Region:Central and South America

Author(s):Shubham

Product Code:KRAA1056

Pages:92

Published On:August 2025

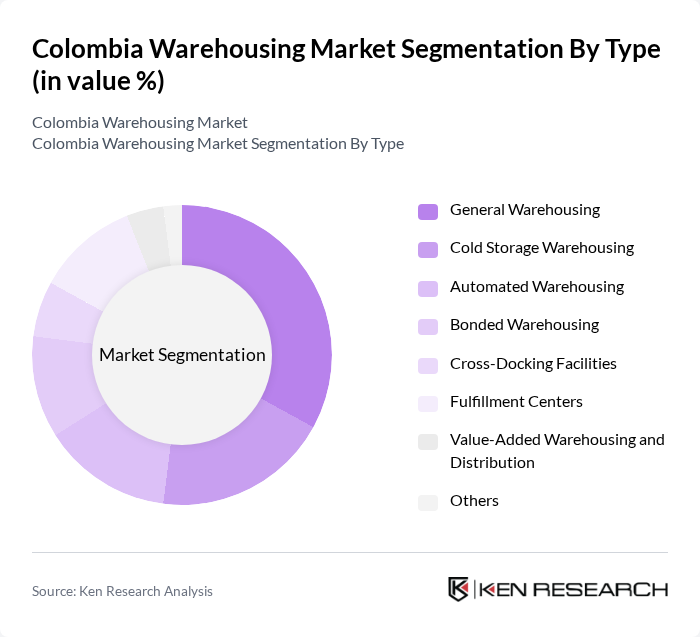

By Type:The warehousing market can be segmented into various types, including General Warehousing, Cold Storage Warehousing, Automated Warehousing, Bonded Warehousing, Cross-Docking Facilities, Fulfillment Centers, Value-Added Warehousing and Distribution, and Others. Each type serves distinct needs, with General Warehousing being the most prevalent due to its versatility in accommodating various goods and the increasing adoption of value-added warehousing and distribution services to support e-commerce and manufacturing .

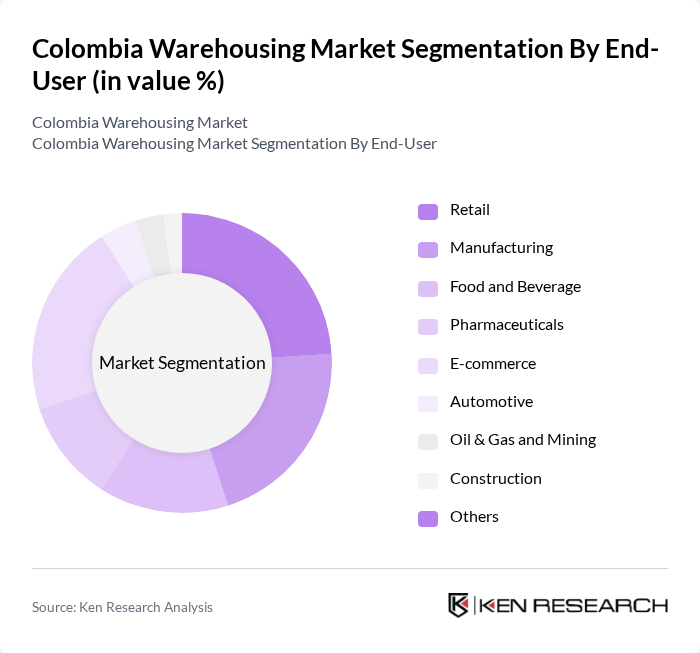

By End-User:The warehousing market is also segmented by end-users, including Retail, Manufacturing, Food and Beverage, Pharmaceuticals, E-commerce, Automotive, Oil & Gas and Mining, Construction, and Others. The E-commerce sector is rapidly growing, driving demand for fulfillment centers, cold chain, and efficient storage solutions, while manufacturing and retail remain significant contributors to warehousing demand .

The Colombia Warehousing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Servientrega, TCC, DHL Supply Chain, Kuehne + Nagel, FedEx, UPS, Inter Rapidísimo, Grupo Argos, Terranum, OPL Carga, Maersk, CEVA Logistics, Logística de Colombia, Grupo EULEN, Intercontinental Logistics contribute to innovation, geographic expansion, and service delivery in this space .

The Colombia warehousing market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As e-commerce continues to expand, businesses will increasingly adopt smart warehousing solutions, integrating AI and IoT technologies to enhance operational efficiency. Furthermore, sustainability initiatives will gain traction, with companies focusing on eco-friendly practices. These trends will not only improve service delivery but also position the market for sustainable growth, attracting further investment and innovation in the logistics sector.

| Segment | Sub-Segments |

|---|---|

| By Type | General Warehousing Cold Storage Warehousing Automated Warehousing Bonded Warehousing Cross-Docking Facilities Fulfillment Centers Value-Added Warehousing and Distribution Others |

| By End-User | Retail Manufacturing Food and Beverage Pharmaceuticals E-commerce Automotive Oil & Gas and Mining Construction Others |

| By Location | Urban Areas Suburban Areas Rural Areas Industrial Zones Port Proximity Airport Proximity Others |

| By Service Type | Storage Services Value-Added Services (Kitting, Packaging, Labeling, Returns Processing) Transportation Services Inventory Management Order Fulfillment Others |

| By Size of Warehouse | Small Warehouses (<5,000 m²) Medium Warehouses (5,000–20,000 m²) Large Warehouses (20,000–50,000 m²) Mega Warehouses (>50,000 m²) Others |

| By Ownership Type | Owned Warehouses Rented Warehouses Leased Warehouses PL-Operated Warehouses Others |

| By Technology Adoption | Manual Warehousing Semi-Automated Warehousing Fully Automated Warehousing Smart Warehousing (WMS, IoT, Robotics) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Warehousing Operations | 70 | Warehouse Managers, Logistics Coordinators |

| Manufacturing Supply Chain Management | 50 | Operations Managers, Supply Chain Analysts |

| E-commerce Fulfillment Centers | 60 | eCommerce Directors, Warehouse Supervisors |

| Cold Storage Facilities | 40 | Facility Managers, Quality Control Officers |

| Third-Party Logistics Providers | 45 | Business Development Managers, Account Executives |

The Colombia Warehousing Market is valued at approximately USD 4.6 billion, driven by the increasing demand for logistics services, e-commerce growth, and efficient supply chain management. This valuation reflects a five-year historical analysis of the third-party logistics and warehousing sector.