Region:Europe

Author(s):Shubham

Product Code:KRAA0814

Pages:84

Published On:August 2025

By Mode of Transportation:

The modes of transportation segment includes various sub-segments such as Road Transport, Rail Transport, Air Transport, and Sea Transport. Among these, Road Transport is the dominant sub-segment, accounting for a significant portion of the market share. This is largely due to the extensive road network in France, which facilitates efficient movement of goods and passengers. The convenience and flexibility offered by road transport make it the preferred choice for both short and long-distance travel. Rail Transport follows closely, benefiting from government investments in high-speed rail infrastructure and sustainable mobility solutions, while Air and Sea Transport cater to specific needs such as international travel and freight shipping .

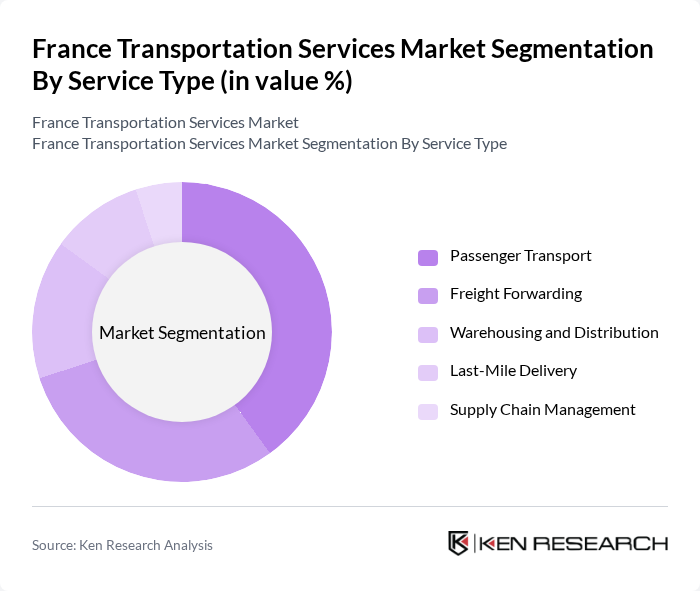

By Service Type:

This segment encompasses Passenger Transport, Freight Forwarding, Warehousing and Distribution, Last-Mile Delivery, and Supply Chain Management. Passenger Transport is the leading sub-segment, driven by the high demand for public transport services in urban areas and ongoing investments in modernizing fleets and expanding service coverage. The growth of ride-sharing services and the increasing preference for convenient travel options have further bolstered this segment. Freight Forwarding is also significant, supported by the rise in e-commerce and global trade. Last-Mile Delivery has gained traction due to the increasing need for efficient delivery solutions in urban settings, while Warehousing and Distribution play a crucial role in logistics management .

The France Transportation Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as SNCF (Société Nationale des Chemins de fer Français), RATP Group (Régie Autonome des Transports Parisiens), Geodis, Transdev, BlaBlaCar, Uber France, Europcar Mobility Group, Keolis, Chronopost, La Poste, FlixBus, FedEx Express France, DHL Express France, Kuehne + Nagel France, CMA CGM Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the transportation services market in France appears promising, driven by technological advancements and a focus on sustainability. The integration of smart transportation solutions is expected to enhance operational efficiency, while the shift towards electric vehicles will align with government sustainability goals. Additionally, the growing trend of Mobility-as-a-Service (MaaS) will likely reshape consumer preferences, leading to increased demand for integrated transport solutions that prioritize convenience and environmental responsibility.

| Segment | Sub-Segments |

|---|---|

| By Mode of Transportation | Road Transport Rail Transport Air Transport Sea Transport |

| By Service Type | Passenger Transport Freight Forwarding Warehousing and Distribution Last-Mile Delivery Supply Chain Management |

| By End-User Industry | Retail Manufacturing Automotive Healthcare Food and Beverage |

| By Region | Northern France Southern France Central France |

| By Service Model | On-Demand Services Subscription Services Pay-Per-Use Services |

| By Vehicle Type | Buses Trucks Vans Motorcycles |

| By Distribution Channel | Online Platforms Offline Retail Direct Sales |

| By Pricing Model | Fixed Pricing Dynamic Pricing Tiered Pricing |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Public Transport Services | 60 | Transport Planners, City Officials |

| Freight and Logistics Operations | 100 | Logistics Managers, Supply Chain Analysts |

| Last-Mile Delivery Solutions | 50 | Operations Managers, E-commerce Executives |

| Rail Transport Services | 40 | Railway Operations Managers, Policy Makers |

| Maritime Transport and Shipping | 40 | Shipping Managers, Port Authorities |

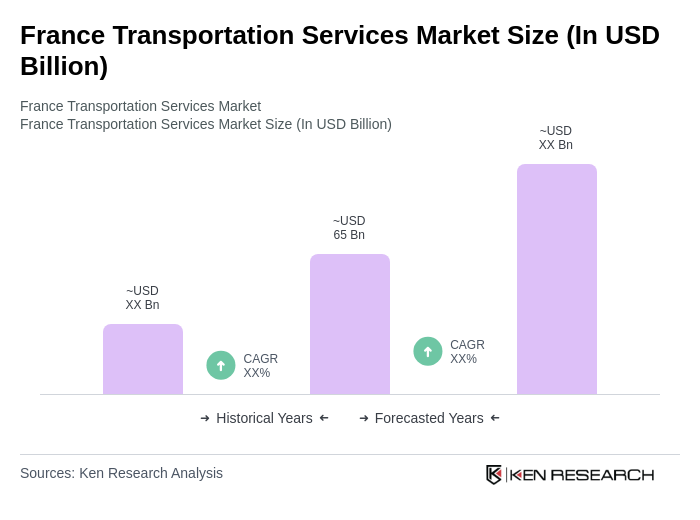

The France Transportation Services Market is valued at approximately USD 65 billion, driven by urbanization, government infrastructure investments, and a growing demand for efficient logistics solutions. This market encompasses both passenger and freight transport services, reflecting robust economic activities.