Region:Europe

Author(s):Shubham

Product Code:KRAA0940

Pages:92

Published On:August 2025

By Type:The market is segmented into Automated Storage and Retrieval Systems (AS/RS), Conveyor Systems, Robotics Solutions, Sortation Systems, Automated Guided Vehicles (AGVs), Warehouse Management Systems (WMS), Palletizing & Depalletizing Systems, Picking & Packing Systems, and Others. These automation solutions are integral for increasing throughput, improving accuracy, and reducing labor dependency in modern warehouses .

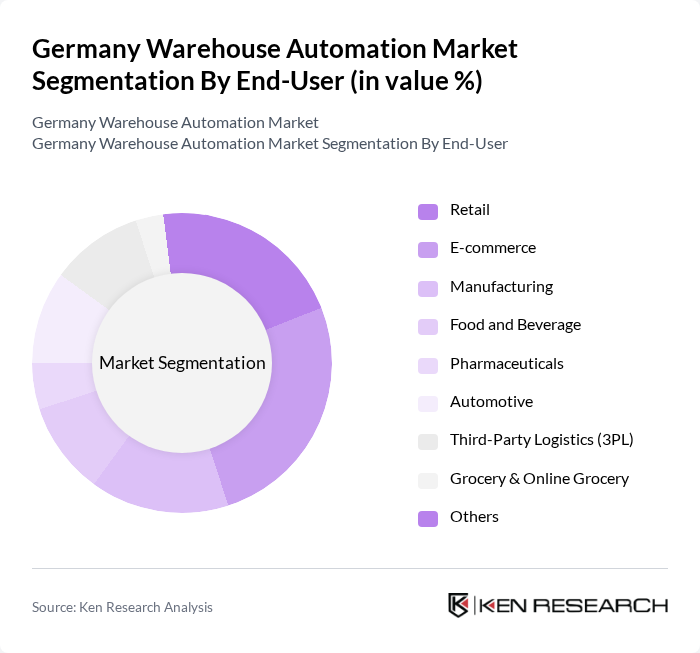

By End-User:The end-user segmentation includes Retail, E-commerce, Manufacturing, Food and Beverage, Pharmaceuticals, Automotive, Third-Party Logistics (3PL), Grocery & Online Grocery, and Others. Each sector is adopting automation to address unique operational challenges, such as high order volumes in e-commerce, traceability in pharmaceuticals, and speed in grocery fulfillment .

The Germany Warehouse Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as KUKA AG, Siemens AG, Dematic GmbH, Swisslog Holding AG, Jungheinrich AG, SSI Schaefer AG, WITRON Logistik + Informatik GmbH, BEUMER Group GmbH & Co. KG, TGW Logistics Group GmbH, Vanderlande Industries, Honeywell Intelligrated, Knapp AG, Murata Machinery, Ltd., AutoStore AS, and Exotec contribute to innovation, geographic expansion, and service delivery in this space.

The future of warehouse automation in Germany appears promising, driven by technological advancements and evolving consumer demands. As companies increasingly adopt smart warehousing solutions, the integration of AI and machine learning will enhance operational efficiency and decision-making processes. Furthermore, the focus on sustainability will likely lead to the development of eco-friendly automation technologies, aligning with Germany's commitment to reducing carbon emissions and promoting green logistics practices in the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Automated Storage and Retrieval Systems (AS/RS) Conveyor Systems Robotics Solutions Sortation Systems Automated Guided Vehicles (AGVs) Warehouse Management Systems (WMS) Palletizing & Depalletizing Systems Picking & Packing Systems Others |

| By End-User | Retail E-commerce Manufacturing Food and Beverage Pharmaceuticals Automotive Third-Party Logistics (3PL) Grocery & Online Grocery Others |

| By Application | Order Fulfillment Inventory Management Shipping and Receiving Returns Processing Cross-Docking Micro-Fulfillment Others |

| By Component | Hardware Software Services |

| By Sales Channel | Direct Sales Distributors Online Sales System Integrators Others |

| By Distribution Mode | Centralized Distribution Decentralized Distribution Hybrid Distribution |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Warehouse Automation | 80 | Warehouse Managers, Operations Directors |

| Manufacturing Automation Solutions | 60 | Production Managers, Automation Engineers |

| E-commerce Fulfillment Centers | 70 | Logistics Coordinators, IT Managers |

| Cold Chain Logistics Automation | 40 | Supply Chain Managers, Quality Assurance Officers |

| Automated Material Handling Systems | 50 | Facility Managers, Equipment Procurement Specialists |

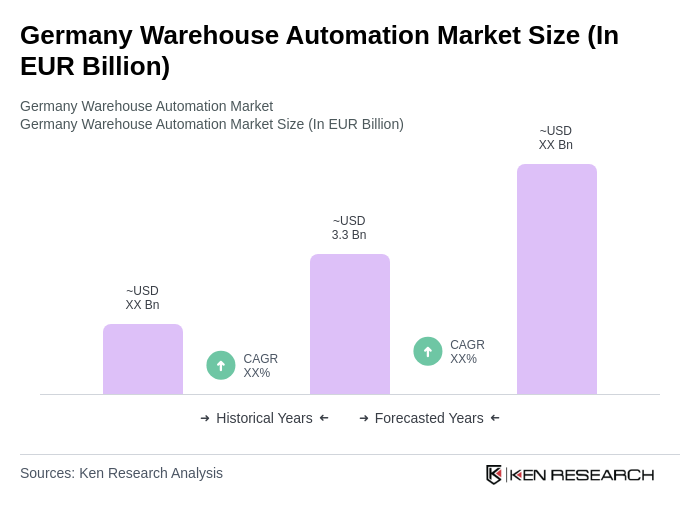

The Germany Warehouse Automation Market is valued at approximately EUR 3.3 billion, reflecting significant growth driven by the demand for efficiency in supply chain operations and the rapid expansion of e-commerce.