Region:Central and South America

Author(s):Rebecca

Product Code:KRAC0327

Pages:85

Published On:August 2025

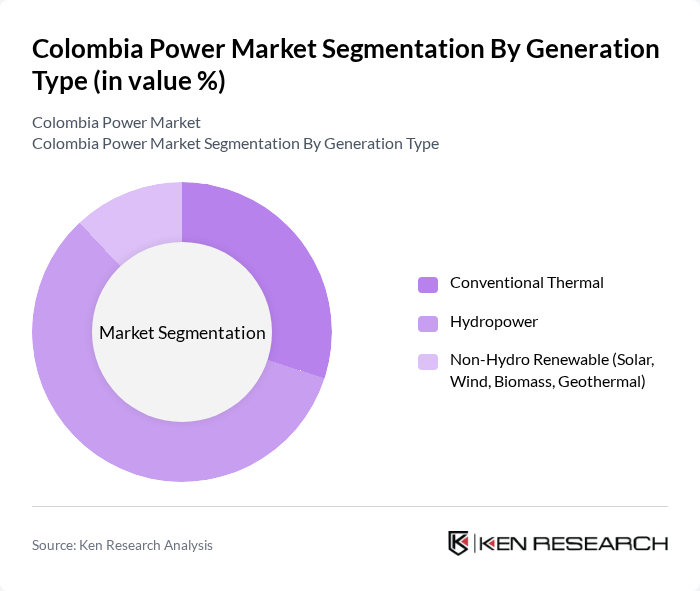

By Generation Type:The generation type segmentation includes Conventional Thermal, Hydropower, and Non-Hydro Renewable sources such as Solar, Wind, Biomass, and Geothermal. Hydropower remains the dominant contributor, leveraging Colombia's extensive river systems and favorable geography. However, Non-Hydro Renewables—especially solar and wind—are rapidly gaining traction as the government and private sector accelerate deployment of cleaner energy projects. The share of non-hydro renewables is expected to continue rising as new capacity comes online .

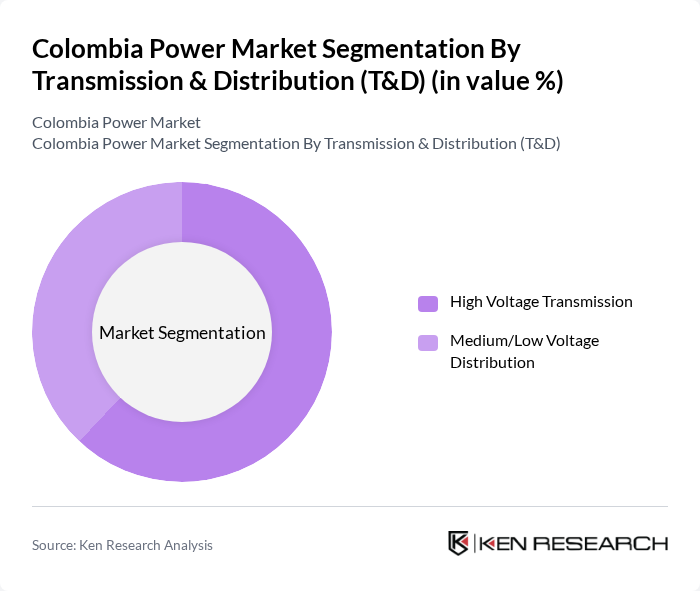

By Transmission & Distribution (T&D):This segmentation includes High Voltage Transmission and Medium/Low Voltage Distribution. High Voltage Transmission is essential for transporting electricity over long distances from generation sites to demand centers, while Medium/Low Voltage Distribution ensures delivery to end-users, especially in urban and industrial areas. Recent investments are focused on expanding and modernizing the high-voltage grid to accommodate new renewable energy projects and improve reliability .

The Colombia Power Market is characterized by a dynamic mix of regional and international players. Leading participants such as Empresas Públicas de Medellín (EPM), Isagen S.A. E.S.P., Celsia S.A. E.S.P., Enel Colombia S.A. E.S.P. (formerly Enel-Codensa and Emgesa), Grupo Energía Bogotá (GEB), Electrificadora del Caribe S.A. E.S.P. (Aire & Afinia), AES Colombia, Enel Green Power Colombia, Interconexión Eléctrica S.A. E.S.P. (ISA), Vatia S.A. E.S.P., TermoCandelaria Power Limited, Ventus Ingeniería S.A., DNV GL Colombia, Prime Energía Colombia, and EPM Solar contribute to innovation, geographic expansion, and service delivery in this space .

The Colombia power market is poised for transformative growth, driven by a strong commitment to renewable energy and infrastructure modernization. With the government’s ambitious targets for renewable energy generation and ongoing investments in grid enhancements, the market is expected to attract significant foreign investment. Additionally, the increasing adoption of electric vehicles and smart grid technologies will further reshape the energy landscape, promoting efficiency and sustainability. These trends indicate a robust future for Colombia's energy sector, aligning with global energy transition goals.

| Segment | Sub-Segments |

|---|---|

| By Generation Type | Conventional Thermal Hydropower Non-Hydro Renewable (Solar, Wind, Biomass, Geothermal) |

| By Transmission & Distribution (T&D) | High Voltage Transmission Medium/Low Voltage Distribution |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Grid-Connected Off-Grid Rooftop Installations Utility-Scale Projects |

| By Investment Source | Domestic Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Region | Andean Region Caribbean Coast (Atlántico, La Guajira) Pacific Region Orinoquía and Amazonía |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Electricity Consumers | 120 | Homeowners, Renters |

| Commercial Power Users | 90 | Facility Managers, Business Owners |

| Industrial Energy Managers | 60 | Operations Directors, Energy Managers |

| Renewable Energy Stakeholders | 50 | Project Developers, Policy Makers |

| Utility Company Executives | 40 | CEOs, CFOs, Regulatory Affairs Managers |

The Colombia Power Market is valued at approximately USD 13 billion, reflecting significant growth driven by rising energy demand, urbanization, and investments in renewable energy sources, particularly solar and wind.