Region:Africa

Author(s):Dev

Product Code:KRAA0419

Pages:84

Published On:August 2025

By Type:The logistics software market in Egypt is segmented into Transportation Management Software, Warehouse Management Software, Freight Management Software, Inventory Management Software, Order Management Software, Supply Chain Management Software, Last-Mile Delivery Software, Customs & Compliance Software, and Others. These software types are integral to optimizing logistics workflows, improving visibility, and supporting the diverse operational needs of logistics providers .

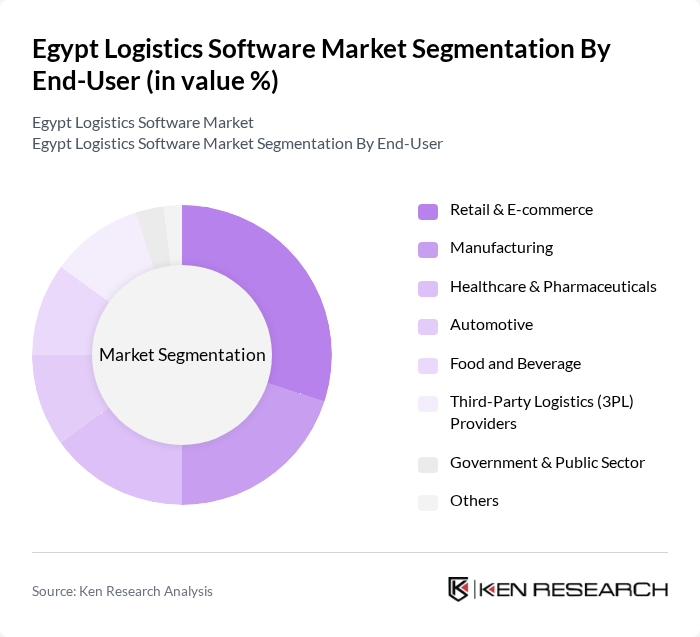

By End-User:The end-user segmentation of the logistics software market includes Retail & E-commerce, Manufacturing, Healthcare & Pharmaceuticals, Automotive, Food and Beverage, Third-Party Logistics (3PL) Providers, Government & Public Sector, and Others. Each sector has distinct logistics requirements, driving the adoption of specialized software solutions to enhance supply chain efficiency and meet regulatory standards .

The Egypt Logistics Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Infor, IBM Corporation, GAC Egypt, Logistics Plus Inc., APEX Group Egypt, DB Schenker Egypt, Nile Logistics International, Manhattan Associates, Descartes Systems Group, Freightos, FourKites, Logiwa, Project44 contribute to innovation, geographic expansion, and service delivery in this space.

The future of the logistics software market in Egypt appears promising, driven by technological advancements and increasing demand for efficiency. As businesses continue to embrace digital transformation, the integration of AI and machine learning into logistics operations is expected to enhance decision-making and operational efficiency. Furthermore, the emphasis on sustainability will likely lead to the development of eco-friendly logistics solutions, aligning with global trends and consumer preferences for greener practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Management Software Warehouse Management Software Freight Management Software Inventory Management Software Order Management Software Supply Chain Management Software Last-Mile Delivery Software Customs & Compliance Software Others |

| By End-User | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Automotive Food and Beverage Third-Party Logistics (3PL) Providers Government & Public Sector Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Others |

| By Region | Cairo Alexandria Giza Port Said Suez Others |

| By Industry Vertical | Logistics and Transportation Retail and E-commerce Manufacturing Healthcare Automotive Food & Beverage Others |

| By Functionality | Route Optimization Fleet Management Load Planning Performance Analytics Real-Time Tracking Electronic Proof of Delivery (ePOD) Customs Clearance Automation Others |

| By Pricing Model | Subscription-Based One-Time License Fee Pay-Per-Use Freemium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics Software Adoption in Retail | 60 | IT Managers, Logistics Coordinators |

| Warehouse Management Systems in Manufacturing | 50 | Operations Managers, Supply Chain Analysts |

| Transportation Management Systems in E-commerce | 40 | Logistics Directors, E-commerce Managers |

| ERP Integration in Logistics | 45 | IT Directors, Business Analysts |

| Impact of Digital Transformation on Logistics | 40 | Chief Technology Officers, Digital Transformation Leads |

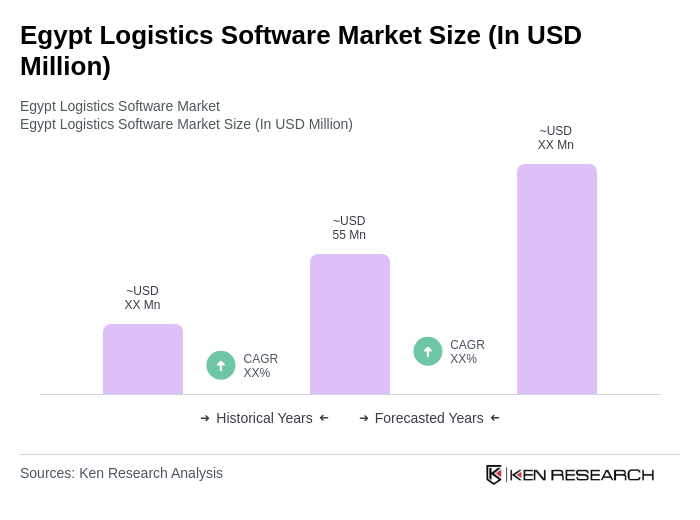

The Egypt Logistics Software Market is valued at approximately USD 55 million, reflecting a five-year historical analysis. This growth is driven by the increasing adoption of digital supply chain solutions and the expansion of e-commerce in the region.