Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA0262

Pages:85

Published On:August 2025

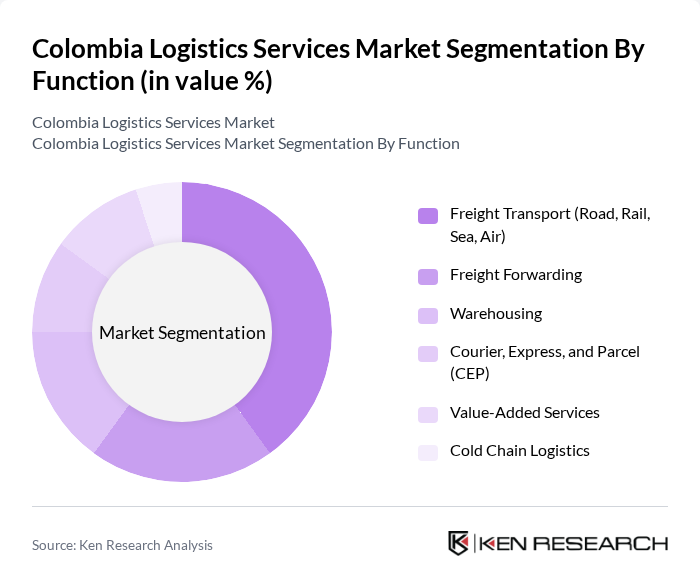

By Function:The logistics services market is segmented by key functions, including Freight Transport (Road, Rail, Sea, Air), Freight Forwarding, Warehousing, Courier, Express, and Parcel (CEP), Value-Added Services, and Cold Chain Logistics. Freight Transport remains the most significant segment, driven by the growing demand for efficient and timely delivery of goods, especially as e-commerce and retail distribution expand. The adoption of digital solutions and real-time tracking is further accelerating the need for reliable transport and logistics services .

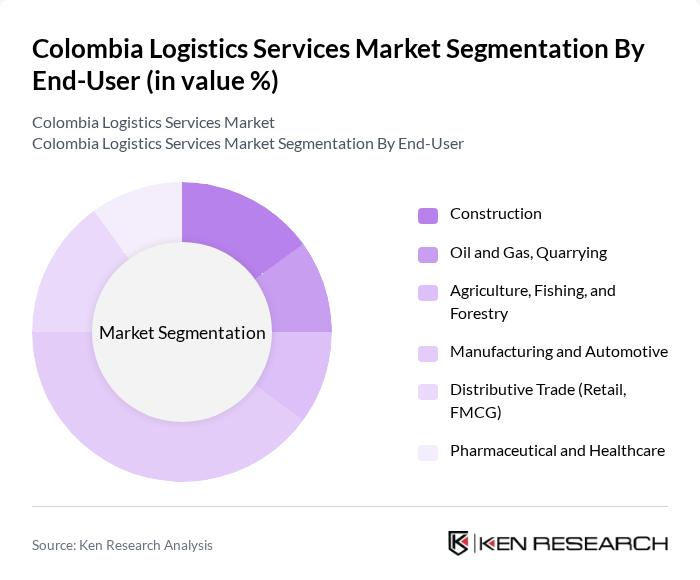

By End-User:The logistics services market is also segmented by end-user industries, including Construction, Oil and Gas, Quarrying, Agriculture, Fishing, and Forestry, Manufacturing and Automotive, Distributive Trade (Retail, FMCG), and Pharmaceutical and Healthcare. Manufacturing and Automotive is the leading end-user segment, as it requires extensive logistics support for the movement of raw materials and finished goods. Growth in manufacturing, automotive, and retail activities in Colombia has significantly contributed to increased demand for logistics services, with e-commerce and FMCG sectors also driving rapid expansion in CEP and warehousing solutions .

The Colombia Logistics Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Servientrega, Coordinadora, TCC, Interrapidisimo, DHL Supply Chain, FedEx, UPS, Kuehne + Nagel, Rappi, Deprisa, Envía, Blu Logistics, Logística de Colombia, Grupo ZFB, and OPL Carga contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Colombia logistics services market appears promising, driven by ongoing digital transformation and sustainability initiatives. As companies increasingly adopt technology, such as AI and automation, logistics operations will become more efficient and responsive. Additionally, the focus on sustainable practices will likely lead to innovations in green logistics, enhancing the sector's resilience. With continued government support and investment, the logistics landscape is set to evolve, positioning Colombia as a key player in regional supply chains.

| Segment | Sub-Segments |

|---|---|

| By Function | Freight Transport (Road, Rail, Sea, Air) Freight Forwarding Warehousing Courier, Express, and Parcel (CEP) Value-Added Services Cold Chain Logistics |

| By End-User | Construction Oil and Gas, Quarrying Agriculture, Fishing, and Forestry Manufacturing and Automotive Distributive Trade (Retail, FMCG) Pharmaceutical and Healthcare |

| By Region | Andean Region Caribbean Region Pacific Region Amazon Region |

| By Service Mode | Road Transport Rail Transport Air Freight Sea Freight Others |

| By Technology Adoption | Traditional Logistics Digital Logistics Automated Warehousing IoT in Logistics Others |

| By Delivery Type | Standard Delivery Express Delivery Scheduled Delivery Same-Day Delivery Others |

| By Customer Type | B2B B2C C2C Government Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Services | 100 | Logistics Coordinators, Supply Chain Managers |

| Manufacturing Supply Chain | 80 | Operations Directors, Procurement Managers |

| Transportation and Freight Forwarding | 60 | Freight Managers, Logistics Analysts |

| Warehousing and Distribution | 50 | Warehouse Managers, Inventory Control Specialists |

| Last-Mile Delivery Services | 40 | Delivery Operations Managers, Customer Experience Leads |

The Colombia Logistics Services Market is valued at approximately USD 22 billion, driven by the increasing demand for efficient supply chain solutions, rapid urbanization, and the expansion of e-commerce.