Region:Asia

Author(s):Geetanshi

Product Code:KRAA2042

Pages:99

Published On:August 2025

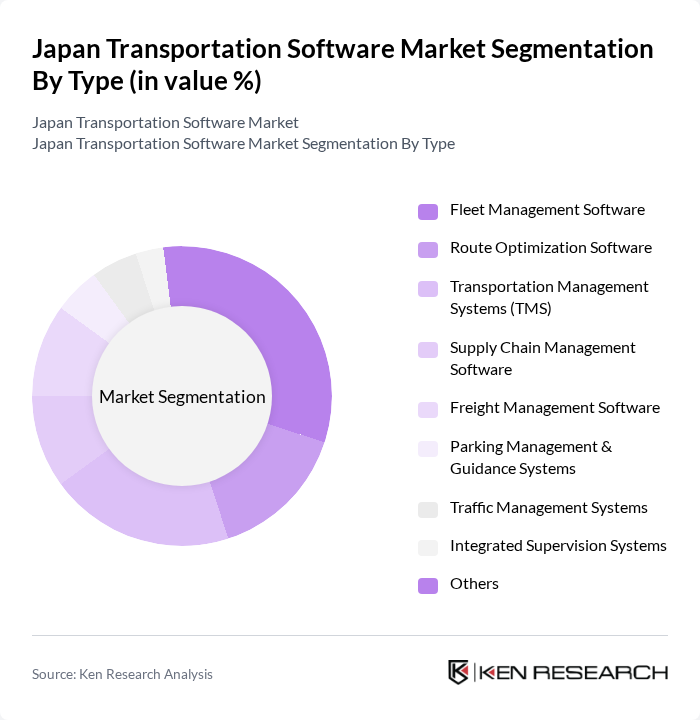

By Type:The market is segmented into Fleet Management Software, Route Optimization Software, Transportation Management Systems (TMS), Supply Chain Management Software, Freight Management Software, Parking Management & Guidance Systems, Traffic Management Systems, Integrated Supervision Systems, and Others. Fleet Management Software leads the segment, driven by its critical role in optimizing vehicle operations, reducing costs, and enhancing service delivery. The adoption of fleet management solutions is accelerating due to the growing complexity of logistics operations and the need for real-time vehicle tracking, predictive maintenance, and regulatory compliance .

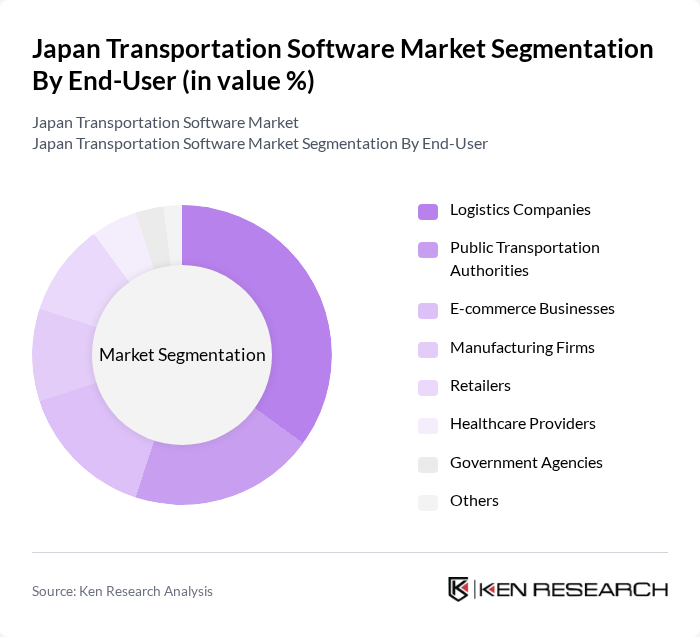

By End-User:End-user segmentation includes Logistics Companies, Public Transportation Authorities, E-commerce Businesses, Manufacturing Firms, Retailers, Healthcare Providers, Government Agencies, and Others. Logistics Companies are the dominant end-user segment, driven by the need for efficient supply chain management, real-time tracking, and timely deliveries. The increasing complexity of logistics operations and the expansion of e-commerce are making transportation software essential for operational agility and customer satisfaction .

The Japan Transportation Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fujitsu Limited, Hitachi, Ltd., NEC Corporation, NTT Data Corporation, Toyota Tsusho Corporation, SoftBank Group Corp., Mitsubishi Corporation, Japan Post Holdings Co., Ltd., Denso Corporation, Yamaha Motor Co., Ltd., Seiko Epson Corporation, Panasonic Corporation, Isuzu Motors Limited, Subaru Corporation, Komatsu Ltd., Zuken Inc., Obic Co., Ltd., Rakuten Group, Inc., East Japan Railway Company (JR East), West Japan Railway Company (JR West) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan transportation software market is poised for significant transformation, driven by technological advancements and evolving consumer expectations. As urbanization continues, the demand for integrated mobility solutions will rise, prompting software developers to innovate. Additionally, the focus on sustainability will lead to the development of eco-friendly transportation solutions. Companies that leverage big data analytics and AI will gain a competitive edge, enhancing operational efficiency and customer satisfaction in this dynamic landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Fleet Management Software Route Optimization Software Transportation Management Systems (TMS) Supply Chain Management Software Freight Management Software Parking Management & Guidance Systems Traffic Management Systems Integrated Supervision Systems Others |

| By End-User | Logistics Companies Public Transportation Authorities E-commerce Businesses Manufacturing Firms Retailers Healthcare Providers Government Agencies Others |

| By Application | Real-Time Tracking Fleet Maintenance Route Planning Compliance Management Ticketing & Payment Solutions Traffic Analytics Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Pricing Model | Subscription-Based One-Time License Fee Pay-Per-Use |

| By User Type | Small and Medium Enterprises (SMEs) Large Enterprises |

| By Region | Kanto Kansai Chubu Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fleet Management Software | 50 | Fleet Managers, Operations Directors |

| Public Transportation Solutions | 40 | Transit Authority Officials, IT Managers |

| Logistics and Supply Chain Software | 45 | Logistics Managers, Supply Chain Analysts |

| Route Optimization Tools | 40 | Transportation Planners, Software Developers |

| Ticketing and Fare Collection Systems | 40 | Revenue Managers, Customer Experience Officers |

The Japan Transportation Software Market is valued at approximately USD 1.0 billion, driven by the increasing demand for efficient logistics solutions and the rapid digitalization of supply chains.