Region:Africa

Author(s):Shubham

Product Code:KRAA0750

Pages:92

Published On:August 2025

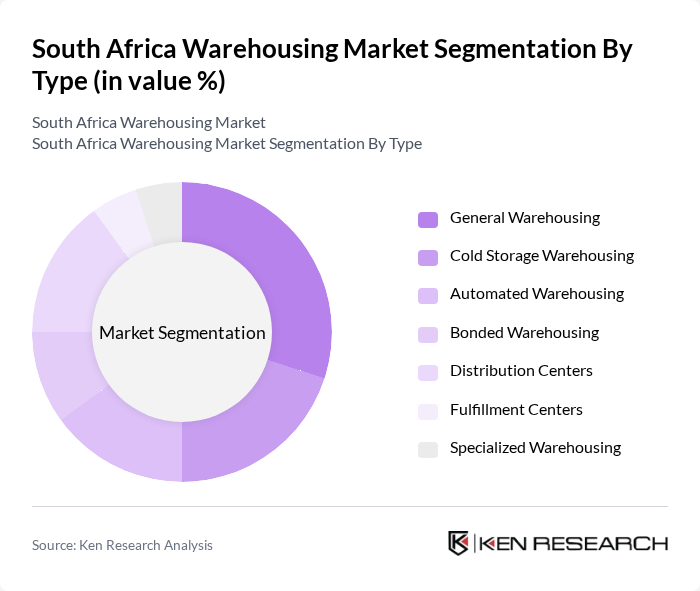

By Type:The warehousing market can be segmented into General Warehousing, Cold Storage Warehousing, Automated Warehousing, Bonded Warehousing, Distribution Centers, Fulfillment Centers, and Specialized Warehousing. General Warehousing remains the most prevalent, accommodating a broad spectrum of goods, while Cold Storage Warehousing is rapidly expanding due to increased demand from the food, agriculture, and pharmaceutical sectors. Automated Warehousing and Fulfillment Centers are also gaining traction, driven by the growth of e-commerce and the need for operational efficiency .

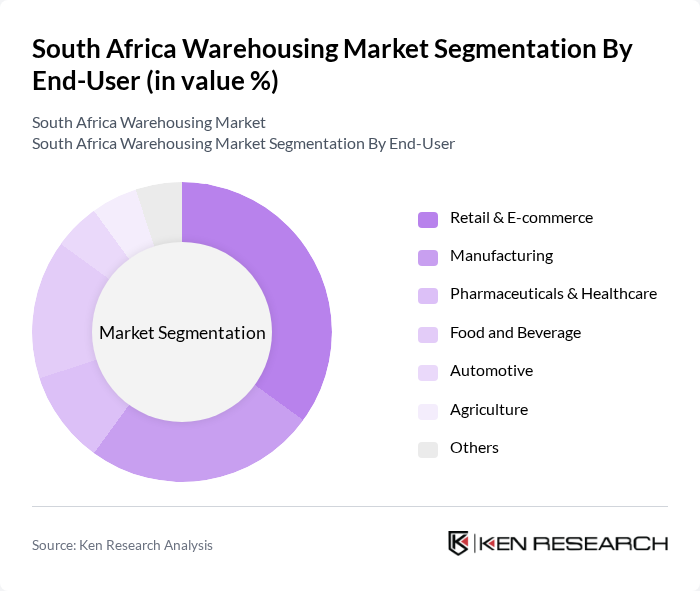

By End-User:The end-user segmentation includes Retail & E-commerce, Manufacturing, Pharmaceuticals & Healthcare, Food and Beverage, Automotive, Agriculture, and Others. Retail & E-commerce is the leading end-user segment, propelled by the surge in online shopping and the need for rapid, reliable logistics. The Food and Beverage and Pharmaceuticals & Healthcare sectors are also significant, reflecting the growing importance of cold chain and specialized storage solutions .

The South Africa Warehousing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Imperial Logistics, Bidvest International Logistics, DHL Supply Chain South Africa, Barloworld Logistics, Kuehne + Nagel South Africa, DSV South Africa, Transnet Freight Rail, Grindrod Limited, Onelogix Group, Maersk South Africa, Rhenus Logistics South Africa, Value Logistics, Laser Logistics, TFG Logistics, and Super Group contribute to innovation, geographic expansion, and service delivery in this space .

The South African warehousing market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As businesses increasingly adopt smart warehousing solutions, the integration of AI and big data analytics will enhance operational efficiency and decision-making. Furthermore, the shift towards omnichannel distribution will necessitate more agile warehousing strategies, enabling companies to meet diverse customer demands. Sustainable practices will also gain traction, aligning with global trends towards environmental responsibility and resource efficiency.

| Segment | Sub-Segments |

|---|---|

| By Type | General Warehousing Cold Storage Warehousing Automated Warehousing Bonded Warehousing Distribution Centers Fulfillment Centers Specialized Warehousing (e.g., hazardous materials, pharmaceuticals) |

| By End-User | Retail & E-commerce Manufacturing Pharmaceuticals & Healthcare Food and Beverage Automotive Agriculture Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) Cross-Docking Drop Shipping Reverse Logistics Others |

| By Location | Urban Warehousing Suburban Warehousing Rural Warehousing Port Warehousing Inland Logistics Parks Others |

| By Size | Small Warehouses (<5,000 sqm) Medium Warehouses (5,000–20,000 sqm) Large Warehouses (>20,000 sqm) Mega Distribution Centers Others |

| By Service Type | Storage Services Value-Added Services (packaging, labeling, kitting) Transportation & Distribution Services Inventory Management Services Order Fulfillment Services Others |

| By Pricing Model | Fixed Pricing Variable Pricing (pay-per-use, volume-based) Subscription-Based Pricing Performance-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Warehousing Operations | 60 | Warehouse Managers, Logistics Coordinators |

| Manufacturing Supply Chain Management | 50 | Operations Directors, Supply Chain Analysts |

| E-commerce Fulfillment Strategies | 45 | eCommerce Operations Managers, Inventory Control Specialists |

| Cold Chain Logistics | 40 | Cold Storage Managers, Quality Assurance Officers |

| Third-Party Logistics Providers | 40 | Business Development Managers, Client Relationship Managers |

The South Africa Warehousing Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by increasing demand for logistics and supply chain solutions, particularly in the retail and e-commerce sectors.