Region:North America

Author(s):Shubham

Product Code:KRAA0860

Pages:93

Published On:August 2025

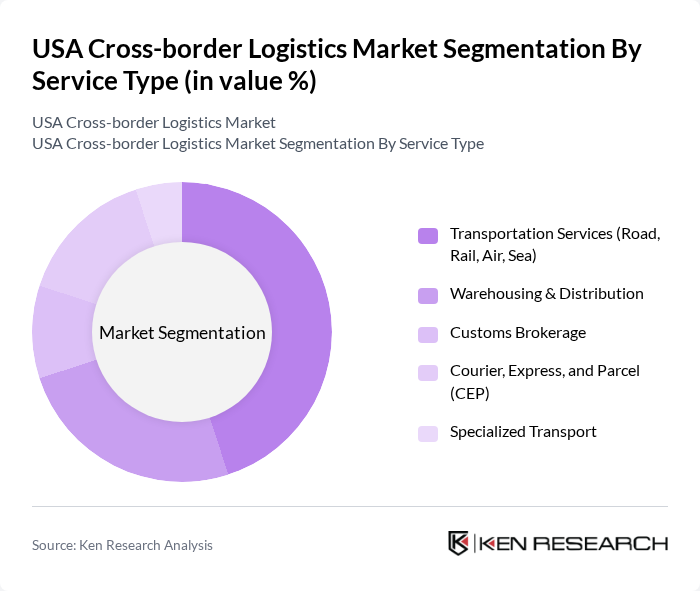

By Service Type:The service type segmentation includes various subsegments such as Transportation Services (Road, Rail, Air, Sea), Warehousing & Distribution, Customs Brokerage, Courier, Express, and Parcel (CEP), and Specialized Transport. Among these, Transportation Services dominate the market due to the increasing demand for efficient and timely delivery solutions. The rise of e-commerce and omnichannel distribution strategies has significantly contributed to the growth of this subsegment, as businesses seek reliable transportation options to meet evolving customer expectations .

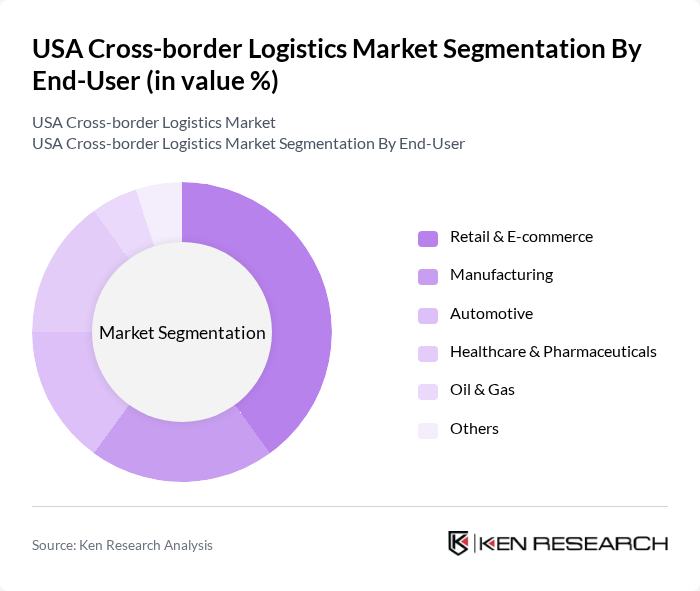

By End-User:The end-user segmentation encompasses Retail & E-commerce, Manufacturing, Automotive, Healthcare & Pharmaceuticals, Oil & Gas, and Others. The Retail & E-commerce subsegment leads the market, driven by the surge in online shopping, expansion of e-commerce platforms, and consumer demand for rapid delivery services. These trends have prompted logistics providers to invest in advanced technologies and optimize their supply chains to cater to the growing needs of e-commerce businesses .

The USA Cross-border Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain & Global Forwarding, FedEx Logistics, UPS Supply Chain Solutions, XPO Logistics, C.H. Robinson Worldwide, Kuehne + Nagel, DB Schenker, Expeditors International of Washington, Geodis, DSV A/S, CEVA Logistics, Ryder Supply Chain Solutions, Maersk Logistics & Services, SF Express, and Amazon Global Logistics contribute to innovation, geographic expansion, and service delivery in this space .

The future of the USA cross-border logistics market is poised for significant transformation, driven by technological advancements and evolving consumer expectations. As logistics providers increasingly adopt automation and AI, operational efficiencies will improve, enabling faster delivery times. Additionally, the focus on sustainability will shape logistics strategies, with companies seeking eco-friendly practices. The integration of blockchain technology will enhance transparency and security in cross-border transactions, further streamlining operations and fostering trust among stakeholders in the logistics ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Transportation Services (Road, Rail, Air, Sea) Warehousing & Distribution Customs Brokerage Courier, Express, and Parcel (CEP) Specialized Transport |

| By End-User | Retail & E-commerce Manufacturing Automotive Healthcare & Pharmaceuticals Oil & Gas Others |

| By Mode of Transport | Road Freight Rail Freight Air Freight Sea/Ocean Freight Intermodal |

| By Shipment Size | Full Truckload (FTL) Less Than Truckload (LTL) Small Parcel Others |

| By Geographic Coverage | North America (US, Canada, Mexico) Latin America Europe Asia-Pacific Others |

| By Delivery Speed | Same-Day Delivery Next-Day Delivery Standard Delivery Expedited Delivery Others |

| By Pricing Model | Fixed Pricing Dynamic Pricing Subscription-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cross-border E-commerce Logistics | 100 | Logistics Coordinators, E-commerce Managers |

| Automotive Supply Chain Management | 60 | Supply Chain Analysts, Procurement Managers |

| Pharmaceutical Distribution Networks | 40 | Compliance Officers, Distribution Managers |

| Retail Supply Chain Operations | 80 | Operations Managers, Inventory Control Specialists |

| Customs Brokerage Services | 50 | Customs Brokers, Regulatory Affairs Specialists |

The USA Cross-border Logistics Market is valued at approximately USD 1.5 trillion, reflecting significant growth driven by global e-commerce expansion, globalization of supply chains, and increasing demand for efficient delivery services.