Region:Middle East

Author(s):Shubham

Product Code:KRAA1121

Pages:86

Published On:August 2025

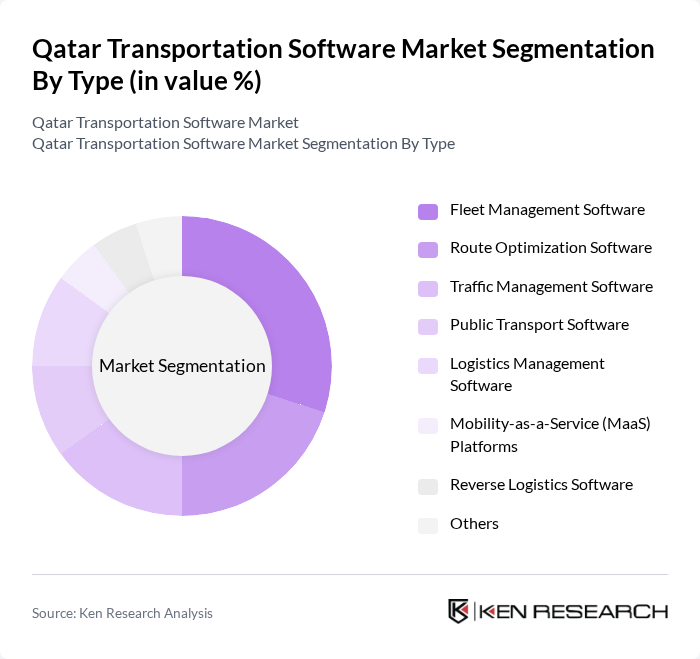

By Type:The transportation software market in Qatar is segmented into Fleet Management Software, Route Optimization Software, Traffic Management Software, Public Transport Software, Logistics Management Software, Mobility-as-a-Service (MaaS) Platforms, Reverse Logistics Software, and Others. Fleet Management Software leads the segment due to the increasing need for efficient vehicle tracking, real-time monitoring, and management solutions by logistics and transportation companies. The growing emphasis on reducing operational costs, improving service delivery, and optimizing fleet utilization has further fueled demand for this software .

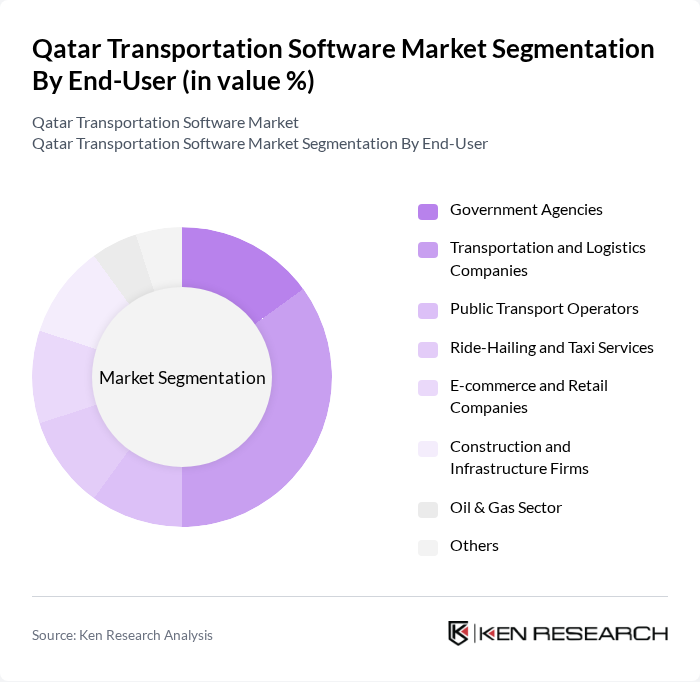

By End-User:The end-user segmentation of the transportation software market includes Government Agencies, Transportation and Logistics Companies, Public Transport Operators, Ride-Hailing and Taxi Services, E-commerce and Retail Companies, Construction and Infrastructure Firms, Oil & Gas Sector, and Others. Transportation and Logistics Companies dominate this segment, driven by the need for efficient supply chain management, real-time tracking solutions, and optimization of delivery routes. The increasing volume of goods transported and the demand for timely deliveries have made this segment a key player in the market .

The Qatar Transportation Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ooredoo, Vodafone Qatar, Mowasalat (Karwa), Gulf Warehousing Company (GWC), Qatar Rail, QTerminals, Trukkin, SAP Qatar, Oracle Qatar, Manhattan Associates, Maersk Qatar, QNB Logistics, Q-Post, Qatar Navigation (Milaha), IBM Qatar contribute to innovation, geographic expansion, and service delivery in this space.

The Qatar transportation software market is poised for significant transformation, driven by technological advancements and evolving consumer expectations. As urbanization accelerates, the demand for integrated transportation solutions will increase, prompting software providers to innovate continuously. Additionally, the government's commitment to smart city initiatives will further enhance the market landscape, encouraging collaboration between public and private sectors. The focus on sustainability will also shape future developments, as stakeholders seek eco-friendly transportation solutions that align with global environmental goals.

| Segment | Sub-Segments |

|---|---|

| By Type | Fleet Management Software Route Optimization Software Traffic Management Software Public Transport Software Logistics Management Software Mobility-as-a-Service (MaaS) Platforms Reverse Logistics Software Others |

| By End-User | Government Agencies Transportation and Logistics Companies Public Transport Operators Ride-Hailing and Taxi Services E-commerce and Retail Companies Construction and Infrastructure Firms Oil & Gas Sector Others |

| By Application | Fleet Tracking & Telematics Route Planning & Scheduling Traffic Analysis & Control Passenger Information & Ticketing Systems Warehouse & Inventory Management Last-Mile Delivery Optimization Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Pricing Model | Subscription-Based One-Time License Fee Pay-Per-Use |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises |

| By Region | Doha Al Rayyan Al Wakrah Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fleet Management Software | 100 | Fleet Managers, Operations Directors |

| Logistics Tracking Solutions | 80 | Logistics Coordinators, IT Managers |

| Route Optimization Tools | 70 | Transportation Analysts, Supply Chain Managers |

| Public Transportation Software | 50 | City Planners, Public Transport Officials |

| Smart Transportation Systems | 60 | Technology Officers, Innovation Managers |

The Qatar Transportation Software Market is valued at approximately USD 210 million, reflecting significant growth driven by urbanization, demand for efficient transportation solutions, and government infrastructure initiatives.