Region:Central and South America

Author(s):Shubham

Product Code:KRAA1138

Pages:83

Published On:August 2025

By Type:The logistics real estate market is segmented into Distribution Centers, Warehouses, Cold Storage Facilities, Flex Space (including industrial condominiums and hybrid logistics/office units), Last-Mile Delivery Hubs, Cross-Dock Facilities, Multi-Tenant Logistics Parks, and Others. Each segment addresses specific operational needs: Distribution Centers and Warehouses support bulk storage and regional distribution; Cold Storage Facilities cater to temperature-sensitive goods; Flex Space and Multi-Tenant Parks offer adaptable solutions for diverse tenants; Last-Mile Hubs and Cross-Dock Facilities enable rapid urban deliveries and efficient transshipment .

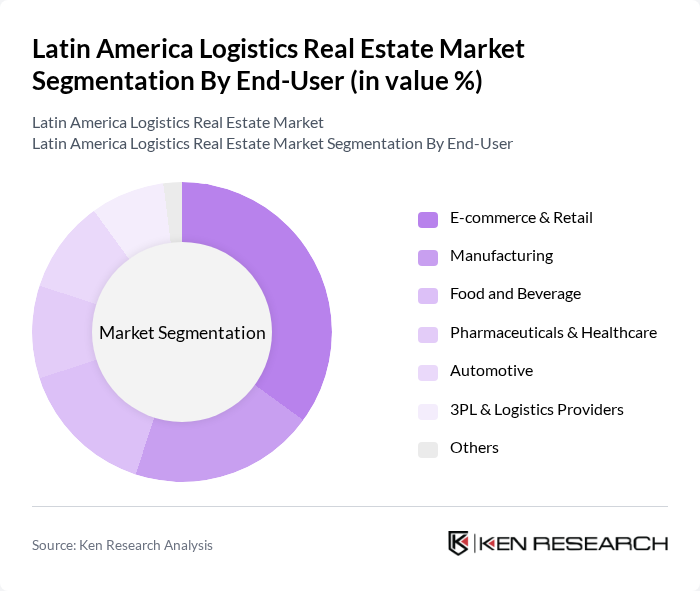

By End-User:The end-user segmentation includes E-commerce & Retail, Manufacturing, Food and Beverage, Pharmaceuticals & Healthcare, Automotive, 3PL & Logistics Providers, and Others. This segmentation reflects the diverse applications of logistics real estate: E-commerce & Retail drives demand for last-mile and fulfillment centers; Manufacturing and Automotive require large-scale distribution and storage; Food and Beverage and Pharmaceuticals need specialized cold storage; 3PL providers seek flexible, multi-client facilities .

The Latin America Logistics Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Prologis, GLP, Goodman Group, LOG Commercial Properties (LOG CP), Vesta, Cyrela Commercial Properties (CCP), BR Properties, Tishman Speyer, CBRE, Colliers International, Cushman & Wakefield, JLL, Fibra Prologis, Fibra Macquarie, Grupo O’Donnell contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Latin America logistics real estate market appears promising, driven by ongoing investments in infrastructure and the rapid growth of e-commerce. As urbanization continues, logistics providers will increasingly focus on optimizing last-mile delivery solutions to meet consumer demands. Additionally, technological advancements, such as automation and data analytics, are expected to enhance operational efficiency, enabling companies to adapt to changing market dynamics and consumer preferences effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Distribution Centers Warehouses Cold Storage Facilities Flex Space (including industrial condominiums and hybrid logistics/office units) Last-Mile Delivery Hubs Cross-Dock Facilities Multi-Tenant Logistics Parks Others |

| By End-User | E-commerce & Retail Manufacturing Food and Beverage Pharmaceuticals & Healthcare Automotive PL & Logistics Providers Others |

| By Investment Source | Domestic Institutional Investors Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Grants & Incentives Private Equity & Venture Capital Others |

| By Location | Major Urban Centers (e.g., São Paulo, Mexico City, Bogotá) Secondary Cities Near Ports Near Airports Industrial Corridors & Logistics Hubs Rural/Peripheral Areas Others |

| By Lease Type | Short-Term Leases Long-Term Leases Build-to-Suit Flexible Leases Others |

| By Facility Size | Small Facilities (Less than 10,000 sq ft) Medium Facilities (10,000 - 50,000 sq ft) Large Facilities (50,000 - 100,000 sq ft) Extra Large Facilities (Over 100,000 sq ft) Mega Distribution Centers (Over 500,000 sq ft) Others |

| By Service Type | Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) Freight Forwarding Transportation Management Value-Added Logistics Services (e.g., packaging, labeling) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Warehouse Space Utilization | 100 | Facility Managers, Operations Directors |

| Distribution Center Development | 80 | Real Estate Developers, Logistics Executives |

| Cold Storage Facilities | 60 | Supply Chain Managers, Food Industry Executives |

| Last-Mile Delivery Solutions | 50 | Logistics Coordinators, Urban Planning Officials |

| Cross-Docking Operations | 40 | Warehouse Supervisors, Transportation Managers |

The Latin America Logistics Real Estate Market is valued at approximately USD 36 billion, driven by the growth of e-commerce, demand for modern warehousing, and infrastructure investments across the region.