Region:Europe

Author(s):Geetanshi

Product Code:KRAA2073

Pages:96

Published On:August 2025

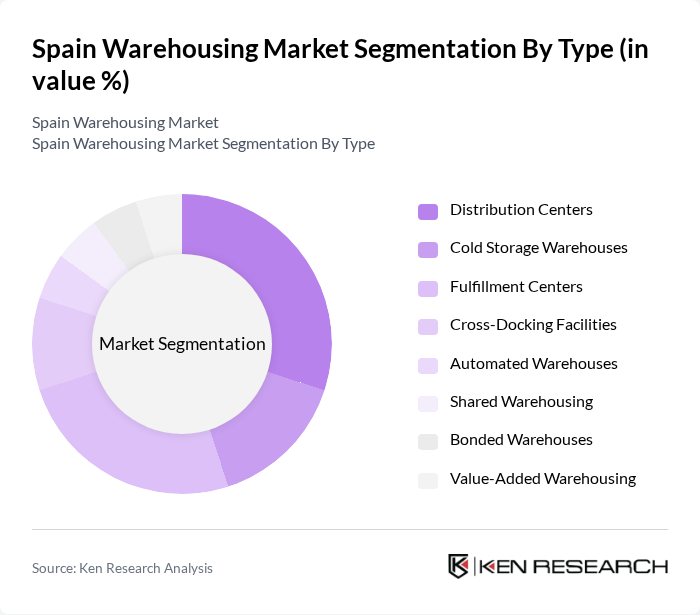

By Type:The warehousing market can be segmented into various types, includingDistribution Centers, Cold Storage Warehouses, Fulfillment Centers, Cross-Docking Facilities, Automated Warehouses, Shared Warehousing, Bonded Warehouses, and Value-Added Warehousing. Each type serves distinct purposes and caters to different industry needs.

TheDistribution Centerssegment is currently dominating the market due to the increasing need for efficient logistics solutions. These centers facilitate the rapid movement of goods, making them essential for retailers and manufacturers. The rise of e-commerce has further amplified the demand for distribution centers, as businesses require streamlined operations to meet consumer expectations for quick delivery. Additionally, advancements in automation, robotics, and digital inventory management are enhancing the efficiency of these centers, solidifying their market leadership.

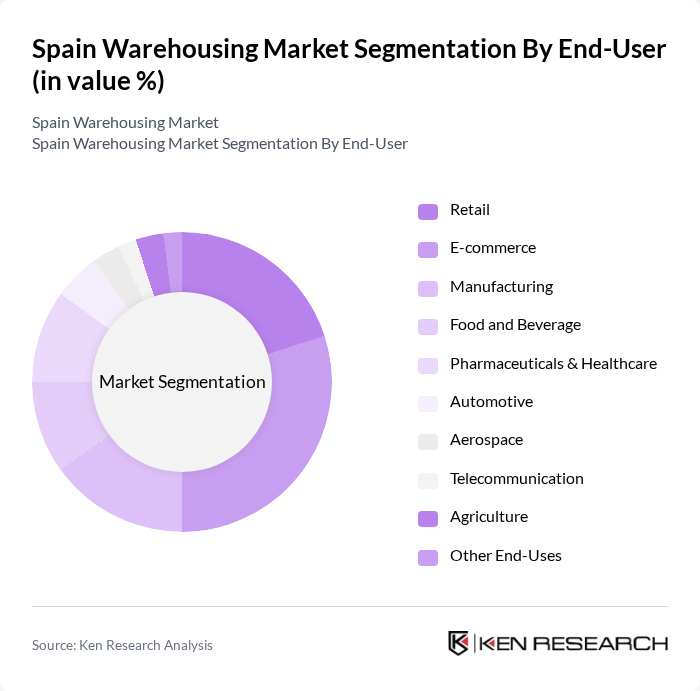

By End-User:The warehousing market can also be segmented by end-user industries, includingRetail, E-commerce, Manufacturing, Food and Beverage, Pharmaceuticals & Healthcare, Automotive, Aerospace, Telecommunication, Agriculture, and Other End-Uses. Each end-user category has unique requirements that influence warehousing solutions.

TheE-commercesegment is leading the market, driven by the rapid growth of online shopping and the need for efficient logistics solutions. As consumers increasingly prefer online purchasing, e-commerce companies are investing heavily in warehousing to ensure quick order fulfillment and inventory management. This trend is further supported by technological advancements such as automation, real-time inventory tracking, and last-mile delivery optimization, making e-commerce a critical driver of the warehousing market.

The Spain Warehousing Market is characterized by a dynamic mix of regional and international players. Leading participants such asPrologis, Segro, Goodman Group, Merlin Properties, Logicor, CTP Invest, Panattoni, VGP, ID Logistics, XPO Logistics, DHL Supply Chain, Kuehne + Nagel, CEVA Logistics, Rhenus Logistics, DSV, FM Logistic, Stef Iberia, Carreras Grupo Logístico, Grupo Sesé, Noatum Logisticscontribute to innovation, geographic expansion, and service delivery in this space.

The future of the Spain warehousing market appears promising, driven by the ongoing digital transformation and the increasing emphasis on sustainability. As e-commerce continues to thrive, logistics providers are expected to invest heavily in smart warehousing technologies, enhancing efficiency and responsiveness. Furthermore, the integration of AI and machine learning will likely optimize inventory management and reduce operational costs. The focus on sustainable practices will also shape the market, as companies seek to minimize their environmental impact while meeting consumer demand for eco-friendly solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Distribution Centers Cold Storage Warehouses Fulfillment Centers Cross-Docking Facilities Automated Warehouses Shared Warehousing Bonded Warehouses Value-Added Warehousing |

| By End-User | Retail E-commerce Manufacturing Food and Beverage Pharmaceuticals & Healthcare Automotive Aerospace Telecommunication Agriculture Other End-Uses |

| By Storage Capacity | Less than 10,000 sq. ft. ,000 - 50,000 sq. ft. ,000 - 100,000 sq. ft. More than 100,000 sq. ft. |

| By Location | Urban Areas Suburban Areas Rural Areas |

| By Service Type | Storage Services Value-Added Services (Packaging, Labelling, Kitting) Transportation & Distribution Services Inventory Management Services |

| By Ownership | Private Warehouses Public Warehouses Contract Warehouses |

| By Technology Adoption | Manual Warehousing Semi-Automated Warehousing Fully Automated Warehousing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Warehousing Operations | 60 | Warehouse Managers, Logistics Coordinators |

| Pharmaceutical Distribution Centers | 40 | Supply Chain Directors, Compliance Officers |

| E-commerce Fulfillment Centers | 50 | Operations Managers, IT Systems Analysts |

| Automotive Parts Warehousing | 45 | Procurement Managers, Inventory Control Specialists |

| Cold Storage Facilities | 40 | Facility Managers, Quality Assurance Leads |

The Spain Warehousing Market is valued at approximately USD 5.3 billion, reflecting significant growth driven by the increasing demand for logistics and supply chain solutions, particularly in the e-commerce sector.