Region:Asia

Author(s):Rebecca

Product Code:KRAA0352

Pages:82

Published On:August 2025

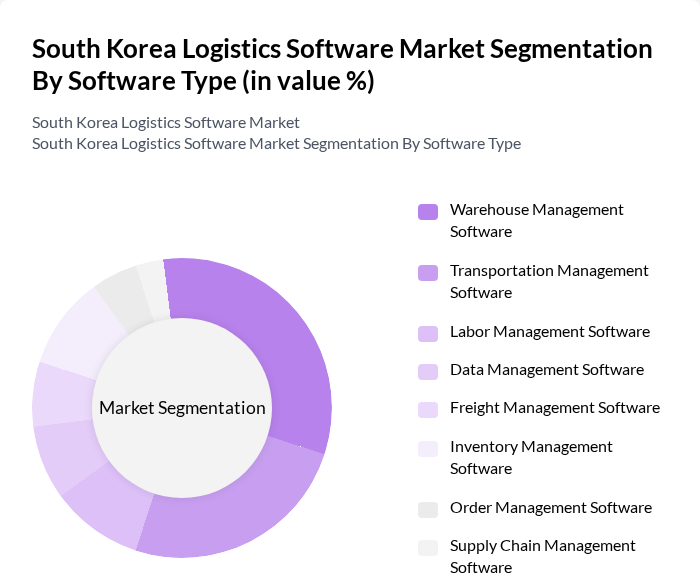

By Software Type:The logistics software market is segmented into various types, including Warehouse Management Software, Transportation Management Software, Labor Management Software, Data Management Software, Freight Management Software, Inventory Management Software, Order Management Software, Supply Chain Management Software, and Others. Among these, Warehouse Management Software is currently leading the market due to the increasing need for efficient inventory control and space optimization in warehouses. The growing trend of automation and digitalization in warehousing operations, including the adoption of robotics and real-time tracking, further supports the dominance of this segment .

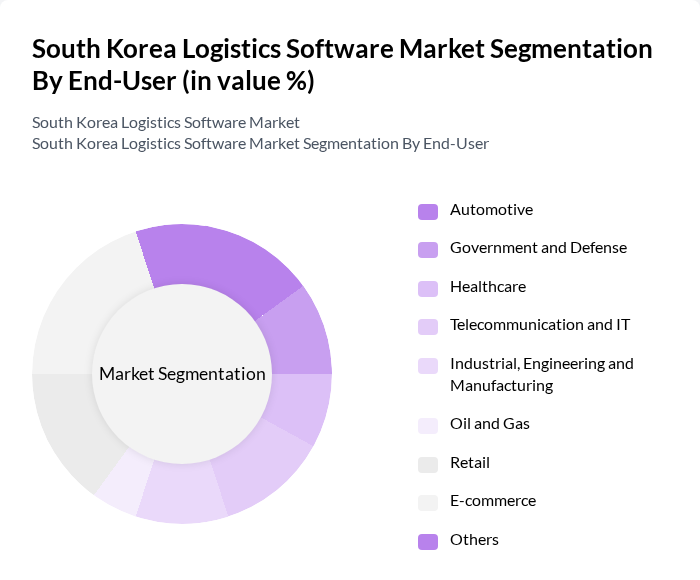

By End-User:The logistics software market is also segmented by end-user industries, including Automotive, Government and Defense, Healthcare, Telecommunication and IT, Industrial, Engineering and Manufacturing, Oil and Gas, Retail, E-commerce, and Others. The E-commerce sector is currently the leading end-user, driven by the rapid growth of online shopping and the need for efficient logistics solutions to manage increased order volumes and customer expectations for fast delivery. Retail and automotive sectors are also significant adopters, leveraging software to optimize inventory and distribution networks .

The South Korea Logistics Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung SDS, LG CNS, SK C&C, Hyundai Glovis, CJ Logistics, Daewoo Logistics, Hanjin Transportation, KCTC, GS ITM, Lotte Data Communication Company, TmaxSoft, Hansol Inticube, Incheon Systems, LogisALL, Korea Software Solutions contribute to innovation, geographic expansion, and service delivery in this space.

The South Korea logistics software market is poised for significant transformation, driven by technological advancements and evolving consumer expectations. As e-commerce continues to expand, logistics companies will increasingly adopt cloud-based solutions and automation technologies to enhance operational efficiency. Furthermore, the integration of AI and machine learning will enable more accurate demand forecasting and inventory management. These trends will not only improve service delivery but also foster a more sustainable logistics ecosystem, aligning with global sustainability goals.

| Segment | Sub-Segments |

|---|---|

| By Software Type | Warehouse Management Software Transportation Management Software Labor Management Software Data Management Software Freight Management Software Inventory Management Software Order Management Software Supply Chain Management Software Others |

| By End-User | Automotive Government and Defense Healthcare Telecommunication and IT Industrial, Engineering and Manufacturing Oil and Gas Retail E-commerce Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Others |

| By Industry Vertical | Food and Beverage Consumer Goods Pharmaceuticals Electronics Others |

| By Functionality | Planning Execution Monitoring Optimization Others |

| By Region | Seoul Busan Incheon Daegu Others |

| By Business Size | Small Enterprises Medium Enterprises Large Enterprises Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Software Adoption | 60 | Logistics Managers, IT Directors |

| Manufacturing Supply Chain Solutions | 50 | Operations Managers, Supply Chain Analysts |

| E-commerce Fulfillment Software | 70 | eCommerce Managers, Warehouse Supervisors |

| Transportation Management Systems | 40 | Fleet Managers, Logistics Coordinators |

| Inventory Management Solutions | 40 | Inventory Managers, Procurement Officers |

The South Korea Logistics Software Market is valued at approximately USD 220 million, driven by the increasing demand for efficient supply chain management solutions and the rapid growth of e-commerce in the region.