Region:Global

Author(s):Shubham

Product Code:KRAA1115

Pages:84

Published On:August 2025

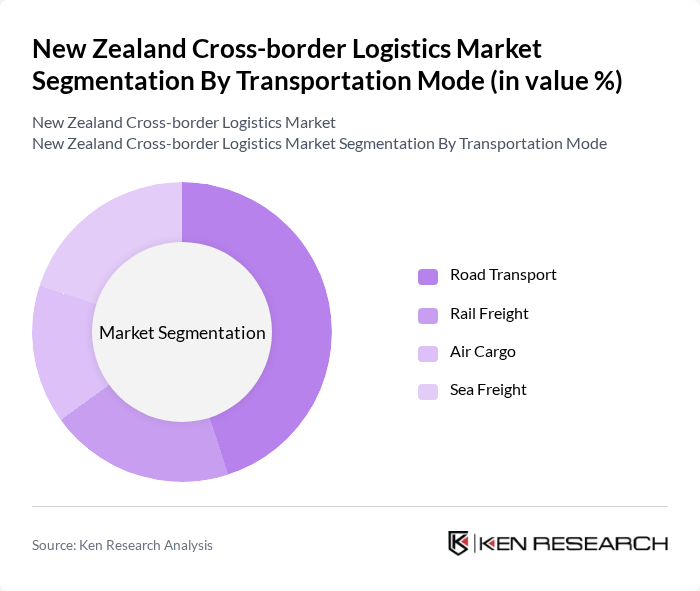

By Transportation Mode:

The transportation mode segment includes Road Transport, Rail Freight, Air Cargo, and Sea Freight. Road Transport holds the largest share, attributed to its flexibility and ability to provide door-to-door services, which is critical for e-commerce and last-mile deliveries. Rail Freight is increasingly utilized for bulk goods, especially in the agricultural and manufacturing sectors. Air Cargo is preferred for high-value and time-sensitive shipments, while Sea Freight remains essential for international trade, particularly for large-volume exports and imports. The sector is also witnessing a push towards sustainable practices and technology-driven optimization .

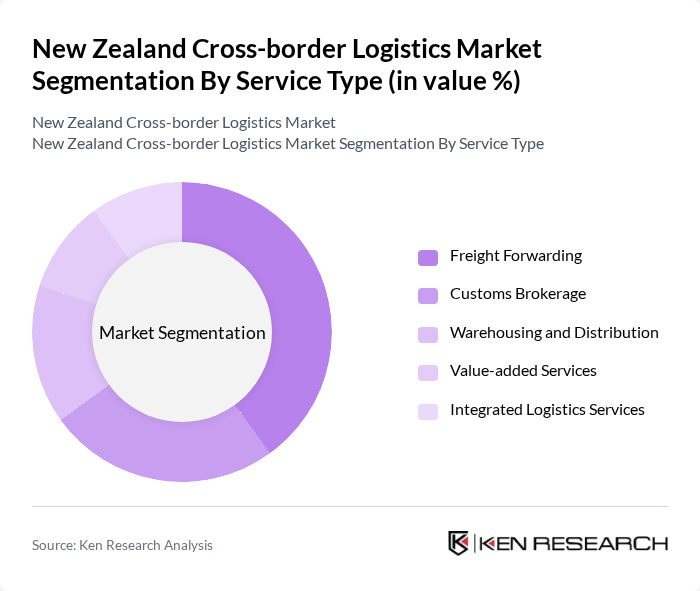

By Service Type:

This segment encompasses Freight Forwarding, Customs Brokerage, Warehousing and Distribution, Value-added Services, and Integrated Logistics Services. Freight Forwarding is the leading service type, driven by the increasing complexity of global supply chains and the need for expert logistics management. Customs Brokerage is vital for ensuring regulatory compliance and smooth border operations. Warehousing and Distribution services are essential for efficient inventory management and timely deliveries. Value-added Services, such as packaging and labeling, are gaining traction as businesses seek to differentiate their offerings, while Integrated Logistics Services are increasingly adopted for end-to-end supply chain solutions .

The New Zealand Cross-border Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mainfreight, Toll Group, Kuehne + Nagel, DB Schenker, DHL Supply Chain, CEVA Logistics, FedEx Express, UPS Supply Chain Solutions, NZ Post (New Zealand Post), C.H. Robinson, Maersk, Mondiale VGL, DSV, Yusen Logistics, and Aramex contribute to innovation, geographic expansion, and service delivery in this space .

The future of New Zealand's cross-border logistics market appears promising, driven by technological advancements and increasing e-commerce activities. As businesses adapt to consumer demands for faster and more efficient delivery, the integration of automation and data analytics will play a crucial role. Additionally, the focus on sustainability will likely shape logistics strategies, encouraging investments in green technologies. Overall, the market is poised for growth, with logistics providers adapting to evolving consumer expectations and regulatory landscapes.

| Segment | Sub-Segments |

|---|---|

| By Transportation Mode | Road Transport Rail Freight Air Cargo Sea Freight |

| By Service Type | Freight Forwarding Customs Brokerage Warehousing and Distribution Value-added Services Integrated Logistics Services |

| By Industry Vertical | Manufacturing Retail Agriculture Healthcare & Pharmaceuticals E-commerce Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cross-border E-commerce Logistics | 100 | Logistics Coordinators, E-commerce Managers |

| Export Compliance and Customs Management | 60 | Customs Brokers, Compliance Officers |

| International Freight Forwarding | 55 | Operations Managers, Freight Analysts |

| Cold Chain Logistics for Perishables | 45 | Supply Chain Managers, Quality Assurance Leads |

| Logistics Technology Adoption | 70 | IT Managers, Digital Transformation Leads |

The New Zealand Cross-border Logistics Market is valued at approximately USD 17 billion, reflecting significant growth driven by the demand for efficient supply chain solutions, e-commerce expansion, and faster delivery services.