, allowing companies to meet rising consumer demands effectively.

- Green Logistics Solutions:With increasing regulatory pressure, the green logistics market is projected to grow to $100 billion by future. Companies are adopting eco-friendly practices, such as electric vehicles and sustainable packaging, to reduce their environmental impact. This shift not only meets consumer expectations but also positions companies favorably in a competitive market focused on sustainability.