Region:Europe

Author(s):Geetanshi

Product Code:KRAA0322

Pages:87

Published On:August 2025

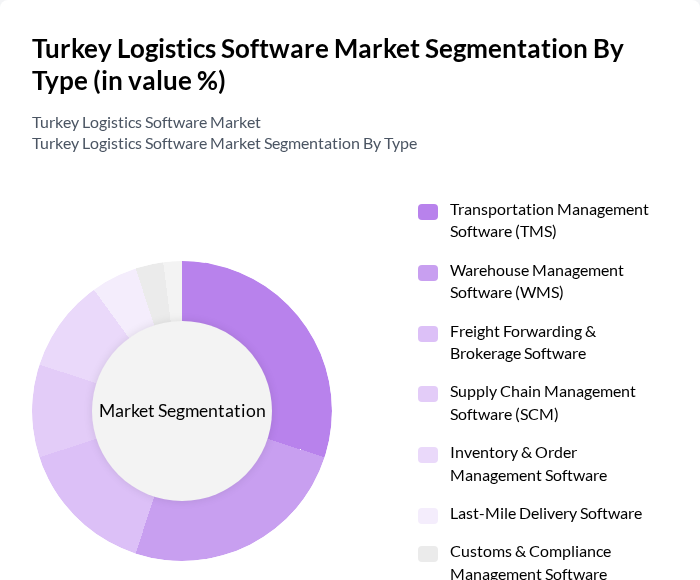

By Type:The logistics software market can be segmented into various types, including Transportation Management Software (TMS), Warehouse Management Software (WMS), Freight Forwarding & Brokerage Software, Supply Chain Management Software (SCM), Inventory & Order Management Software, Last-Mile Delivery Software, Customs & Compliance Management Software, and Others. Each of these segments plays a crucial role in streamlining logistics operations and enhancing overall efficiency. TMS and WMS are particularly prominent due to the focus on optimizing transportation routes and warehouse automation, while last-mile delivery and compliance solutions are gaining traction with the rise of e-commerce and regulatory requirements .

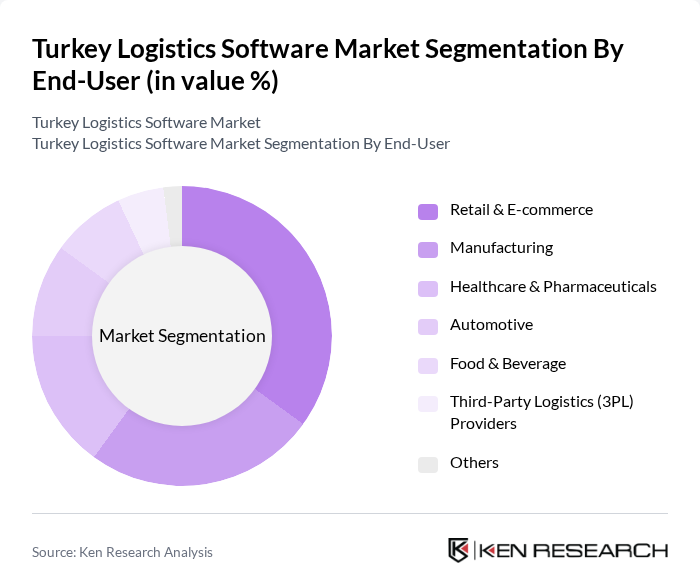

By End-User:The logistics software market serves various end-users, including Retail & E-commerce, Manufacturing, Healthcare & Pharmaceuticals, Automotive, Food & Beverage, Third-Party Logistics (3PL) Providers, and Others. Each sector has unique requirements that drive the adoption of specialized logistics software solutions. Retail & e-commerce lead due to the surge in online shopping and demand for rapid delivery, while manufacturing and healthcare emphasize traceability and compliance .

The Turkey Logistics Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Logo Yaz?l?m, Nebim, Setlog, Transporeon, SAP SE, Oracle Corporation, Manhattan Associates, Infor, WiseTech Global (CargoWise), Blue Yonder, Descartes Systems Group, Freightos, Kargoist, Project44, FourKites contribute to innovation, geographic expansion, and service delivery in this space.

The future of the logistics software market in Turkey appears promising, driven by technological advancements and increasing demand for efficiency. The integration of artificial intelligence and IoT devices is expected to revolutionize logistics operations, enhancing automation and real-time data analytics. Additionally, as sustainability becomes a priority, logistics companies are likely to adopt green practices, further influencing software development. These trends will shape a more agile and responsive logistics landscape, positioning Turkey as a key player in the regional logistics sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Management Software (TMS) Warehouse Management Software (WMS) Freight Forwarding & Brokerage Software Supply Chain Management Software (SCM) Inventory & Order Management Software Last-Mile Delivery Software Customs & Compliance Management Software Others |

| By End-User | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Automotive Food & Beverage Third-Party Logistics (3PL) Providers Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Others |

| By Region | Marmara Aegean Central Anatolia Eastern Anatolia Southeastern Anatolia |

| By Business Size | Large Enterprises Medium Enterprises Small Enterprises Startups Others |

| By Functionality | Order Management Fleet Management Route Optimization Performance Analytics & Reporting Real-Time Tracking & Visibility Others |

| By Pricing Model | Subscription-Based One-Time License Fee Pay-Per-Use Freemium/Trial Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Software Adoption | 60 | Logistics Managers, IT Directors |

| Manufacturing Supply Chain Solutions | 50 | Operations Managers, Supply Chain Analysts |

| E-commerce Fulfillment Software | 50 | eCommerce Managers, Warehouse Supervisors |

| Transportation Management Systems | 40 | Fleet Managers, Logistics Coordinators |

| Inventory Management Solutions | 40 | Inventory Managers, Procurement Officers |

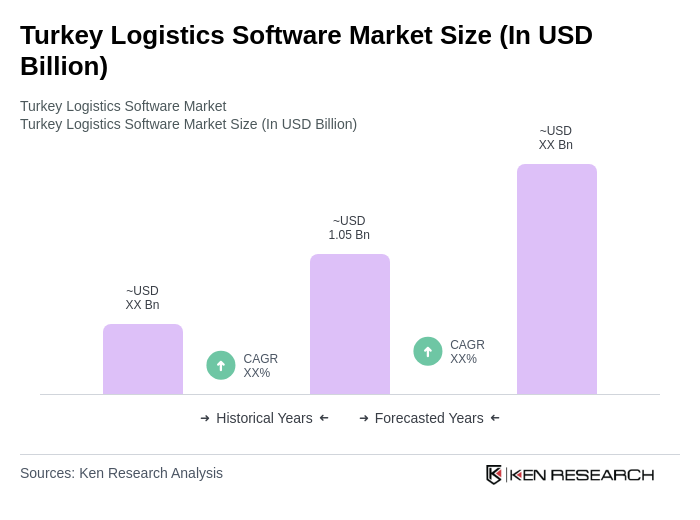

The Turkey Logistics Software Market is valued at approximately USD 1.05 billion, reflecting significant growth driven by the demand for efficient supply chain management, e-commerce expansion, and the adoption of advanced technologies like IoT and AI.