Region:Asia

Author(s):Shubham

Product Code:KRAA1139

Pages:92

Published On:August 2025

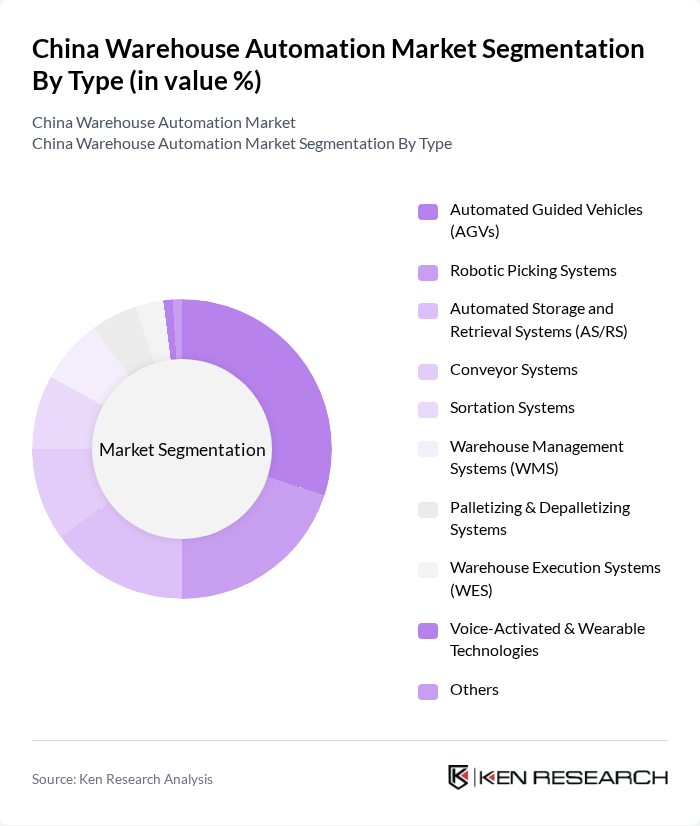

By Type:The market is segmented into various types of automation solutions, including Automated Guided Vehicles (AGVs), Robotic Picking Systems, Automated Storage and Retrieval Systems (AS/RS), Conveyor Systems, Sortation Systems, Warehouse Management Systems (WMS), Palletizing & Depalletizing Systems, Warehouse Execution Systems (WES), Voice-Activated & Wearable Technologies, and Others. Among these, Automated Guided Vehicles (AGVs) and mobile robotics are leading the market due to their versatility, scalability, and efficiency in material handling, which are crucial for modern warehouses seeking to address labor shortages and increase throughput .

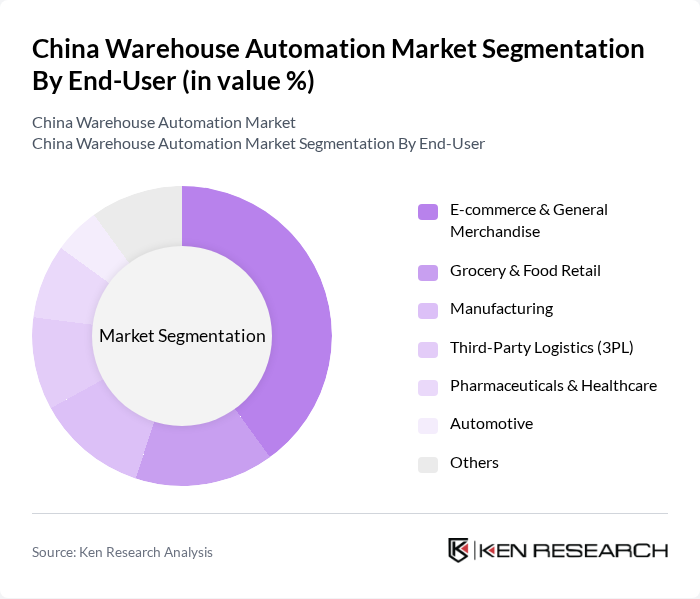

By End-User:The end-user segmentation includes E-commerce & General Merchandise, Grocery & Food Retail, Manufacturing, Third-Party Logistics (3PL), Pharmaceuticals & Healthcare, Automotive, and Others. The E-commerce & General Merchandise sector is the dominant end-user, driven by the surge in online shopping, the need for rapid and accurate order fulfillment, and the increasing adoption of automation by major e-commerce platforms and retailers .

The China Warehouse Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hikrobot (Hikvision Robotics), Geekplus Technology Co., Ltd., Quicktron Intelligent Technology, Hai Robotics, Intralox (Shanghai) Automation Equipment Co., Ltd., Dematic (KION Group), Honeywell Intelligrated, Swisslog (Waldner Group), SIASUN Robot & Automation Co., Ltd., BPS Global Group, Shanghai Jingxing Storage Equipment Engineering Co., Ltd., Vanderlande Industries, SSI Schaefer, Knapp AG, Murata Machinery contribute to innovation, geographic expansion, and service delivery in this space.

The future of the China warehouse automation market appears promising, driven by the increasing integration of advanced technologies and the growing need for efficiency in logistics. As companies continue to embrace automation, the focus will shift towards enhancing operational efficiency through data analytics and IoT applications. Additionally, the expansion of smart warehouses will likely redefine traditional warehousing practices, enabling businesses to respond swiftly to market demands and improve overall supply chain resilience.

| Segment | Sub-Segments |

|---|---|

| By Type | Automated Guided Vehicles (AGVs) Robotic Picking Systems Automated Storage and Retrieval Systems (AS/RS) Conveyor Systems Sortation Systems Warehouse Management Systems (WMS) Palletizing & Depalletizing Systems Warehouse Execution Systems (WES) Voice-Activated & Wearable Technologies Others |

| By End-User | E-commerce & General Merchandise Grocery & Food Retail Manufacturing Third-Party Logistics (3PL) Pharmaceuticals & Healthcare Automotive Others |

| By Application | Order Fulfillment Inventory Management Shipping and Receiving Returns Processing Cross-Docking Micro-Fulfillment Others |

| By Component | Hardware Software Services |

| By Sales Channel | Direct Sales Distributors/Integrators Online Sales Others |

| By Distribution Mode | Centralized Distribution Decentralized Distribution Hybrid Distribution |

| By Price Range | Low-End Solutions Mid-Range Solutions High-End Solutions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| E-commerce Warehouse Automation | 100 | Warehouse Managers, IT Directors |

| Manufacturing Sector Automation | 80 | Operations Managers, Production Supervisors |

| Retail Distribution Centers | 60 | Logistics Coordinators, Supply Chain Managers |

| Third-party Logistics Providers | 50 | Business Development Managers, Automation Specialists |

| Technology Providers in Automation | 40 | Product Managers, Sales Executives |

The China Warehouse Automation Market is valued at approximately USD 4.7 billion, driven by the rapid growth of e-commerce, the need for efficient supply chain management, and the integration of advanced technologies like robotics and AI in warehouse operations.