Region:Central and South America

Author(s):Rebecca

Product Code:KRAA0331

Pages:84

Published On:August 2025

By Type:The market is segmented into various types, including Freight Forwarding, Customs Brokerage, Warehousing Services, Transportation Services, and Value-Added Services. Among these, Freight Forwarding is the leading sub-segment, driven by the increasing demand for efficient shipping solutions, growth of international trade, and the need for integrated supply chain management. Customs Brokerage plays a crucial role in ensuring compliance with evolving regulations and facilitating smooth cross-border transactions. Warehousing Services have surged due to the rise in e-commerce and nearshoring, while Transportation Services remain essential for the movement of goods across borders. Value-Added Services are gaining traction as businesses seek to optimize logistics efficiency and enhance customer experience .

By End-User:The end-user segmentation includes Automotive, Electronics & Electricals, Pharmaceuticals & Healthcare, Retail & E-commerce, Aerospace, Agriculture & Food, and Others. The Automotive sector is the dominant end-user, driven by Mexico's status as a leading manufacturing hub for global automotive companies and robust cross-border supply chains. Electronics & Electricals follows, benefiting from the increasing demand for consumer electronics and industrial components. Retail & E-commerce has experienced significant growth, particularly with the surge in online shopping and demand for fast delivery. Pharmaceuticals & Healthcare is expanding due to the need for timely and compliant delivery of medical supplies and equipment .

The Mexico Cross-border Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, FedEx Logistics, UPS Supply Chain Solutions, Kuehne + Nagel, DB Schenker, XPO Logistics, C.H. Robinson, Grupo Traxión, Estafeta, Ryder System, Inc., Expeditors International, Geodis, DSV, Penske Logistics, TUM (Transportes Unidos Mexicanos) contribute to innovation, geographic expansion, and service delivery in this space.

The future of Mexico's cross-border logistics market appears promising, driven by ongoing investments in infrastructure and technology. As e-commerce continues to expand, logistics providers are likely to adopt advanced technologies such as AI and automation to enhance efficiency. Additionally, the focus on sustainability will shape logistics strategies, with companies increasingly adopting green practices. These trends will create a more resilient and responsive logistics ecosystem, positioning Mexico as a key player in global supply chains.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Forwarding Customs Brokerage Warehousing Services Transportation Services Value-Added Services (e.g., packaging, labeling, reverse logistics) |

| By End-User | Automotive Electronics & Electricals Pharmaceuticals & Healthcare Retail & E-commerce Aerospace Agriculture & Food Others |

| By Mode of Transport | Road Rail Air Sea Multimodal |

| By Service Type | Full Truck Load (FTL) Less Than Truck Load (LTL) Intermodal Services Expedited Services Cold Chain Logistics Others |

| By Geographic Coverage | Northern Mexico (e.g., Nuevo León, Chihuahua, Baja California) Central Mexico (e.g., Mexico City, Bajío region) Southern Mexico Border Regions (U.S.-Mexico border states) Others |

| By Customer Type | B2B B2C Government NGOs Others |

| By Technology Utilization | Traditional Logistics Digital Logistics Platforms IoT-Enabled Logistics Blockchain in Logistics Automation & Robotics Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cross-border Freight Forwarding | 100 | Logistics Coordinators, Freight Managers |

| Customs Brokerage Services | 60 | Customs Brokers, Compliance Officers |

| Warehousing and Distribution | 50 | Warehouse Managers, Operations Directors |

| Last-Mile Delivery Solutions | 40 | Delivery Managers, Supply Chain Analysts |

| Technology in Logistics | 40 | IT Managers, Logistics Technology Specialists |

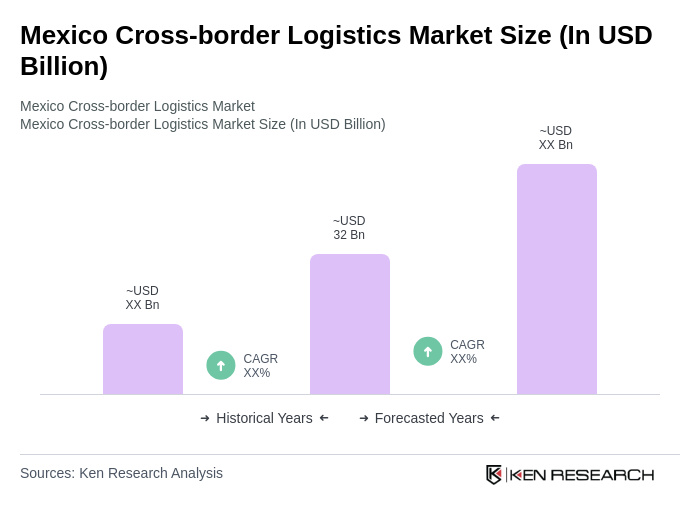

The Mexico Cross-border Logistics Market is valued at approximately USD 32 billion, reflecting significant growth driven by increased trade activities, particularly with the United States, and the impact of the USMCA agreement, which has facilitated smoother trade relations.