Region:Asia

Author(s):Shubham

Product Code:KRAA1054

Pages:89

Published On:August 2025

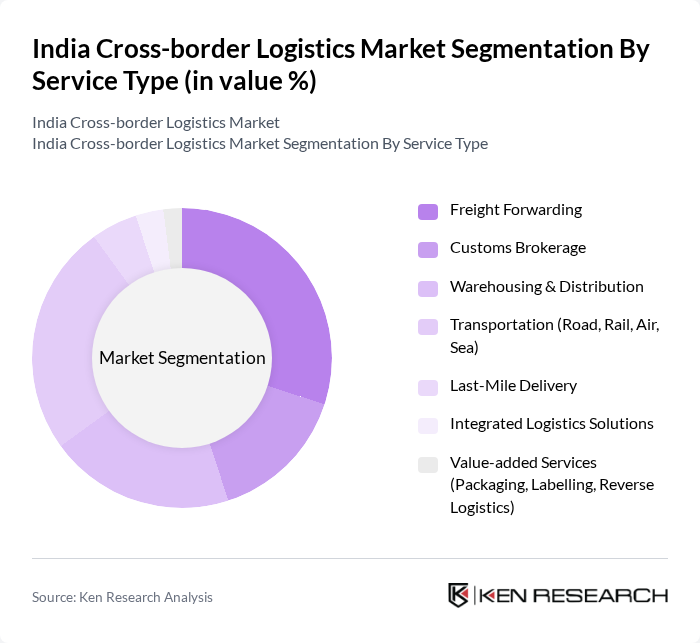

By Service Type:The service type segmentation includes sub-segments such as Freight Forwarding, Customs Brokerage, Warehousing & Distribution, Transportation (Road, Rail, Air, Sea), Last-Mile Delivery, Integrated Logistics Solutions, and Value-added Services (Packaging, Labelling, Reverse Logistics). Each of these services is integral to the cross-border logistics process, addressing diverse customer requirements and operational complexities. Freight forwarding and transportation services are particularly critical due to the need for efficient international movement and customs compliance, while warehousing and value-added services support inventory management and product customization for export markets .

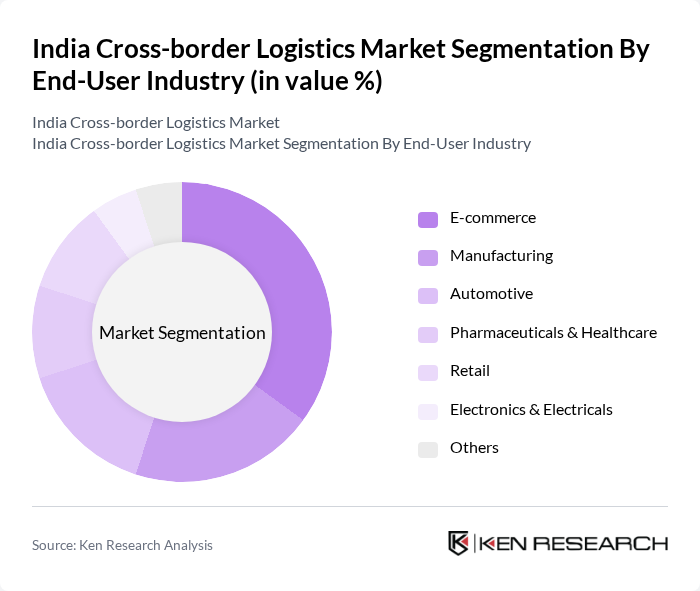

By End-User Industry:The end-user industry segmentation covers E-commerce, Manufacturing, Automotive, Pharmaceuticals & Healthcare, Retail, Electronics & Electricals, and Others. E-commerce is the dominant segment, reflecting the rapid growth of cross-border online retail and the increasing participation of Indian sellers in global marketplaces. Manufacturing and automotive industries also contribute significantly due to the export of components and finished goods, while pharmaceuticals and electronics require specialized logistics solutions for compliance and product safety .

The India Cross-border Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Express India Pvt. Ltd., FedEx Express Transportation and Supply Chain Services (India), Blue Dart Express Ltd., Delhivery Ltd., Gati Ltd., TCI Express Ltd., Mahindra Logistics Ltd., Allcargo Logistics Ltd., Xpressbees Logistics, DTDC Express Limited, Safexpress Pvt. Ltd., Rivigo Services Pvt. Ltd., Ecom Express Pvt. Ltd., Aramex India Pvt. Ltd., and UPS Express Pvt. Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India cross-border logistics market appears promising, driven by technological advancements and increasing globalization. As companies adopt digital logistics solutions, including AI and blockchain, operational efficiencies are expected to improve significantly. Furthermore, the expansion of logistics hubs and the development of smart infrastructure will facilitate smoother cross-border trade. These trends indicate a robust growth trajectory, positioning India as a key player in the global logistics landscape in future.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Freight Forwarding Customs Brokerage Warehousing & Distribution Transportation (Road, Rail, Air, Sea) Last-Mile Delivery Integrated Logistics Solutions Value-added Services (Packaging, Labelling, Reverse Logistics) |

| By End-User Industry | E-commerce Manufacturing Automotive Pharmaceuticals & Healthcare Retail Electronics & Electricals Others |

| By Region | North India South India East India West India Central India Northeastern India Others |

| By Mode of Transport | Road Rail Air Sea Multimodal Others |

| By Customer Type | B2B B2C C2C Others |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cross-border E-commerce Logistics | 100 | Logistics Coordinators, E-commerce Managers |

| Pharmaceutical Import/Export Logistics | 80 | Supply Chain Managers, Compliance Officers |

| Textile Export Logistics | 60 | Export Managers, Freight Forwarding Specialists |

| Automotive Component Supply Chain | 50 | Procurement Managers, Logistics Analysts |

| Electronics Goods Shipping | 70 | Operations Managers, Customs Brokers |

The India Cross-border Logistics Market is valued at approximately USD 12 billion, reflecting significant growth driven by increasing demand for efficient supply chain solutions and the expansion of cross-border e-commerce activities.