Region:Africa

Author(s):Dev

Product Code:KRAA0433

Pages:98

Published On:August 2025

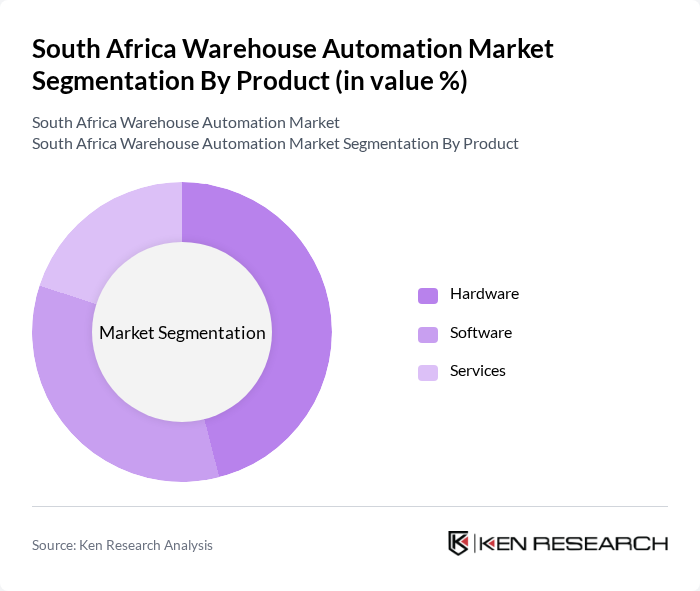

By Product:The product segmentation of the market includes Hardware, Software, and Services. Hardware encompasses the physical components necessary for automation, such as conveyors, sorters, and robotics. Software includes warehouse management systems (WMS), warehouse control systems (WCS), and other platforms that manage and control automated operations. Services refer to consulting, integration, support, and maintenance provided to ensure optimal performance of automated systems .

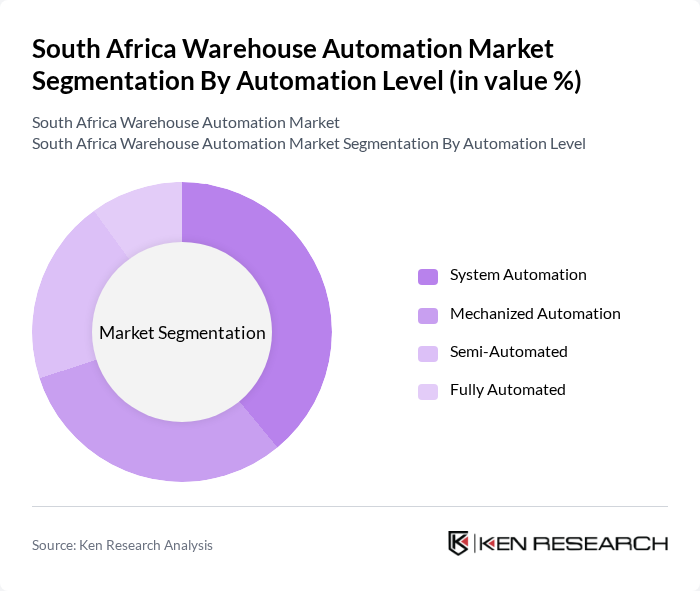

By Automation Level:This segmentation includes System Automation, Mechanized Automation, Semi-Automated, and Fully Automated. System Automation involves the complete integration of automated systems for end-to-end warehouse processes. Mechanized Automation refers to the use of machinery and equipment to assist human workers in specific tasks. Semi-Automated systems combine automated equipment with manual intervention for certain operations, while Fully Automated systems operate independently with minimal or no human input, leveraging robotics, AI, and advanced control systems .

The South Africa Warehouse Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dematic (KION Group), Swisslog (KUKA Group), SSI Schaefer, Vanderlande (Toyota Industries), Interroll, Honeywell Intelligrated, Knapp AG, Barloworld Logistics, Fortna, Dovetail (a WiseTech Global company), Siemens Logistics, Omnia Group (Omnia Warehouse Automation), Zebra Technologies, SICK AG, and Blue Yonder (JDA Software) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the South African warehouse automation market appears promising, driven by ongoing technological advancements and increasing demand for efficiency. As companies continue to embrace automation, the integration of AI and IoT technologies will play a pivotal role in enhancing operational capabilities. Furthermore, the expansion of e-commerce will necessitate further investments in automated solutions, ensuring that businesses can meet consumer demands while optimizing their supply chain processes. This trend is expected to reshape the logistics landscape significantly.

| Segment | Sub-Segments |

|---|---|

| By Product | Hardware Software Services |

| By Automation Level | System Automation Mechanized Automation Semi-Automated Fully Automated |

| By Technology | Automated Storage and Retrieval Systems (AS/RS) Autonomous Mobile Robots (AMRs) Automated Guided Vehicles (AGVs) Automatic Identification and Data Capture MRO Outbounds Others |

| By Application | Inventory Management Order Fulfillment Shipping and Receiving Returns Management Cross-Docking Others |

| By Vertical | Retail E-commerce Manufacturing Food and Beverage Pharmaceuticals Automotive Others |

| By Region | Gauteng Western Cape KwaZulu-Natal Eastern Cape Free State Limpopo Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Warehouse Automation | 100 | Warehouse Managers, Operations Directors |

| Manufacturing Automation Solutions | 80 | Production Managers, Supply Chain Analysts |

| E-commerce Fulfillment Centers | 90 | Logistics Coordinators, IT Managers |

| Cold Chain Logistics Automation | 70 | Quality Assurance Managers, Facility Managers |

| Automated Inventory Management | 60 | Inventory Managers, Procurement Specialists |

The South Africa Warehouse Automation Market is valued at approximately USD 1.1 billion, driven by the increasing demand for efficiency in supply chain operations, the growth of e-commerce, and the adoption of advanced inventory management solutions.