Region:Middle East

Author(s):Dev

Product Code:KRAA0411

Pages:95

Published On:August 2025

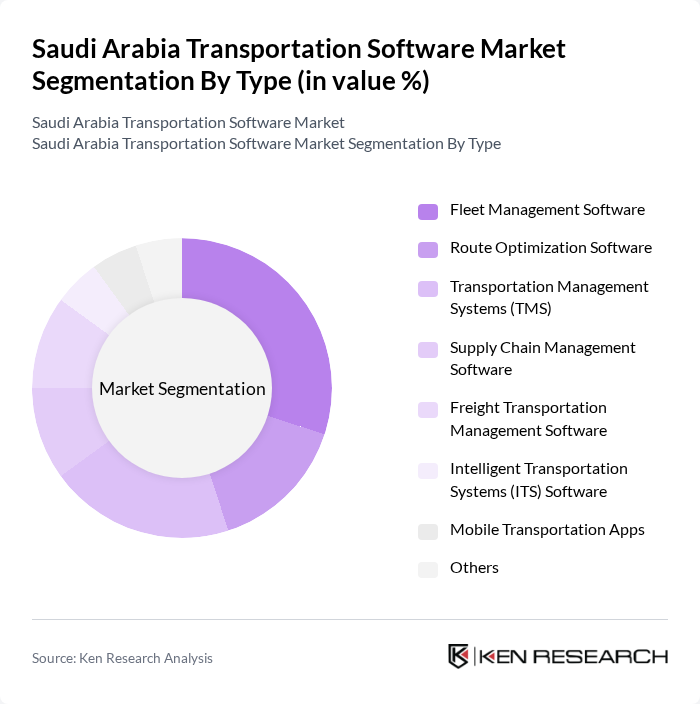

By Type:The transportation software market can be segmented into Fleet Management Software, Route Optimization Software, Transportation Management Systems (TMS), Supply Chain Management Software, Freight Transportation Management Software, Intelligent Transportation Systems (ITS) Software, Mobile Transportation Apps, and Others. Fleet Management Software remains the leading sub-segment due to its essential role in enhancing operational efficiency, reducing costs, and supporting compliance for logistics companies. The increasing adoption of IoT, artificial intelligence, and cloud-based solutions is accelerating demand for advanced fleet management and route optimization platforms .

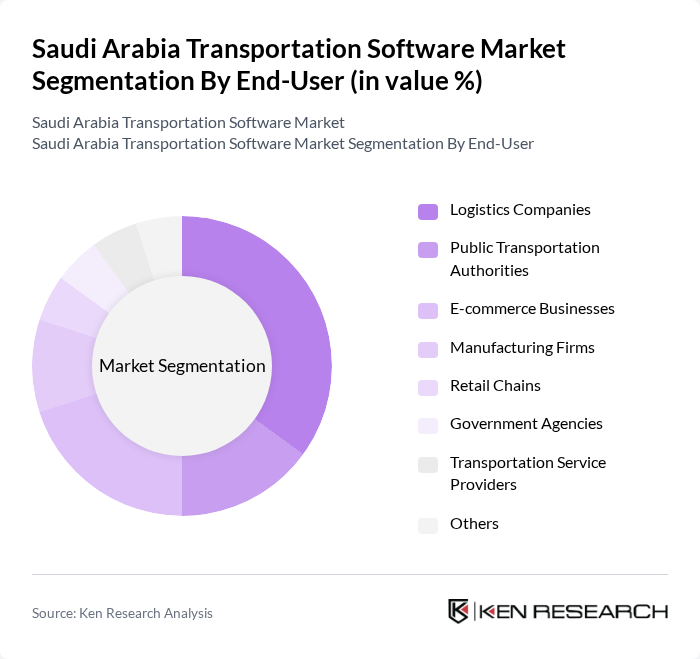

By End-User:The end-user segmentation of the transportation software market includes Logistics Companies, Public Transportation Authorities, E-commerce Businesses, Manufacturing Firms, Retail Chains, Government Agencies, Transportation Service Providers, and Others. Logistics Companies are the dominant end-user segment, driven by the need for efficient supply chain management, real-time tracking, and automation. The rapid expansion of e-commerce and the adoption of digital logistics solutions have significantly increased demand for transportation software among logistics providers, enabling them to optimize operations and meet customer expectations for timely deliveries .

The Saudi Arabia Transportation Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, IBM Corporation, Microsoft Corporation, Infor, Geotab, Trimble Inc., Omnicomm, Teletrac Navman, Descartes Systems Group, Project44, FourKites, Transporeon, Tahaqom (Saudi Arabia), Elm Company (Saudi Arabia), Naqel Express (Saudi Arabia), SAPTCO (Saudi Public Transport Company), OTLob (Saudi Arabia) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the transportation software market in Saudi Arabia appears promising, driven by ongoing urbanization and government initiatives aimed at enhancing infrastructure. As the demand for efficient logistics solutions continues to rise, companies are likely to invest in advanced software technologies. Additionally, the integration of AI and machine learning will play a crucial role in optimizing transportation operations, while the development of smart cities will further stimulate market growth, creating a more interconnected and efficient transportation ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Fleet Management Software Route Optimization Software Transportation Management Systems (TMS) Supply Chain Management Software Freight Transportation Management Software Intelligent Transportation Systems (ITS) Software Mobile Transportation Apps Others |

| By End-User | Logistics Companies Public Transportation Authorities E-commerce Businesses Manufacturing Firms Retail Chains Government Agencies Transportation Service Providers Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Vehicle Type | Light Commercial Vehicles Heavy-Duty Trucks Buses Passenger Cars Others |

| By Functionality | Real-Time Tracking Route Planning & Optimization Fleet Maintenance & Diagnostics Driver Behavior & Safety Management Predictive Analytics & Reporting Others |

| By Pricing Model | Subscription-Based One-Time License Fee Pay-Per-Use Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fleet Management Software Users | 100 | Fleet Managers, Operations Directors |

| Public Transport Ticketing Systems | 60 | IT Managers, Transport Authority Officials |

| Logistics and Supply Chain Software | 80 | Logistics Coordinators, Supply Chain Analysts |

| Route Optimization Solutions | 50 | Route Planners, Software Developers |

| Smart Transportation Initiatives | 40 | Urban Planners, Technology Consultants |

The Saudi Arabia Transportation Software Market is valued at approximately USD 330 million, driven by the increasing demand for efficient logistics solutions, rapid urbanization, and government investments in transportation infrastructure.