Region:Central and South America

Author(s):Shubham

Product Code:KRAA1108

Pages:83

Published On:August 2025

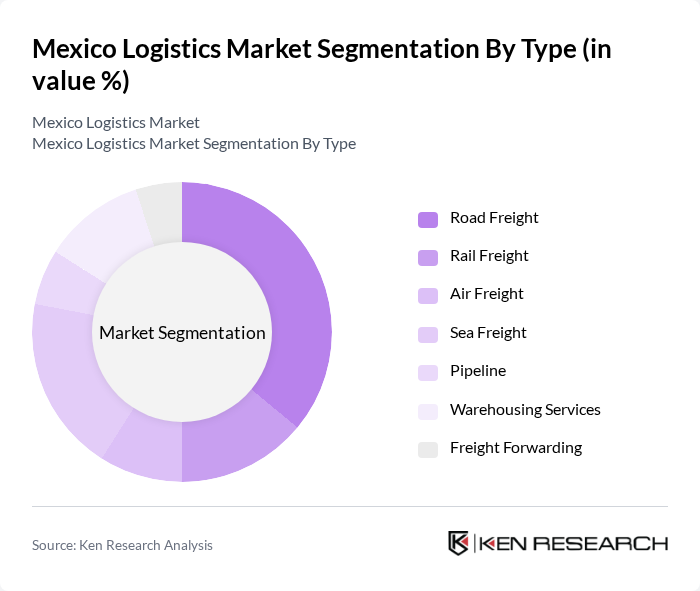

By Type:The logistics market can be segmented into various types, including Road Freight, Rail Freight, Air Freight, Sea Freight, Pipeline, Warehousing Services, and Freight Forwarding. Each of these segments plays a crucial role in the overall logistics ecosystem, catering to different transportation needs and operational requirements .

The Road Freight segment is the dominant player in the logistics market, accounting for the largest portion of the overall market share. This dominance is attributed to Mexico’s extensive road network, which facilitates the efficient movement of goods across various regions. The increasing demand for last-mile delivery services, driven by the growth of e-commerce and nearshoring, has further bolstered the road freight sector. Additionally, the flexibility and cost-effectiveness of road transportation make it a preferred choice for many businesses .

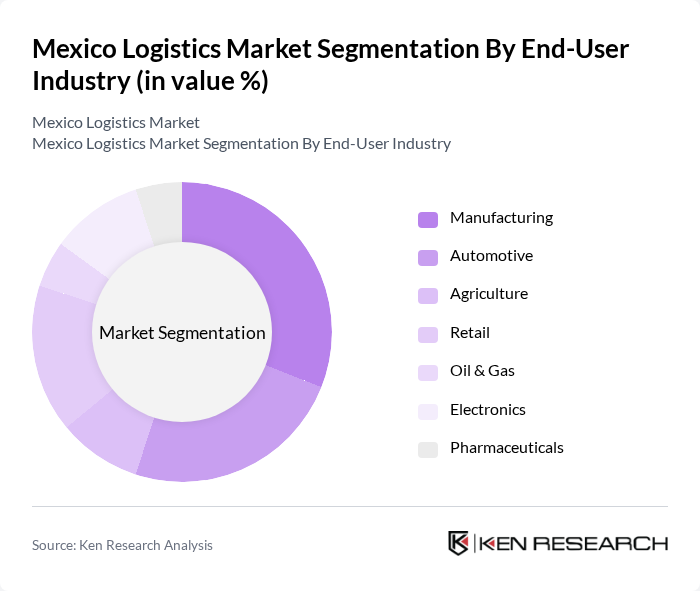

By End-User Industry:The logistics market serves various end-user industries, including Manufacturing, Automotive, Agriculture, Retail, Oil & Gas, Electronics, and Pharmaceuticals. Each industry has unique logistics requirements, influencing the demand for specific logistics services .

The Manufacturing sector is the leading end-user industry in the logistics market, driven by the high volume of goods produced and the need for efficient supply chain management. The automotive industry also plays a significant role, requiring timely delivery of parts and components to maintain production schedules. The rapid growth of e-commerce has further increased the demand for logistics services in the Retail sector, making it a vital contributor to the overall market .

The Mexico Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grupo TMM, DHL Supply Chain Mexico, Estafeta, Kuehne + Nagel Mexico, FedEx Express Mexico, UPS Mexico, XPO Logistics Mexico, CEVA Logistics Mexico, Grupo Senda, Transportes Castores, Logística de México (LDM), Grupo ADO, Transplace Mexico, Traxión, Grupo Bimbo (Logistics Division) contribute to innovation, geographic expansion, and service delivery in this space.

The Mexico logistics market is poised for significant transformation, driven by technological advancements and evolving consumer expectations. As e-commerce continues to expand, logistics providers will increasingly focus on enhancing last-mile delivery solutions and integrating automation into their operations. Additionally, sustainability will become a key priority, with companies investing in green logistics practices. The combination of these trends is expected to reshape the logistics landscape, fostering innovation and improving service delivery across the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Road Freight Rail Freight Air Freight Sea Freight Pipeline Warehousing Services Freight Forwarding |

| By End-User Industry | Manufacturing Automotive Agriculture Retail Oil & Gas Electronics Pharmaceuticals |

| By Logistics Function | Freight Transportation Warehousing Distribution Services Supply Chain Management Cold Chain Logistics Last-Mile Delivery |

| By Distribution Mode | Road Transport Rail Transport Air Transport Sea Transport Intermodal Transport |

| By Service Type | Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) Freight Forwarding Customs Brokerage |

| By Geography | Mexico City Metropolitan Area Northern Border Region Central Mexico Gulf Coast Pacific Coast |

| By Technology Adoption | Automated Systems Tracking and Visibility Solutions Data Analytics Tools Digital Logistics Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Freight Transportation Services | 100 | Logistics Directors, Fleet Managers |

| Warehousing and Distribution | 60 | Warehouse Managers, Operations Supervisors |

| Last-Mile Delivery Solutions | 50 | Delivery Managers, eCommerce Logistics Coordinators |

| Cold Chain Logistics | 40 | Supply Chain Analysts, Quality Control Managers |

| Logistics Technology Adoption | 50 | IT Managers, Digital Transformation Leads |

The Mexico Logistics Market is valued at approximately USD 87 billion, driven by the increasing demand for efficient supply chain solutions, the rapid expansion of e-commerce, and the growth of manufacturing and nearshoring activities in the region.