Region:Europe

Author(s):Shubham

Product Code:KRAA0871

Pages:93

Published On:August 2025

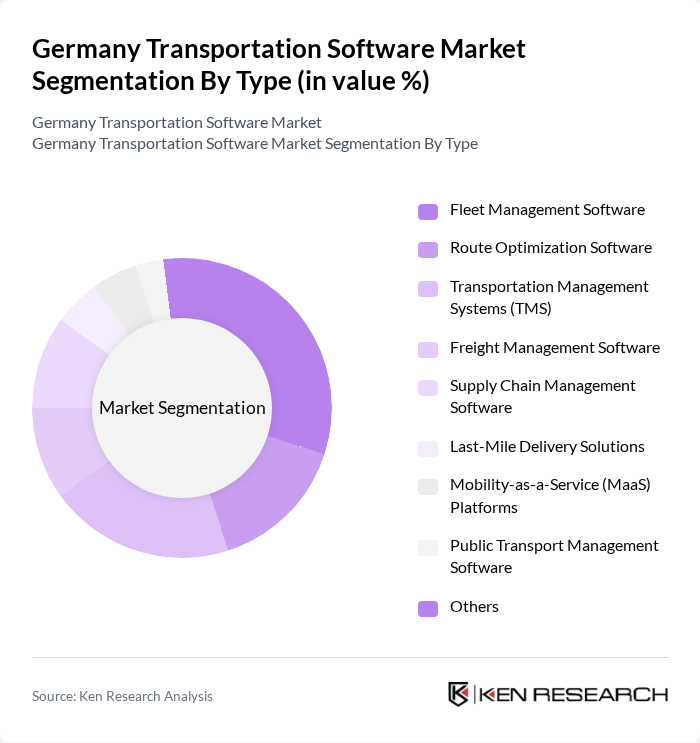

By Type:The transportation software market is segmented into various types, including Fleet Management Software, Route Optimization Software, Transportation Management Systems (TMS), Freight Management Software, Supply Chain Management Software, Last-Mile Delivery Solutions, Mobility-as-a-Service (MaaS) Platforms, Public Transport Management Software, and Others. Fleet Management Software is currently the leading sub-segment due to its critical role in optimizing vehicle operations, reducing costs, and improving service delivery. The increasing focus on operational efficiency, regulatory compliance, and the need for real-time tracking are driving the demand for this software .

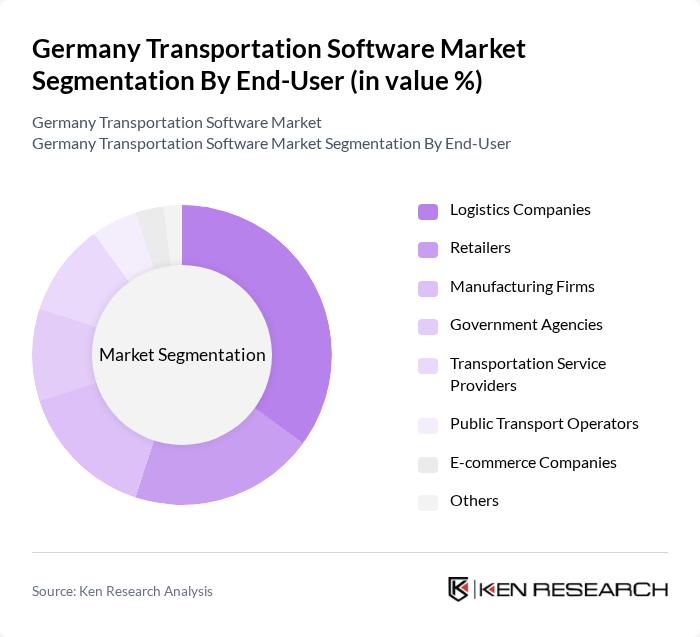

By End-User:The end-user segmentation includes Logistics Companies, Retailers, Manufacturing Firms, Government Agencies, Transportation Service Providers, Public Transport Operators, E-commerce Companies, and Others. Logistics Companies are the dominant end-user segment, driven by the need for efficient supply chain management and real-time tracking of shipments. The increasing complexity of logistics operations and the demand for transparency in the supply chain are propelling the adoption of transportation software among these companies .

The Germany Transportation Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Siemens AG, Transporeon GmbH (a Trimble Company), PTV Group, Trimble Inc., Oracle Corporation, Descartes Systems Group, Infor, Fleet Complete, WiseTech Global (CargoWise), FourKites, project44, Locus.sh, Motive (formerly KeepTruckin), Freightos contribute to innovation, geographic expansion, and service delivery in this space.

The future of the transportation software market in Germany appears promising, driven by technological advancements and increasing demand for sustainable solutions. As companies prioritize efficiency and customer satisfaction, the integration of AI and IoT technologies will become more prevalent. Additionally, the ongoing push for electric and autonomous vehicles will likely reshape the landscape, creating new opportunities for software developers to innovate and meet the evolving needs of the transportation sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Fleet Management Software Route Optimization Software Transportation Management Systems (TMS) Freight Management Software Supply Chain Management Software Last-Mile Delivery Solutions Mobility-as-a-Service (MaaS) Platforms Public Transport Management Software Others |

| By End-User | Logistics Companies Retailers Manufacturing Firms Government Agencies Transportation Service Providers Public Transport Operators E-commerce Companies Others |

| By Application | Freight Transportation Passenger Transportation Public Transport Management Supply Chain Logistics Urban Mobility Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Pricing Model | Subscription-Based One-Time License Fee Pay-Per-Use |

| By Region | North Germany South Germany East Germany West Germany |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fleet Management Software | 100 | Fleet Managers, IT Directors |

| Route Optimization Solutions | 70 | Logistics Coordinators, Operations Managers |

| Tracking and Monitoring Systems | 60 | Supply Chain Analysts, IT Specialists |

| Transportation Management Systems (TMS) | 80 | Procurement Officers, Business Analysts |

| Integration with ERP Systems | 50 | IT Managers, System Integrators |

The Germany Transportation Software Market is valued at approximately USD 8.3 billion, reflecting significant growth driven by the demand for efficient logistics solutions, e-commerce expansion, and the need for real-time data analytics in transportation management.