Region:Middle East

Author(s):Rebecca

Product Code:KRAB6875

Pages:91

Published On:October 2025

Market.png)

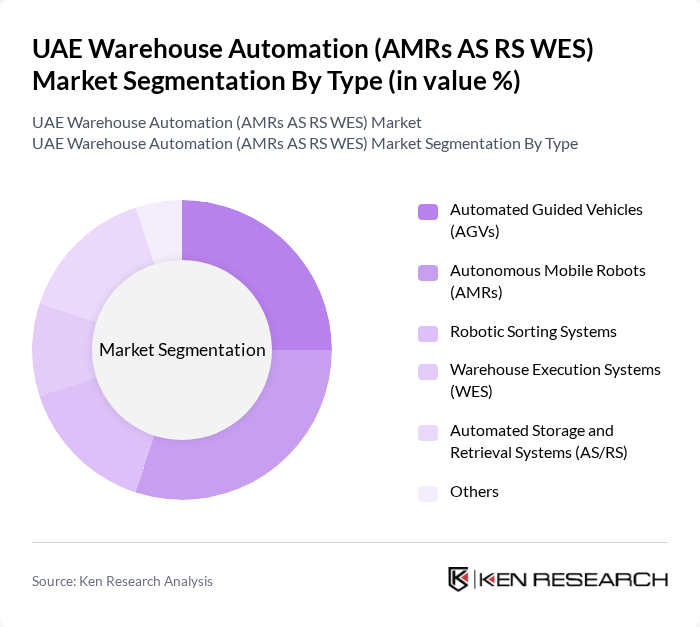

By Type:The market is segmented into various types of automation technologies, including Automated Guided Vehicles (AGVs), Autonomous Mobile Robots (AMRs), Robotic Sorting Systems, Warehouse Execution Systems (WES), Automated Storage and Retrieval Systems (AS/RS), and Others. Each of these sub-segments plays a crucial role in enhancing operational efficiency and streamlining warehouse processes.

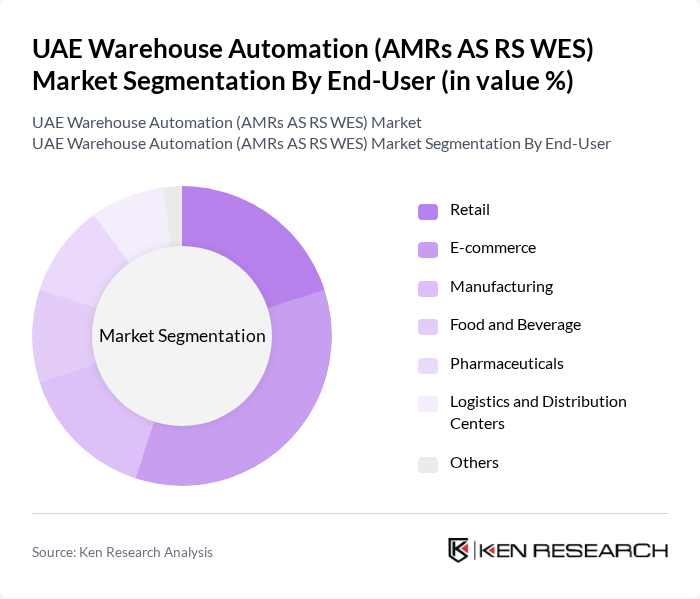

By End-User:The end-user segmentation includes Retail, E-commerce, Manufacturing, Food and Beverage, Pharmaceuticals, Logistics and Distribution Centers, and Others. Each sector has unique requirements and is increasingly adopting warehouse automation solutions to enhance efficiency and meet consumer demands.

The UAE Warehouse Automation (AMRs AS RS WES) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dematic, Honeywell Intelligrated, Siemens AG, Kiva Systems (Amazon Robotics), Vanderlande Industries, Swisslog, GreyOrange, Fetch Robotics, Seegrid, Zebra Technologies, Bastian Solutions, Murata Machinery, Invia Robotics, Locus Robotics, and 6 River Systems contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE warehouse automation market appears promising, driven by ongoing technological advancements and increasing demand for efficiency. As businesses continue to embrace automation, the integration of AI and machine learning will enhance operational capabilities. Furthermore, the expansion of logistics infrastructure will support the growth of automated systems, enabling companies to meet the rising expectations of consumers for faster and more reliable services. The focus on sustainability will also shape future developments in this sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Automated Guided Vehicles (AGVs) Autonomous Mobile Robots (AMRs) Robotic Sorting Systems Warehouse Execution Systems (WES) Automated Storage and Retrieval Systems (AS/RS) Others |

| By End-User | Retail E-commerce Manufacturing Food and Beverage Pharmaceuticals Logistics and Distribution Centers Others |

| By Application | Inventory Management Order Fulfillment Shipping and Receiving Returns Processing Others |

| By Component | Hardware Software Services |

| By Sales Channel | Direct Sales Distributors Online Sales Others |

| By Distribution Mode | Centralized Distribution Decentralized Distribution Hybrid Distribution |

| By Price Range | Low-End Solutions Mid-Range Solutions High-End Solutions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automated Material Handling Systems | 100 | Warehouse Operations Managers, Automation Engineers |

| Warehouse Execution Systems (WES) | 80 | IT Managers, Logistics Directors |

| Automated Storage and Retrieval Systems (AS/RS) | 75 | Supply Chain Managers, Facility Managers |

| Autonomous Mobile Robots (AMRs) | 90 | Procurement Managers, Robotics Specialists |

| Integration of Automation Technologies | 70 | Consultants, Business Development Managers |

The UAE Warehouse Automation market is valued at approximately USD 1.2 billion, driven by the increasing demand for efficiency in logistics and the rapid growth of e-commerce and retail sectors.