Region:Europe

Author(s):Rebecca

Product Code:KRAC0321

Pages:95

Published On:August 2025

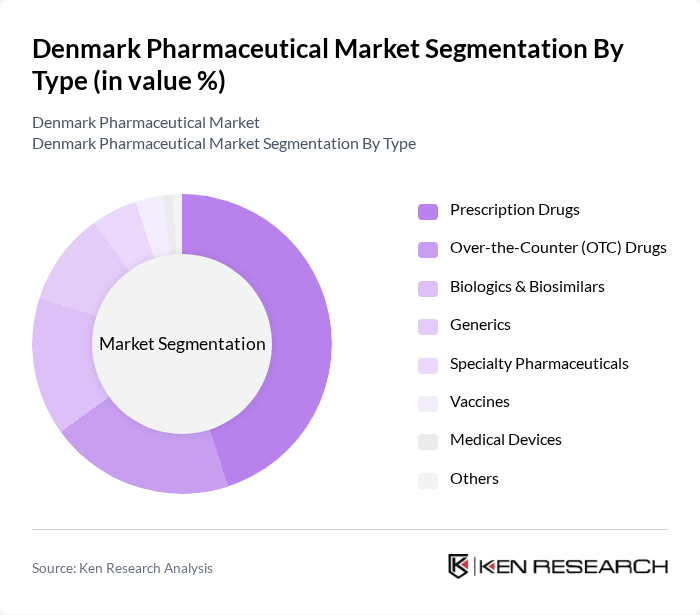

By Type:The pharmaceutical market can be segmented into various types, including Prescription Drugs, Over-the-Counter (OTC) Drugs, Biologics & Biosimilars, Generics, Specialty Pharmaceuticals, Vaccines, Medical Devices, and Others. Among these, Prescription Drugs dominate the market, supported by the increasing incidence of chronic diseases and the growing demand for innovative therapies. The trend towards personalized medicine, biologics, and digital health solutions is gaining traction, further driving the growth of these segments. Conventional drugs (small molecules) hold the largest revenue share, while biologics & biosimilars are rapidly expanding due to advances in biotechnology and increased investment in R&D.

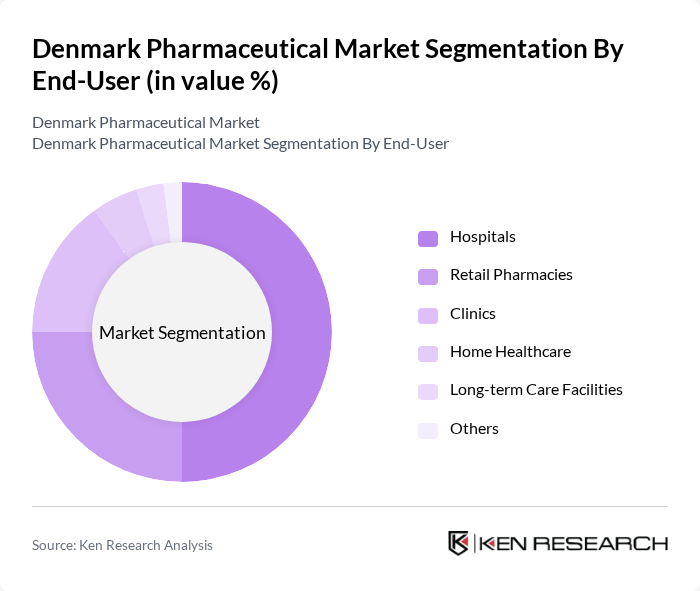

By End-User:The end-user segmentation includes Hospitals, Retail Pharmacies, Clinics, Home Healthcare, Long-term Care Facilities, and Others. Hospitals are the leading end-user segment, driven by the increasing number of hospital admissions and the demand for advanced medical treatments. The trend towards outpatient care, home healthcare, and long-term care facilities is gaining momentum, reflecting changing patient preferences and healthcare delivery models. Retail pharmacies and clinics continue to play a vital role in the distribution and accessibility of pharmaceutical products.

The Denmark Pharmaceutical Market is characterized by a dynamic mix of regional and international players. Leading participants such as Novo Nordisk A/S, H. Lundbeck A/S, LEO Pharma A/S, Ferring Pharmaceuticals A/S, Orifarm Group A/S, Genmab A/S, Zealand Pharma A/S, Bavarian Nordic A/S, ALK-Abelló A/S, Xellia Pharmaceuticals ApS, Acesion Pharma ApS, Sandoz A/S, Takeda Pharma A/S, Merck Sharp & Dohme A/S, Pfizer ApS, Sanofi A/S, Roche A/S contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Denmark pharmaceutical market appears promising, driven by advancements in biotechnology and a growing emphasis on personalized medicine. As the healthcare landscape evolves, the integration of digital health solutions and telemedicine is expected to enhance patient care and streamline drug delivery. Additionally, collaborations between pharmaceutical companies and technology firms will likely foster innovation, leading to the development of more effective therapies and improved healthcare outcomes for the aging population.

| Segment | Sub-Segments |

|---|---|

| By Type | Prescription Drugs Over-the-Counter (OTC) Drugs Biologics & Biosimilars Generics Specialty Pharmaceuticals Vaccines Medical Devices Others |

| By End-User | Hospitals Retail Pharmacies Clinics Home Healthcare Long-term Care Facilities Others |

| By Distribution Channel | Direct Sales Wholesalers Online Pharmacies Retail Pharmacies Hospital Pharmacies Others |

| By Therapeutic Area | Cardiovascular Disorders Oncology Neurology / CNS Disorders Infectious Diseases Endocrinology (incl. Diabetes) Respiratory Disorders Dermatology Others |

| By Formulation | Tablets Injectables Topicals Liquids Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Penetration Pricing Value-Based Pricing Others |

| By Market Segment | Hospital Segment Retail Segment Institutional Segment Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oncology Drug Market | 100 | Oncologists, Clinical Researchers |

| Cardiovascular Pharmaceuticals | 80 | Cardiologists, Pharmacists |

| Infectious Disease Treatments | 70 | Infectious Disease Specialists, Hospital Administrators |

| Generic Drug Market | 90 | Generic Drug Manufacturers, Regulatory Affairs Managers |

| Biopharmaceutical Innovations | 60 | Biotech Researchers, Product Development Managers |

The Denmark Pharmaceutical Market is valued at approximately USD 13 billion, driven by factors such as an aging population, increasing chronic disease prevalence, and significant investments in research and development by key players like Novo Nordisk and Lundbeck.