Region:Middle East

Author(s):Geetanshi

Product Code:KRAA1950

Pages:100

Published On:August 2025

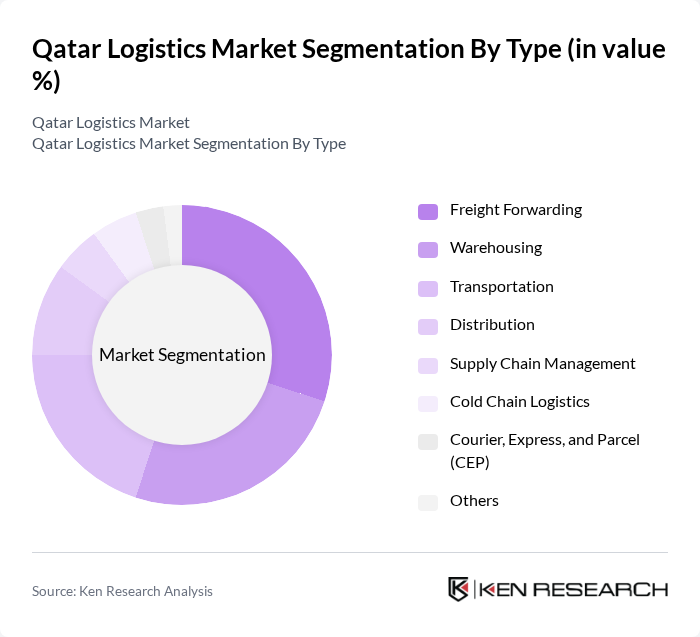

By Type:The logistics market can be segmented into various types, including Freight Forwarding, Warehousing, Transportation, Distribution, Supply Chain Management, Cold Chain Logistics, Courier, Express, and Parcel (CEP), and Others. Among these, Freight Forwarding is currently the leading sub-segment due to the increasing demand for international shipping and trade facilitation. The rise of e-commerce and Qatar’s role as a global air and sea freight hub have significantly boosted the need for efficient freight forwarding services, as businesses seek to optimize their supply chains and reduce delivery times .

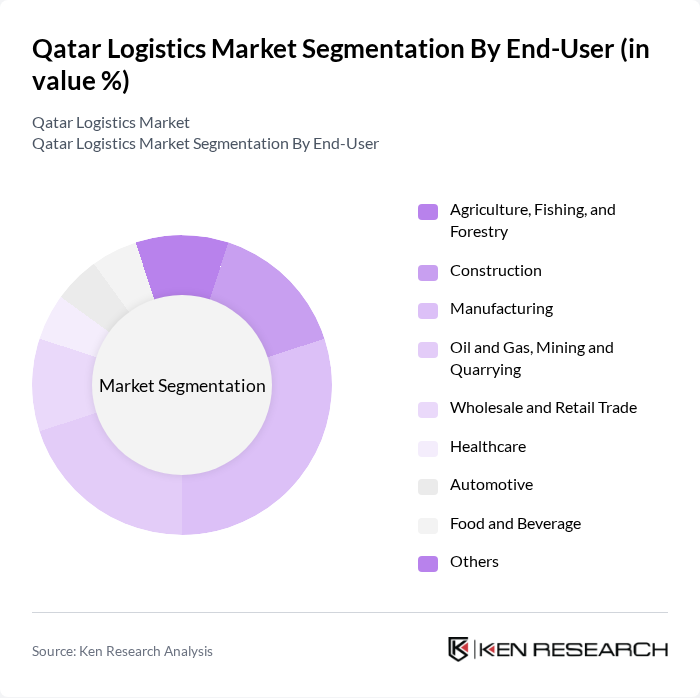

By End-User:The logistics market is also segmented by end-user industries, including Agriculture, Fishing, and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale and Retail Trade, Healthcare, Automotive, Food and Beverage, and Others. The Manufacturing sector is the dominant end-user, driven by the need for efficient supply chain solutions to manage production and distribution processes. The growth of manufacturing activities in Qatar, particularly in the industrial and construction sectors, has led to increased demand for logistics services. The Oil and Gas sector also remains a significant contributor due to Qatar’s position as a leading energy exporter .

The Qatar Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Warehousing Company (GWC), Qatar Navigation Q.P.S.C. (Milaha), Qatar Airways Cargo, Nakilat (Qatar Gas Transport Company Limited), DHL Supply Chain, DB Schenker, Agility Logistics, Kuehne + Nagel, CEVA Logistics, Aramex, FedEx, UPS, XPO Logistics, Rhenus Logistics, DSV contribute to innovation, geographic expansion, and service delivery in this space.

The Qatar logistics market is poised for significant transformation, driven by advancements in technology and infrastructure. As the government continues to invest in logistics capabilities, the sector is expected to embrace digital solutions, enhancing operational efficiency. Furthermore, sustainability initiatives will likely gain traction, aligning with global trends. By future, the integration of automation and data analytics will redefine logistics operations, enabling companies to respond swiftly to market demands and improve service delivery.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Forwarding Warehousing Transportation Distribution Supply Chain Management Cold Chain Logistics Courier, Express, and Parcel (CEP) Others |

| By End-User | Agriculture, Fishing, and Forestry Construction Manufacturing Oil and Gas, Mining and Quarrying Wholesale and Retail Trade Healthcare Automotive Food and Beverage Others |

| By Service Type | Last-Mile Delivery Intermodal Transport Bulk Transport Value-Added Services Others |

| By Distribution Mode | Road Rail Air Sea Others |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Others |

| By Customer Type | B2B B2C Government Others |

| By Technology Integration | IoT Solutions AI and Machine Learning Blockchain Technology Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Freight Forwarding Services | 60 | Logistics Managers, Operations Directors |

| Warehousing Solutions | 45 | Warehouse Managers, Supply Chain Analysts |

| Last-Mile Delivery Operations | 40 | Delivery Managers, E-commerce Executives |

| Cold Chain Logistics | 42 | Quality Assurance Managers, Procurement Specialists |

| Logistics Technology Solutions | 50 | IT Managers, Technology Officers |

The Qatar Logistics Market is valued at approximately USD 10 billion, driven by strategic investments in infrastructure and technology, as well as the growth of e-commerce and logistics connectivity through major projects like Hamad Port and Hamad International Airport.