Region:Europe

Author(s):Shubham

Product Code:KRAA0783

Pages:84

Published On:August 2025

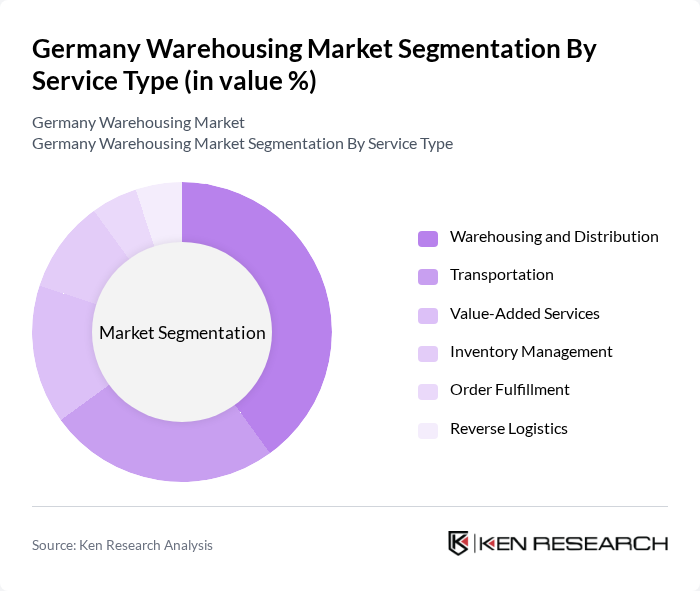

By Service Type:The service type segmentation includes Warehousing and Distribution, Transportation, Value-Added Services, Inventory Management, Order Fulfillment, and Reverse Logistics. Warehousing and Distribution is the leading subsegment, driven by the increasing demand for storage solutions and efficient distribution networks. The rise of e-commerce and the need for rapid, flexible fulfillment have significantly influenced this trend, as businesses seek to optimize their supply chains and enhance customer satisfaction through automation and digital inventory management .

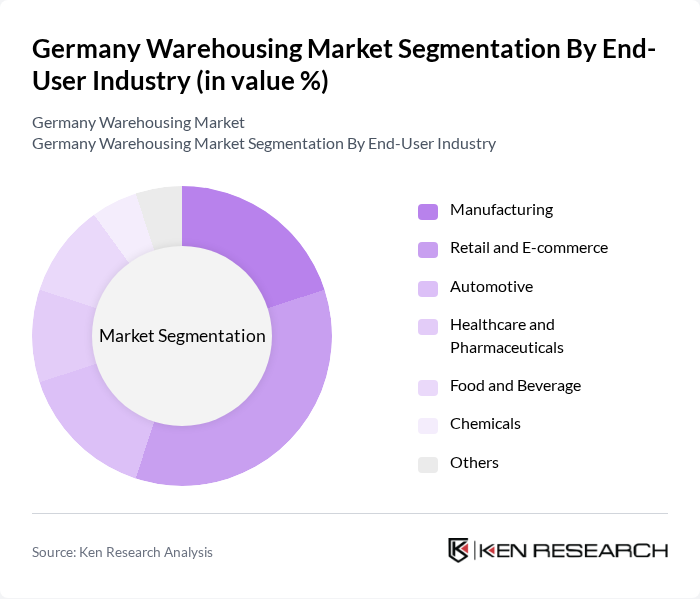

By End-User Industry:The end-user industry segmentation encompasses Manufacturing, Retail and E-commerce, Automotive, Healthcare and Pharmaceuticals, Food and Beverage, Chemicals, and Others. Retail and E-commerce is the dominant subsegment, fueled by the rapid growth of online shopping and evolving consumer behaviors. This shift has led to increased demand for warehousing solutions that can accommodate quick order processing, efficient last-mile delivery, and scalable storage for fluctuating inventory volumes .

The Germany Warehousing Market is characterized by a dynamic mix of regional and international players. Leading participants such as DB Schenker, DHL Supply Chain (Deutsche Post AG), Kuehne + Nagel International AG, DSV A/S, Rhenus Logistics (Rhenus SE & Co. KG), DACHSER Group SE & Co. KG, Hellmann Worldwide Logistics SE & Co. KG, FIEGE Logistik Stiftung & Co. KG, GEODIS SA, XPO Logistics, GXO Logistics, Logwin AG, Yusen Logistics, Nippon Express Co. Ltd., DPDgroup contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Germany warehousing market appears promising, driven by the ongoing digital transformation and the increasing demand for efficient logistics solutions. As e-commerce continues to expand, companies are likely to invest in smart warehousing technologies, enhancing operational efficiency. Furthermore, sustainability initiatives will play a crucial role, with businesses focusing on eco-friendly practices to meet regulatory requirements and consumer expectations. This evolving landscape presents significant opportunities for growth and innovation in the warehousing sector.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Warehousing and Distribution Transportation Value-Added Services Inventory Management Order Fulfillment Reverse Logistics |

| By End-User Industry | Manufacturing Retail and E-commerce Automotive Healthcare and Pharmaceuticals Food and Beverage Chemicals Others |

| By Storage Capacity | Less than 10,000 sq. ft. ,000 - 50,000 sq. ft. ,000 - 100,000 sq. ft. More than 100,000 sq. ft. |

| By Location | Urban Areas Suburban Areas Rural Areas |

| By Ownership | Private Warehouses Public Warehouses Contract Warehouses |

| By Technology Adoption | Manual Warehousing Semi-Automated Warehousing Fully Automated Warehousing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Warehousing Operations | 100 | Warehouse Managers, Logistics Coordinators |

| Pharmaceutical Distribution Centers | 60 | Supply Chain Directors, Compliance Officers |

| Automotive Parts Warehousing | 50 | Operations Managers, Inventory Control Specialists |

| E-commerce Fulfillment Centers | 80 | eCommerce Operations Managers, Warehouse Supervisors |

| Cold Storage Facilities | 40 | Facility Managers, Quality Assurance Leads |

The Germany Warehousing Market is valued at approximately USD 20 billion, driven by the increasing demand for logistics services, rapid e-commerce growth, and the need for efficient supply chain management.