Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA0241

Pages:96

Published On:August 2025

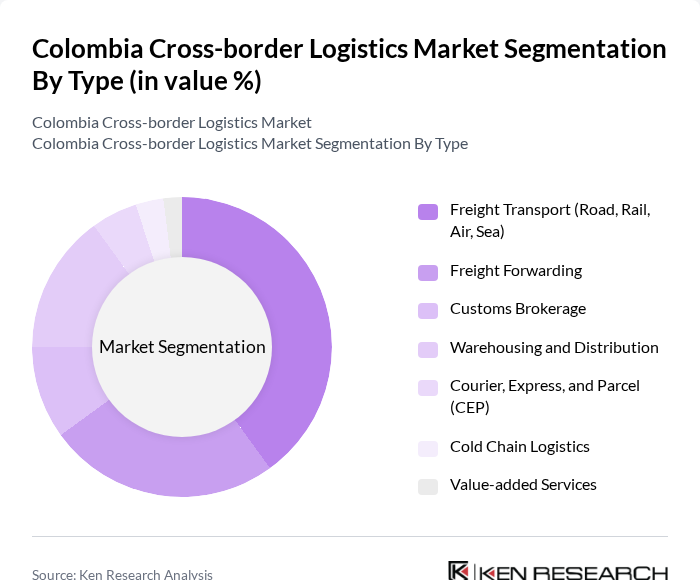

By Type:The cross-border logistics market is segmented into various types, including Freight Transport (Road, Rail, Air, Sea), Freight Forwarding, Customs Brokerage, Warehousing and Distribution, Courier, Express, and Parcel (CEP), Cold Chain Logistics, and Value-added Services. Each of these segments plays a crucial role in facilitating the movement of goods across borders, catering to different customer needs and operational requirements. Freight Transport remains the largest segment, driven by the need for efficient movement of goods across borders, while CEP and Cold Chain Logistics are experiencing rapid growth due to the rise of e-commerce and demand for temperature-sensitive shipments .

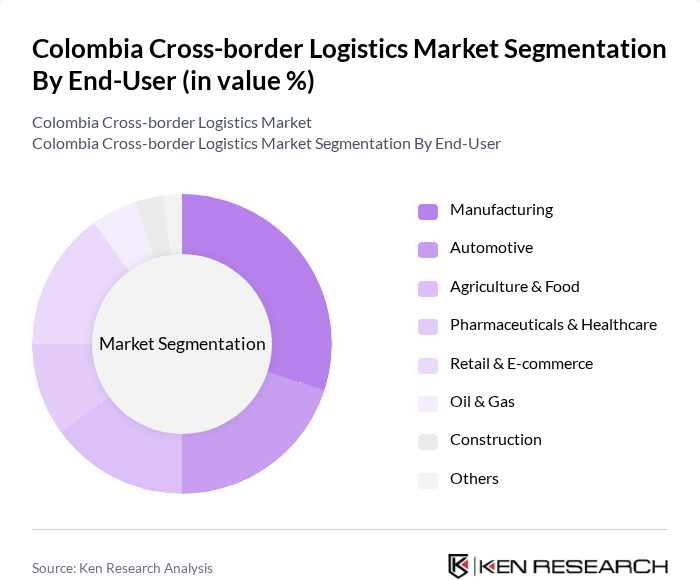

By End-User:The end-user segmentation includes Manufacturing, Automotive, Agriculture & Food, Pharmaceuticals & Healthcare, Retail & E-commerce, Oil & Gas, Construction, and Others. Each sector has unique logistics requirements, influencing the demand for specific services and solutions tailored to their operational needs. Manufacturing, Automotive, and Agriculture & Food are leading end-users, with Retail & E-commerce showing accelerated growth due to digital commerce adoption and last-mile delivery needs .

The Colombia Cross-border Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Servientrega, Coordinadora Mercantil, TCC S.A., Inter Rapidísimo, DHL Express, FedEx Express, UPS, Kuehne + Nagel, DB Schenker, Maersk Line, APM Terminals, Carga Express, Grupo Logístico TIBA, Panalpina (DSV), Logística de Colombia contribute to innovation, geographic expansion, and service delivery in this space .

The future of Colombia's cross-border logistics market appears promising, driven by ongoing investments in infrastructure and technology. As e-commerce continues to expand, logistics providers are likely to adopt innovative solutions to enhance efficiency. Additionally, the government's commitment to improving trade facilitation policies will further streamline operations. The focus on sustainability will also shape logistics strategies, encouraging companies to adopt greener practices, which could attract environmentally conscious consumers and businesses alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Transport (Road, Rail, Air, Sea) Freight Forwarding Customs Brokerage Warehousing and Distribution Courier, Express, and Parcel (CEP) Cold Chain Logistics Value-added Services |

| By End-User | Manufacturing Automotive Agriculture & Food Pharmaceuticals & Healthcare Retail & E-commerce Oil & Gas Construction Others |

| By Service Type | Full Truck Load (FTL) Less than Truck Load (LTL) Intermodal Services Express Delivery Last-Mile Delivery Others |

| By Mode of Transport | Road Transport Rail Transport Air Transport Sea Transport Inland Waterways Others |

| By Geographic Coverage | Andean Region (including Bogotá, Medellín, Cali) Caribbean Region (including Barranquilla, Cartagena, Santa Marta) Pacific Region (including Buenaventura) Border Zones (Venezuela, Ecuador, Panama) Others |

| By Customer Type | B2B B2C Government NGOs Others |

| By Technology Utilization | IoT in Logistics Blockchain for Supply Chain AI and Machine Learning Big Data Analytics Digital Freight Platforms Automation & Robotics Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cross-border Freight Forwarding | 100 | Logistics Coordinators, Freight Managers |

| Customs Brokerage Services | 80 | Customs Agents, Compliance Officers |

| Transportation Services for Exports | 70 | Export Managers, Operations Directors |

| Warehousing Solutions for Imports | 60 | Warehouse Managers, Supply Chain Analysts |

| Logistics Technology Providers | 45 | IT Managers, Product Development Leads |

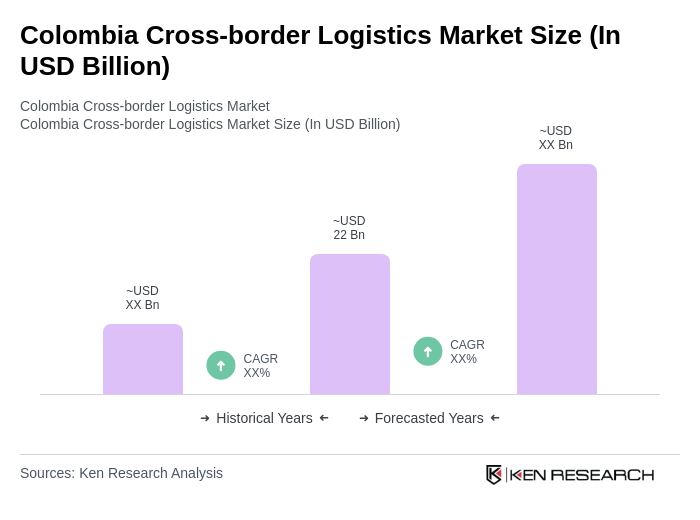

The Colombia Cross-border Logistics Market is valued at approximately USD 22 billion, reflecting significant growth driven by the demand for efficient supply chain solutions, e-commerce expansion, and infrastructure improvements.