Region:Central and South America

Author(s):Shubham

Product Code:KRAA1153

Pages:96

Published On:August 2025

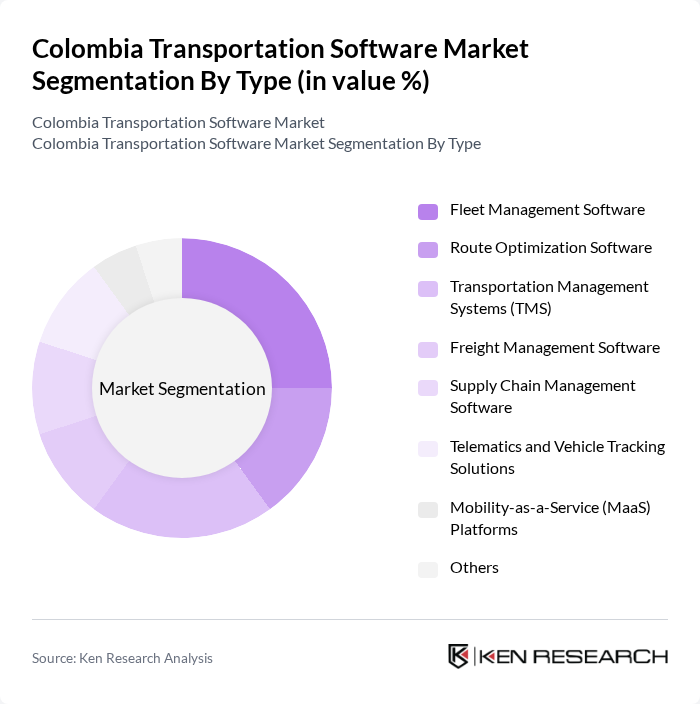

By Type:The transportation software market in Colombia can be segmented into Fleet Management Software, Route Optimization Software, Transportation Management Systems (TMS), Freight Management Software, Supply Chain Management Software, Telematics and Vehicle Tracking Solutions, Mobility-as-a-Service (MaaS) Platforms, and Others. These solutions are integral to improving operational efficiency, enhancing real-time visibility, and reducing costs for logistics providers and shippers. Fleet Management Software and TMS are particularly in demand as companies seek to optimize routes, monitor vehicle health, and ensure regulatory compliance .

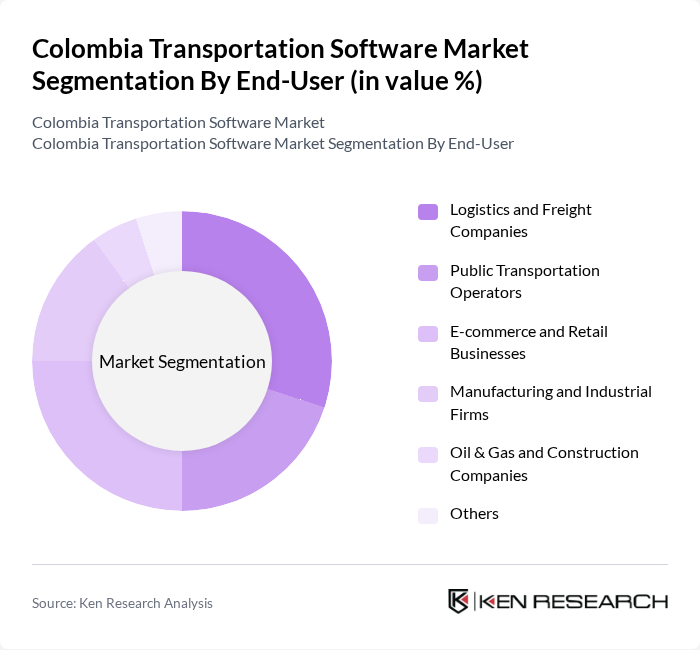

By End-User:The end-user segmentation of the transportation software market includes Logistics and Freight Companies, Public Transportation Operators, E-commerce and Retail Businesses, Manufacturing and Industrial Firms, Oil & Gas and Construction Companies, and Others. Logistics and freight companies are the leading users, leveraging software for route planning, fleet tracking, and regulatory compliance. E-commerce and retail businesses increasingly depend on these solutions to manage last-mile delivery and inventory, while public transportation operators use them for scheduling and passenger information systems .

The Colombia Transportation Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Geotab, Trimble Transportation, SAP SE (SAP Transportation Management), Oracle Corporation, Microsoft Corporation, GFT Technologies SE, Tata Consultancy Services (TCS), Omnicomm, WiseTech Global (CargoWise), Transporeon, Coordinadora Mercantil SA, Ditransa, Siigo (local ERP/logistics software), Sonda Colombia, and Axity Colombia contribute to innovation, geographic expansion, and service delivery in this space.

The Colombia transportation software market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As urbanization accelerates, the demand for integrated mobility solutions will increase, fostering innovation in software development. The rise of electric vehicles and smart transportation systems will further shape the landscape, encouraging partnerships between software providers and local governments. In future, the focus on sustainability and user-centric solutions will be paramount, positioning the market for robust growth and enhanced service delivery.

| Segment | Sub-Segments |

|---|---|

| By Type | Fleet Management Software Route Optimization Software Transportation Management Systems (TMS) Freight Management Software Supply Chain Management Software Telematics and Vehicle Tracking Solutions Mobility-as-a-Service (MaaS) Platforms Others |

| By End-User | Logistics and Freight Companies Public Transportation Operators E-commerce and Retail Businesses Manufacturing and Industrial Firms Oil & Gas and Construction Companies Others |

| By Application | Freight Transportation Passenger Transportation Last-Mile Delivery Supply Chain Logistics Urban Mobility Management Others |

| By Deployment Model | Cloud-Based Solutions On-Premises Solutions Hybrid Solutions |

| By Pricing Model | Subscription-Based Pricing One-Time License Fee Pay-Per-Use Pricing |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises |

| By Region | Andean Region Caribbean Region Pacific Region Amazon Region Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fleet Management Software Users | 100 | Fleet Managers, IT Directors |

| Logistics Tracking Solutions | 80 | Logistics Coordinators, Operations Managers |

| Route Optimization Software | 60 | Transportation Planners, Supply Chain Analysts |

| Public Transportation Software Solutions | 50 | City Transport Officials, Software Product Managers |

| Last-Mile Delivery Software | 70 | Delivery Managers, E-commerce Logistics Heads |

The Colombia Transportation Software Market is valued at approximately USD 1.1 billion, driven by the increasing demand for efficient logistics solutions, urbanization, and the need for real-time tracking and management of transportation systems.