Region:Central and South America

Author(s):Rebecca

Product Code:KRAA0353

Pages:98

Published On:August 2025

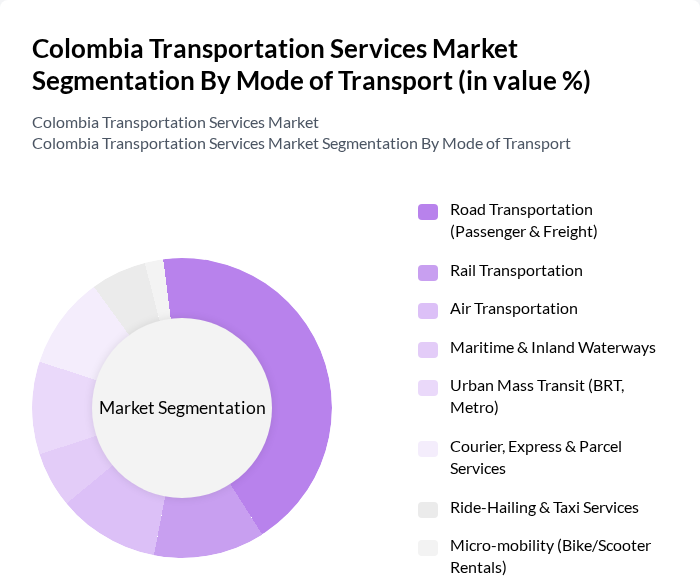

By Mode of Transport:The transportation services market in Colombia can be segmented into road, rail, air, maritime, urban mass transit, courier services, ride-hailing, micro-mobility, and others. Each mode plays a crucial role in meeting the diverse transportation needs of the population and businesses. Road transportation remains the backbone of both passenger and freight movement, supported by a growing network of highways and urban roads. Rail transport is primarily used for bulk goods and select intercity connections. Air transport is essential for time-sensitive cargo and passenger travel, while maritime and inland waterways handle international trade and regional logistics. Urban mass transit, including BRT and metro systems, is expanding in major cities to address congestion and sustainability. Courier, express, and parcel services are growing rapidly, driven by e-commerce. Ride-hailing and micro-mobility solutions are increasingly popular in urban centers, catering to last-mile and flexible mobility needs .

The road transportation segment, encompassing both passenger and freight services, dominates the market due to its extensive network and flexibility. The increasing reliance on road transport for logistics and commuting, coupled with the growth of e-commerce and last-mile delivery, has solidified its position. Rail transportation follows, primarily serving bulk goods and select intercity travel, while air transportation is essential for time-sensitive deliveries and high-value cargo. Urban mass transit systems are gaining traction as cities focus on sustainable and efficient transport solutions. Courier, express, and parcel services are expanding rapidly, driven by the digital economy and consumer demand for fast delivery .

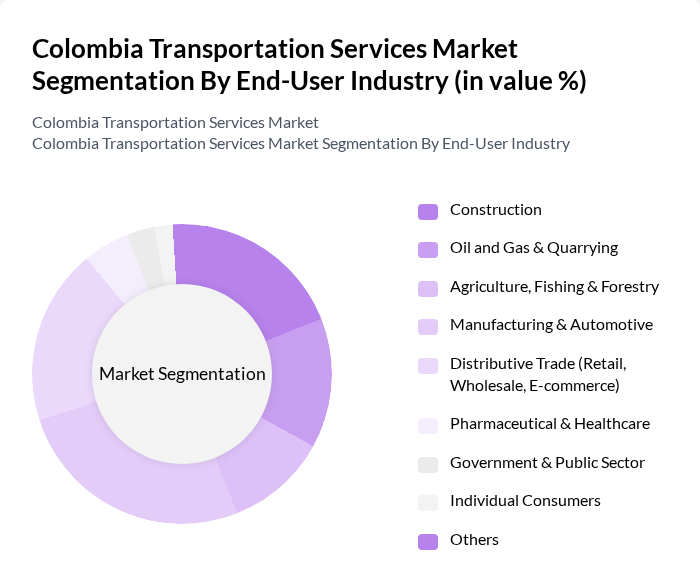

By End-User Industry:The transportation services market is also segmented by end-user industries, including construction, oil and gas, agriculture, manufacturing, distributive trade, healthcare, government, individual consumers, and others. Each industry has unique transportation needs that drive demand for specific services. Manufacturing and automotive require robust logistics for raw materials and finished goods. Construction depends on bulk and heavy transport for materials and equipment. Distributive trade, especially retail and e-commerce, drives demand for fast and flexible delivery solutions. Agriculture, fishing, and forestry need specialized logistics for perishables and bulk commodities. Healthcare and pharmaceuticals require secure and timely distribution. The government and public sector utilize transportation for infrastructure and public services, while individual consumers increasingly use ride-hailing, courier, and micro-mobility services .

The manufacturing and automotive sector is the leading end-user industry, driven by the need for efficient logistics and supply chain management. The construction industry also plays a significant role, requiring transportation for materials and equipment. Distributive trade, particularly e-commerce, has surged, further increasing demand for transportation services. Other sectors like healthcare and agriculture contribute to the market but to a lesser extent .

The Colombia Transportation Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as TransMilenio S.A., Avianca Holdings S.A., Grupo Bolivariano de Transporte, Uber Technologies, Inc., Didi Chuxing Technology Co., Rappi, Easy Taxi, Coordinadora Mercantil S.A., Ditransa S.A., Metro de Medellín, Servientrega S.A., TCC S.A., Expreso Palmira S.A., Redbus, Flota La Macarena S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The Colombia transportation services market is poised for significant transformation as urbanization accelerates and government investments in infrastructure continue. The integration of technology, particularly in logistics and public transport, will enhance efficiency and customer experience. Additionally, the shift towards sustainable practices, including electric vehicles and smart transportation solutions, will shape the future landscape. As e-commerce continues to grow, the demand for innovative last-mile delivery solutions will further drive market evolution, creating a dynamic environment for transportation services.

| Segment | Sub-Segments |

|---|---|

| By Mode of Transport | Road Transportation (Passenger & Freight) Rail Transportation Air Transportation Maritime & Inland Waterways Urban Mass Transit (BRT, Metro) Courier, Express & Parcel Services Ride-Hailing & Taxi Services Micro-mobility (Bike/Scooter Rentals) Others |

| By End-User Industry | Construction Oil and Gas & Quarrying Agriculture, Fishing & Forestry Manufacturing & Automotive Distributive Trade (Retail, Wholesale, E-commerce) Pharmaceutical & Healthcare Government & Public Sector Individual Consumers Others |

| By Region | Bogotá Medellín Cali Barranquilla Cartagena Bucaramanga Others |

| By Vehicle Type | Buses Trucks (LTL, FTL) Vans Motorcycles Cars Others |

| By Service Type | Scheduled Services On-Demand Services Charter Services Freight Forwarding Warehousing & Value-Added Logistics Others |

| By Payment Method | Cash Credit/Debit Cards Mobile Payments Others |

| By Policy Support | Subsidies for Public Transport Tax Incentives for Electric Vehicles Grants for Infrastructure Development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Public Transport Services | 60 | City Transport Officials, Public Transit Operators |

| Logistics and Freight Services | 50 | Logistics Managers, Supply Chain Coordinators |

| Intercity Bus Services | 40 | Bus Company Executives, Route Planners |

| Air Cargo Services | 40 | Aviation Logistics Managers, Freight Forwarders |

| Maritime Transport Operations | 40 | Port Authorities, Shipping Line Managers |

The Colombia Transportation Services Market is valued at approximately USD 21 billion, driven by urbanization, logistics demand, and government investments in infrastructure modernization. This market is crucial for the country's economic development and growth.