Region:Europe

Author(s):Geetanshi

Product Code:KRAA0319

Pages:91

Published On:August 2025

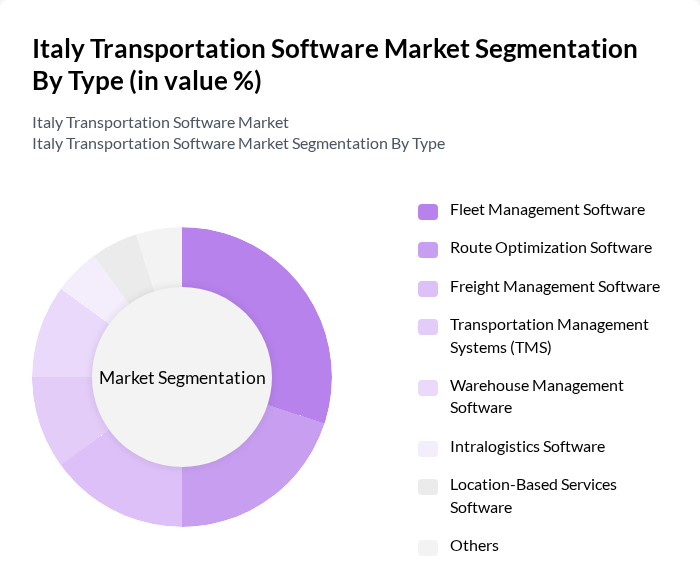

By Type:The market is segmented into various types of transportation software, including Fleet Management Software, Route Optimization Software, Freight Management Software, Transportation Management Systems (TMS), Warehouse Management Software, Intralogistics Software, Location-Based Services Software, and Others. Fleet Management Software is currently the leading segment due to its critical role in enhancing operational efficiency and reducing costs for logistics companies. The increasing focus on real-time tracking, predictive maintenance, and compliance management has driven its adoption across logistics, e-commerce, and industrial sectors. Route Optimization and Location-Based Services Software are also experiencing robust growth, supported by the rollout of 5G and IoT technologies, which enhance real-time visibility and operational agility .

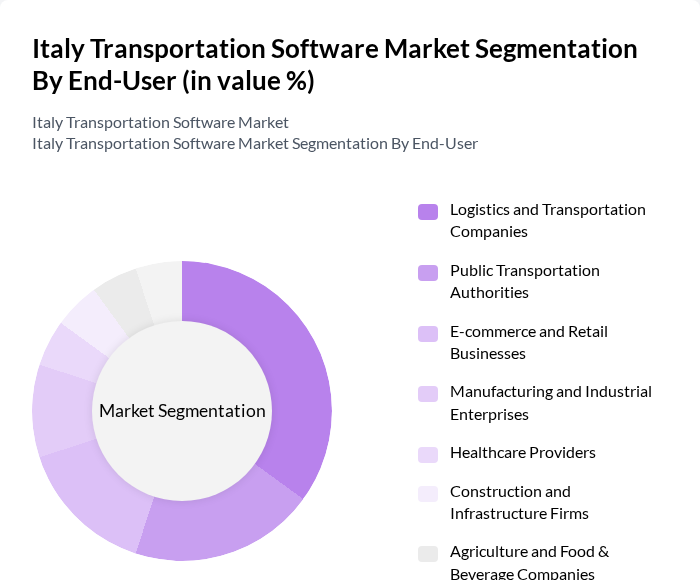

By End-User:The end-user segmentation includes Logistics and Transportation Companies, Public Transportation Authorities, E-commerce and Retail Businesses, Manufacturing and Industrial Enterprises, Healthcare Providers, Construction and Infrastructure Firms, Agriculture and Food & Beverage Companies, and Others. Logistics and Transportation Companies dominate this segment, driven by the need for efficient supply chain management, real-time tracking solutions, and compliance with evolving regulatory requirements. The increasing complexity of logistics operations and the demand for cost-effective, scalable software solutions have led to a surge in adoption among these companies. E-commerce and retail businesses are also rapidly increasing their use of transportation software to enhance last-mile delivery and customer experience .

The Italy Transportation Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, IBM Corporation, Microsoft Corporation, Trimble Inc., Descartes Systems Group, Transporeon (a Trimble Company), Geotab Inc., Telepass S.p.A., Targa Telematics S.p.A., Project44, FourKites, Locus.sh, Zucchetti S.p.A., Generix Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Italian transportation software market appears promising, driven by technological advancements and increasing consumer expectations. The integration of artificial intelligence and machine learning is expected to enhance operational efficiencies, while the focus on sustainability will push for greener solutions. Additionally, the rise of Mobility-as-a-Service (MaaS) will reshape urban transportation, creating new avenues for software development. As these trends evolve, companies must adapt to remain competitive in a rapidly changing landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Fleet Management Software Route Optimization Software Freight Management Software Transportation Management Systems (TMS) Warehouse Management Software Intralogistics Software Location-Based Services Software Others |

| By End-User | Logistics and Transportation Companies Public Transportation Authorities E-commerce and Retail Businesses Manufacturing and Industrial Enterprises Healthcare Providers Construction and Infrastructure Firms Agriculture and Food & Beverage Companies Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Others |

| By Functionality | Fleet Tracking & Telematics Driver & Labor Management Compliance & Regulatory Management Reporting, Analytics & Optimization Billing & Yard Management Systems Integration & Maintenance Others |

| By Industry Vertical | Retail Healthcare Manufacturing Construction Agriculture Food & Beverage Others |

| By Geographic Coverage | Northern Italy Central Italy Southern Italy Islands Others |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fleet Management Software | 60 | Fleet Managers, Operations Directors |

| Logistics Tracking Solutions | 50 | Logistics Coordinators, IT Managers |

| Route Optimization Tools | 40 | Transportation Analysts, Supply Chain Managers |

| Public Transportation Software | 40 | City Planners, Transit Authority Officials |

| Last-Mile Delivery Solutions | 50 | Delivery Managers, E-commerce Logistics Heads |

The Italy Transportation Software Market is valued at approximately USD 3.2 billion, driven by the increasing demand for efficient logistics solutions, e-commerce growth, and the need for real-time tracking and management of transportation operations.