Region:Europe

Author(s):Shubham

Product Code:KRAA1140

Pages:91

Published On:August 2025

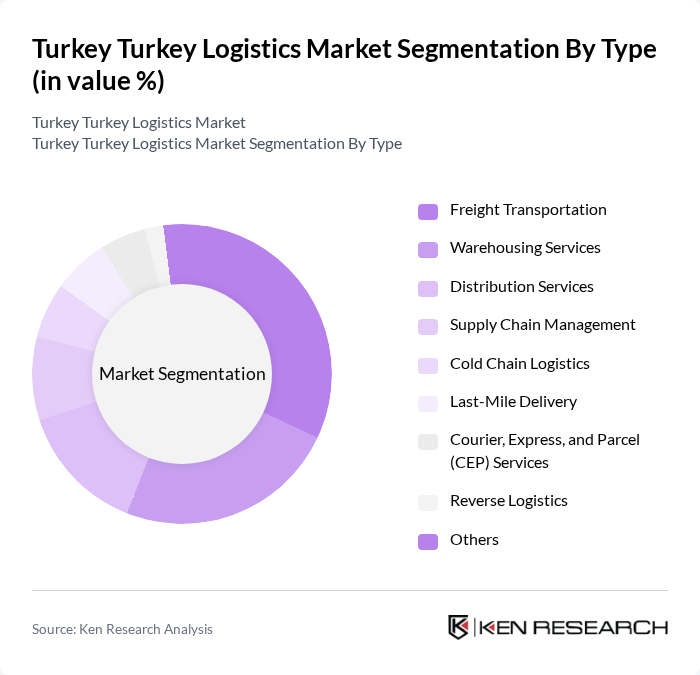

By Type:The logistics market is segmented into Freight Transportation, Warehousing Services, Distribution Services, Supply Chain Management, Cold Chain Logistics, Last-Mile Delivery, Courier, Express, and Parcel (CEP) Services, Reverse Logistics, and Others. Freight Transportation remains the largest segment, driven by Turkey’s extensive road and rail networks and its role as a regional trade hub. Warehousing Services have grown rapidly due to e-commerce and the need for advanced inventory management. Last-Mile Delivery and CEP services are expanding with urbanization and consumer demand for fast, flexible delivery. Cold Chain Logistics is increasingly important for pharmaceuticals and perishable goods, while Supply Chain Management and Reverse Logistics are gaining traction as companies seek efficiency and sustainability .

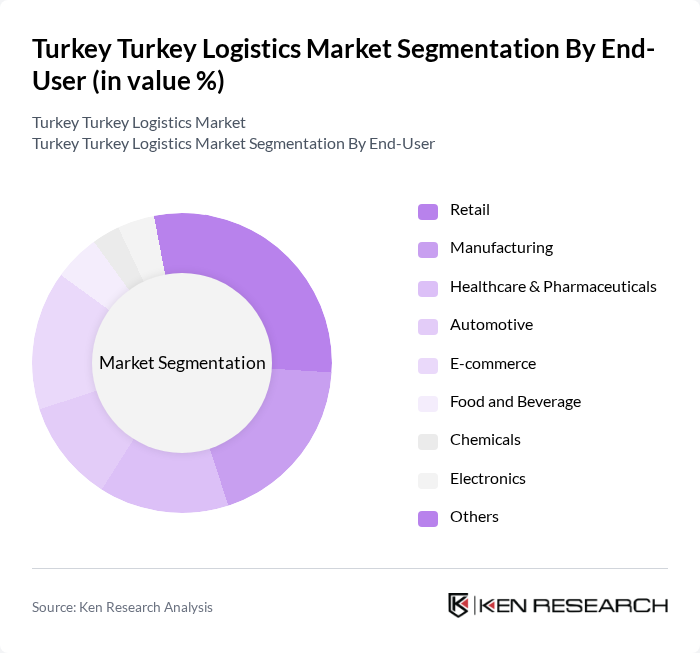

By End-User:The logistics market serves diverse end-user segments, including Retail, Manufacturing, Healthcare & Pharmaceuticals, Automotive, E-commerce, Food and Beverage, Chemicals, Electronics, and Others. Retail and E-commerce are primary drivers, supported by Turkey’s young, digitally engaged population and the proliferation of online shopping. Manufacturing and Automotive sectors require robust freight and warehousing solutions, while Healthcare & Pharmaceuticals depend on cold chain and time-sensitive logistics. Food and Beverage, Chemicals, and Electronics segments also rely on specialized logistics services for safety, compliance, and timely delivery .

The Turkey Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aras Kargo, MNG Kargo, Yurtiçi Kargo, PTT Kargo, DHL Express Turkey, UPS Turkey, FedEx Turkey, Kuehne + Nagel Turkey, DB Schenker Arkas, CEVA Logistics Turkey, Geodis Turkey, TNT Express Turkey, Ekol Logistics, Omsan Logistics, Netlog Logistics, Borusan Lojistik, Mars Logistics, Reysa? Logistics, Barsan Global Logistics, and Sürat Kargo contribute to innovation, geographic expansion, and service delivery in this space .

The logistics market in Turkey is poised for significant transformation, driven by advancements in technology and evolving consumer expectations. As companies increasingly adopt digital solutions, the integration of AI and automation will enhance operational efficiency. Furthermore, the focus on sustainability will lead to the development of eco-friendly logistics practices. These trends are expected to reshape the logistics landscape, fostering innovation and improving service delivery, ultimately positioning Turkey as a key logistics hub in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Transportation Warehousing Services Distribution Services Supply Chain Management Cold Chain Logistics Last-Mile Delivery Courier, Express, and Parcel (CEP) Services Reverse Logistics Others |

| By End-User | Retail Manufacturing Healthcare & Pharmaceuticals Automotive E-commerce Food and Beverage Chemicals Electronics Others |

| By Service Type | Road Freight Rail Freight Air Freight Sea Freight Intermodal & Multimodal Transport Warehousing & Value-Added Services Others |

| By Distribution Channel | Direct Sales Online Platforms Third-Party Logistics Providers (3PL) Retail Partnerships Others |

| By Geographic Coverage | Domestic Logistics International Logistics Regional Logistics Urban Logistics Rural Logistics Cross-Border Logistics Others |

| By Technology Adoption | Automated Warehousing Fleet Management Systems Tracking and Visibility Solutions Robotics and Automation in Logistics Transportation Management Systems (TMS) Blockchain and Digital Platforms Others |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Performance-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Transportation Services | 100 | Logistics Managers, Fleet Operations Directors |

| Warehousing Solutions | 80 | Warehouse Managers, Supply Chain Analysts |

| Freight Forwarding | 60 | Operations Managers, Customs Compliance Officers |

| Last-Mile Delivery | 50 | Delivery Managers, E-commerce Logistics Coordinators |

| Cold Chain Logistics | 40 | Quality Assurance Managers, Supply Chain Directors |

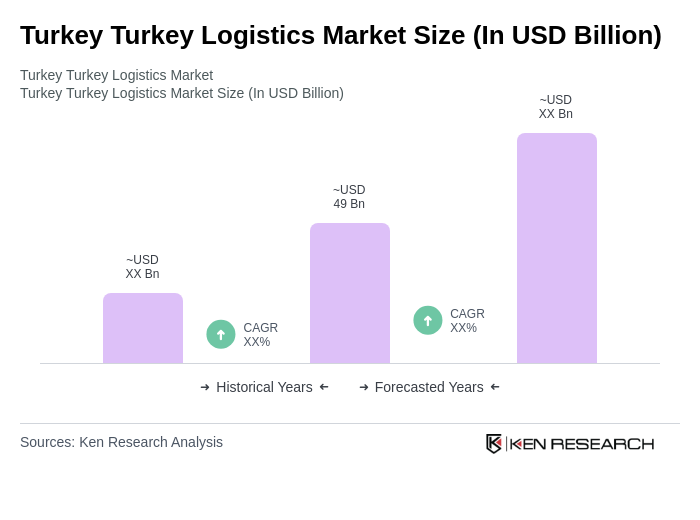

The Turkey Logistics Market is valued at approximately USD 49 billion, reflecting significant growth driven by e-commerce expansion, urbanization, and investments in logistics infrastructure and technology.