Region:Europe

Author(s):Dev

Product Code:KRAA1477

Pages:87

Published On:August 2025

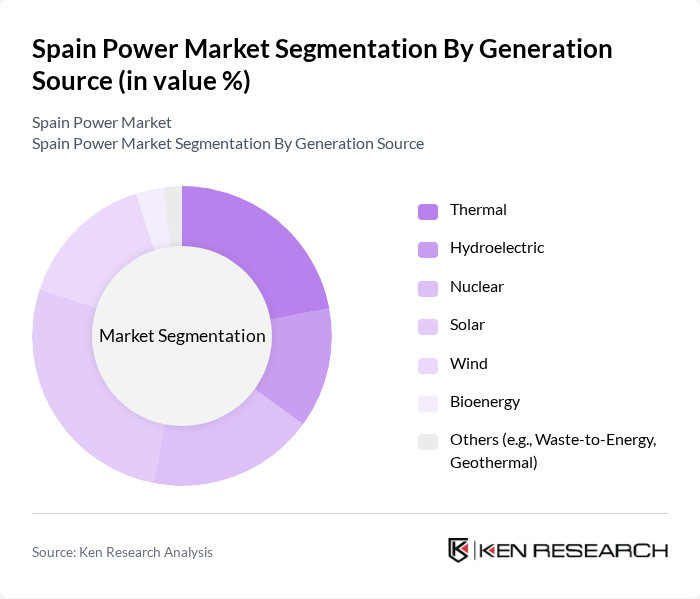

By Generation Source:The generation source segmentation includes various methods of electricity production, each contributing uniquely to the overall energy mix. The subsegments are Thermal, Hydroelectric, Nuclear, Solar, Wind, Bioenergy, and Others (e.g., Waste-to-Energy, Geothermal). Among these, Solar and Wind are rapidly gaining traction due to technological advancements and favorable government policies, while Thermal and Nuclear continue to play significant roles in energy stability. Spain’s installed renewable energy capacity reached approximately 67.9 GW, with solar and wind accounting for the largest share of new additions .

By End-User:The end-user segmentation encompasses various sectors that consume electricity, including Residential, Commercial, Industrial, and Government & Utilities. The Residential segment is the largest consumer, driven by increasing household energy needs and the adoption of smart home technologies. The Commercial and Industrial sectors are also significant, with growing energy efficiency initiatives and sustainability goals influencing their consumption patterns. Catalonia leads in industrial consumption, while residential demand continues to rise nationwide .

The Spain Power Market is characterized by a dynamic mix of regional and international players. Leading participants such as Iberdrola S.A., Endesa S.A., Naturgy Energy Group S.A., Acciona Energía S.A., EDP Renewables S.A., Siemens Gamesa Renewable Energy S.A., Solaria Energía y Medio Ambiente S.A., Fotowatio Renewable Ventures S.L., Green Eagle Solutions S.L., Grenergy Renovables S.A., Capital Energy S.L., Enel Green Power España S.L., TotalEnergies SE, Nordex SE, and Red Eléctrica de España (REE) contribute to innovation, geographic expansion, and service delivery in this space.

The Spain power market is poised for transformative growth, driven by the increasing integration of renewable energy sources and advancements in energy storage technologies. In future, the focus on sustainability and carbon neutrality will likely lead to a significant rise in decentralized energy systems. Additionally, the digitalization of energy management will enhance operational efficiency, enabling better resource allocation and grid management, ultimately supporting Spain's ambitious energy transition goals.

| Segment | Sub-Segments |

|---|---|

| By Generation Source | Thermal Hydroelectric Nuclear Solar Wind Bioenergy Others (e.g., Waste-to-Energy, Geothermal) |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Transmission & Distribution | Transmission (High Voltage) Distribution (Low Voltage) |

| By Application | Grid-Connected Off-Grid Rooftop Installations Utility-Scale Projects |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) |

| By Technology | Photovoltaic (PV) Concentrated Solar Power (CSP) Onshore Wind Offshore Wind Biomass Gasification |

| By Distribution Mode | Direct Sales Online Sales Distributors Retail Outlets |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Electricity Consumers | 120 | Homeowners, Renters |

| Commercial Energy Users | 90 | Facility Managers, Energy Procurement Managers |

| Renewable Energy Project Developers | 60 | Project Managers, Business Development Managers |

| Utility Company Executives | 50 | CEOs, CFOs, Regulatory Affairs Managers |

| Energy Policy Makers | 40 | Government Officials, Regulatory Analysts |

The Spain Power Market is valued at approximately USD 40 billion, reflecting significant growth driven by renewable energy expansion, regulatory changes, and increasing electricity demand. This valuation is based on a comprehensive five-year historical analysis.