Region:Europe

Author(s):Shubham

Product Code:KRAA0749

Pages:97

Published On:August 2025

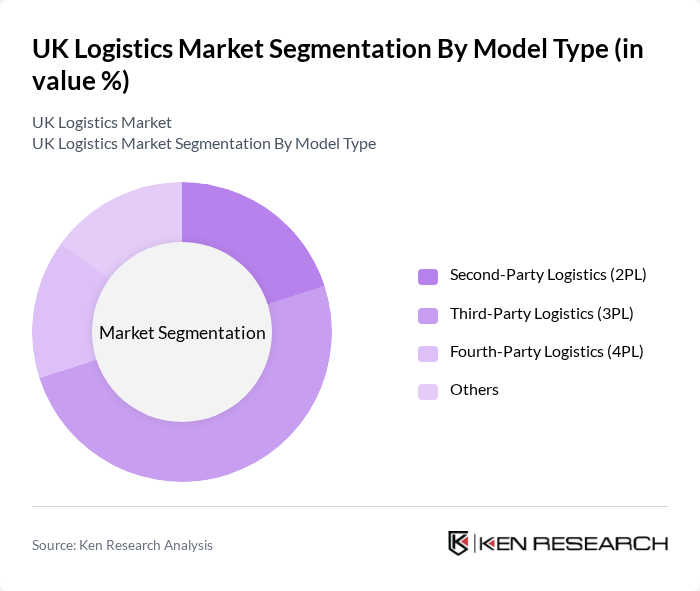

By Model Type:

The logistics market is segmented into four primary model types: Second-Party Logistics (2PL), Third-Party Logistics (3PL), Fourth-Party Logistics (4PL), and Others. Among these, Third-Party Logistics (3PL) is the leading subsegment, driven by the increasing complexity of supply chains and the demand for specialized logistics services. Companies are increasingly outsourcing logistics functions to 3PL providers to enhance efficiency and focus on core business activities. The trend towards e-commerce has further accelerated the growth of 3PL services, as businesses seek to streamline their operations and improve customer service .

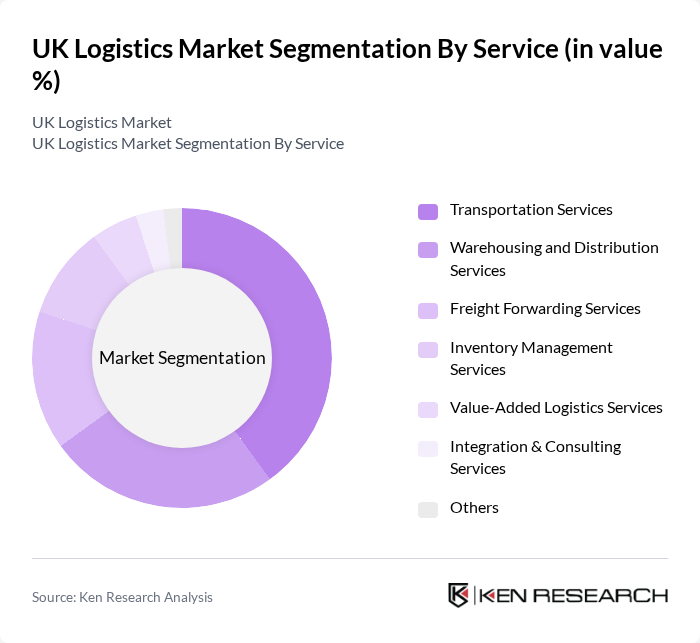

By Service:

The logistics market is also categorized by service types, including Transportation Services, Warehousing and Distribution Services, Freight Forwarding Services, Inventory Management Services, Value-Added Logistics Services, Integration & Consulting Services, and Others. Transportation Services dominate this segment, as they are essential for the movement of goods across various channels. The rise of e-commerce has significantly increased the demand for efficient transportation solutions, leading to innovations in last-mile delivery and logistics technology. Companies are investing in advanced tracking systems, warehouse automation, and omnichannel logistics to enhance service delivery and customer satisfaction .

The UK Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, XPO Logistics, Kuehne + Nagel, DB Schenker, UPS Supply Chain Solutions, FedEx Logistics, DPD Group, Geodis, CEVA Logistics, Wincanton, GXO Logistics, ID Logistics, Clipper Logistics, Eddie Stobart Logistics, Palletways, Tesco (Supply Chain & Distribution), Stobart Group, Tuffnells contribute to innovation, geographic expansion, and service delivery in this space.

The UK logistics market is poised for significant transformation as it adapts to evolving consumer expectations and technological advancements. In future, the integration of AI and automation will streamline operations, while sustainability initiatives will reshape logistics practices. Companies will increasingly focus on enhancing last-mile delivery solutions to meet the growing demand for speed and efficiency. As the market evolves, collaboration between logistics providers and technology firms will be crucial for driving innovation and maintaining competitiveness in this dynamic landscape.

| Segment | Sub-Segments |

|---|---|

| By Model Type | Second-Party Logistics (2PL) Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) Others |

| By Service | Transportation Services Warehousing and Distribution Services Freight Forwarding Services Inventory Management Services Value-Added Logistics Services Integration & Consulting Services Others |

| By Mode of Transportation | Roadways Seaways Railways Airways Intermodal Transport Others |

| By End-Use | Manufacturing Consumer Goods Retail Food and Beverages IT Hardware Healthcare Chemicals Construction Automotive Telecom Oil and Gas Others |

| By Region | North West England Yorkshire and the Humber West Midlands East of England South West England South East England East Midlands North East England Greater London Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Operations | 100 | Logistics Managers, Supply Chain Analysts |

| Food and Beverage Distribution | 60 | Operations Managers, Warehouse Supervisors |

| Pharmaceutical Supply Chain | 40 | Compliance Officers, Logistics Coordinators |

| Automotive Logistics Management | 50 | Procurement Managers, Distribution Planners |

| E-commerce Fulfillment Strategies | 80 | E-commerce Managers, Logistics Operations Managers |

The UK logistics market is valued at approximately USD 540 billion, driven by the growth of e-commerce, automation, and efficient supply chain management. This valuation reflects a five-year historical analysis of the sector's performance and investment trends.