Region:Europe

Author(s):Shubham

Product Code:KRAA0834

Pages:84

Published On:August 2025

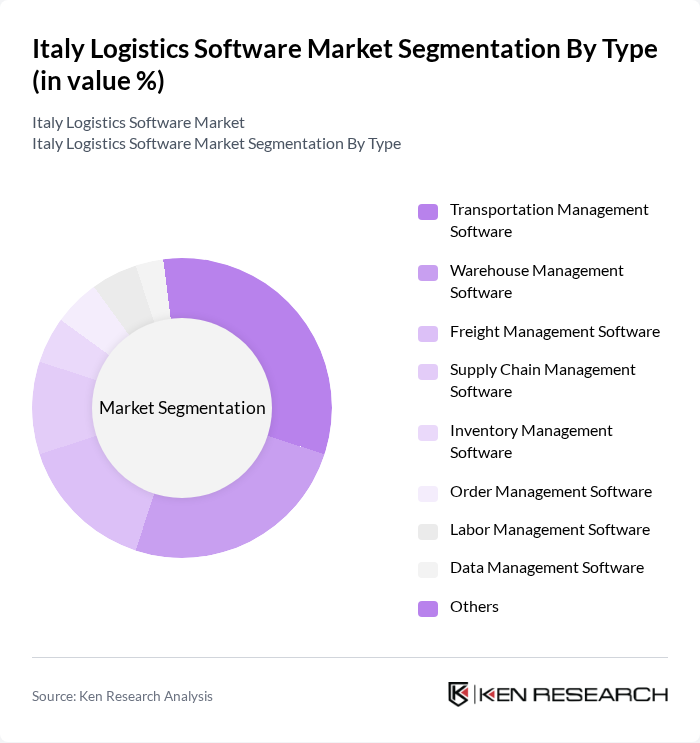

By Type:The logistics software market can be segmented into various types, including Transportation Management Software, Warehouse Management Software, Freight Management Software, Supply Chain Management Software, Inventory Management Software, Order Management Software, Labor Management Software, Data Management Software, and Others. Each of these sub-segments plays a crucial role in enhancing operational efficiency and streamlining logistics processes. Transportation Management Software and Warehouse Management Software are particularly prominent due to the growing need for real-time visibility, route optimization, and automated warehouse operations in response to the surge in e-commerce and omnichannel retailing .

By End-User:The logistics software market is also segmented by end-user industries, which include Retail, Manufacturing, E-commerce, Healthcare, Automotive, Food and Beverage, Government and Defense, Telecommunication and IT, Industrial, Engineering and Manufacturing, Oil and Gas, and Others. Each sector has unique requirements that drive the demand for specialized logistics software solutions. The retail and e-commerce sectors are leading adopters, leveraging logistics software for order fulfillment, inventory management, and last-mile delivery optimization, while manufacturing and automotive industries focus on supply chain integration and process automation .

The Italy Logistics Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Manhattan Associates, Blue Yonder (formerly JDA Software), Infor, Descartes Systems Group, Generix Group S.A., System Logistics S.p.A., Zucchetti S.p.A., Transporeon (Trimble Inc.), FourKites, Project44, TESISQUARE S.p.A., Beta 80 Group, and KFI S.r.l. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the logistics software market in Italy appears promising, driven by technological advancements and evolving consumer expectations. As companies increasingly prioritize real-time data analytics and automation, the demand for innovative software solutions is expected to rise. Furthermore, the focus on sustainability will likely shape the development of logistics software, encouraging investments in green technologies and practices. This evolving landscape presents opportunities for companies to enhance operational efficiency and meet regulatory requirements effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Management Software Warehouse Management Software Freight Management Software Supply Chain Management Software Inventory Management Software Order Management Software Labor Management Software Data Management Software Others |

| By End-User | Retail Manufacturing E-commerce Healthcare Automotive Food and Beverage Government and Defense Telecommunication and IT Industrial, Engineering and Manufacturing Oil and Gas Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Functionality | Planning Execution Monitoring |

| By Industry Vertical | Transportation and Logistics Retail and E-commerce Manufacturing Healthcare Energy and Renewables |

| By Region | Northern Italy Central Italy Southern Italy |

| By Pricing Model | Subscription-Based One-Time License Fee Pay-As-You-Go |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Logistics Software | 60 | IT Managers, Operations Directors |

| Retail Logistics Software Solutions | 50 | Supply Chain Managers, E-commerce Directors |

| Transportation Management Systems | 45 | Logistics Coordinators, Fleet Managers |

| Warehouse Management Software | 55 | Warehouse Supervisors, Inventory Managers |

| Last-Mile Delivery Solutions | 40 | Delivery Managers, Customer Experience Leads |

The Italy Logistics Software Market is valued at approximately USD 700 million, reflecting a significant growth driven by the demand for efficient supply chain management solutions and advancements in technology such as artificial intelligence and machine learning.