Region:Europe

Author(s):Shubham

Product Code:KRAC0680

Pages:93

Published On:August 2025

By Type:The pharmaceutical market can be segmented into various types, including Prescription Drugs (Rx) – Branded, Prescription Drugs (Rx) – Generics, Over-the-Counter (OTC) Drugs, Biologics, Biosimilars, Vaccines, Specialty Pharmaceuticals, and Others. Among these, Prescription Drugs (Rx) – Branded and Biologics are leading segments due to their high demand and significant investment in research and development. The increasing prevalence of chronic diseases and the need for advanced treatment options are driving the growth of these segments.

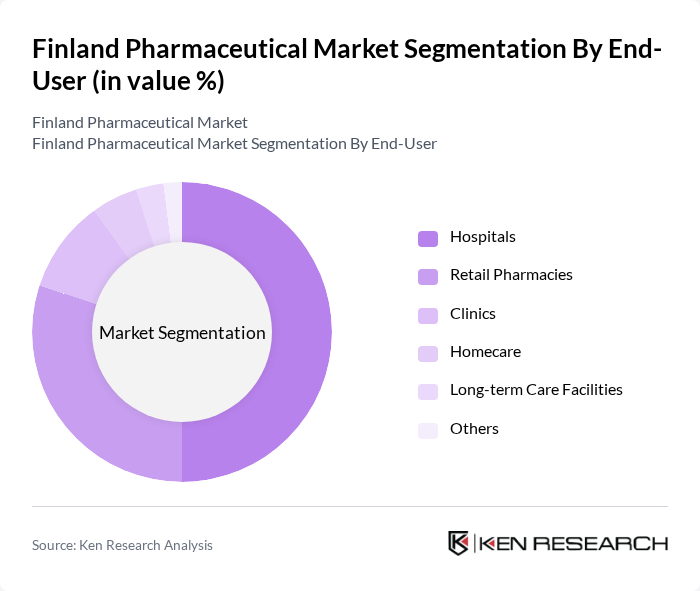

By End-User:The end-user segmentation includes Hospitals, Retail Pharmacies, Clinics, Homecare, Long-term Care Facilities, and Others. Hospitals are the dominant end-user segment, driven by higher volumes of inpatient and specialty care prescribing, oncology and biologics administration, and formulary-driven uptake of new therapies. Retail pharmacies play a significant role through reimbursed outpatient prescriptions and consumer health demand in OTC products.

The Finland Pharmaceutical Market is characterized by a dynamic mix of regional and international players. Leading participants such as Orion Oyj (Orion Corporation), Bayer Oy, Pfizer Oy, Novartis Finland Oy, Roche Oy, Sanofi Oy, MSD Finland Oy (Merck Sharp & Dohme), GlaxoSmithKline Oy (GSK), AbbVie Oy, Amgen AB, Finland Branch, Eli Lilly Finland Oy, Astellas Pharma Oy, Teva Finland Oy, Sandoz A/S, Finland Branch, Boehringer Ingelheim Finland Ky contribute to innovation, geographic expansion, and service delivery in this space.

The Finnish pharmaceutical market is poised for significant transformation driven by technological advancements and demographic shifts. The integration of artificial intelligence in drug development is expected to streamline processes, reducing time-to-market for new therapies. Additionally, the growing emphasis on preventive healthcare will likely lead to increased investments in innovative treatments. As the healthcare landscape evolves, collaboration between pharmaceutical companies and research institutions will be crucial in addressing emerging health challenges and enhancing patient care.

| Segment | Sub-Segments |

|---|---|

| By Type | Prescription Drugs (Rx) – Branded Prescription Drugs (Rx) – Generics Over-the-Counter (OTC) Drugs Biologics Biosimilars Vaccines Specialty Pharmaceuticals Others |

| By End-User | Hospitals Retail Pharmacies Clinics Homecare Long-term Care Facilities Others |

| By Distribution Channel | Direct Sales Wholesalers/Full-line Distributors Online Pharmacies (E-pharmacies) Retail Pharmacies Hospital Pharmacies Others |

| By Therapeutic Area (ATC-aligned) | Cardiovascular System Antineoplastic & Immunomodulating Agents (Oncology, immunology) Nervous System Anti-infectives for Systemic Use Alimentary Tract & Metabolism (incl. diabetes) Respiratory System Musculo-skeletal System Genito-urinary System & Sex Hormones Dermatologicals Sensory Organs Others |

| By Formulation | Tablets & Capsules (oral solids) Injectables (parenterals) Topicals Liquids/Suspensions Inhalation & Nasal Others |

| By Pricing Strategy | Premium Pricing (innovative/specialty) Reference/Competitive Pricing Generic Penetration Pricing Value-Based Pricing/Outcomes-based Others |

| By Market Segment | Hospital Segment Retail Segment Institutional/Public Procurement Segment Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Retail Market | 120 | Pharmacy Owners, Retail Pharmacists |

| Hospital Pharmacy Operations | 90 | Hospital Pharmacists, Pharmacy Directors |

| Biopharmaceuticals Sector | 60 | Biotech Researchers, Product Managers |

| Generic Drug Market | 60 | Generic Drug Manufacturers, Regulatory Affairs Specialists |

| Patient Adherence Programs | 70 | Healthcare Providers, Patient Advocacy Representatives |

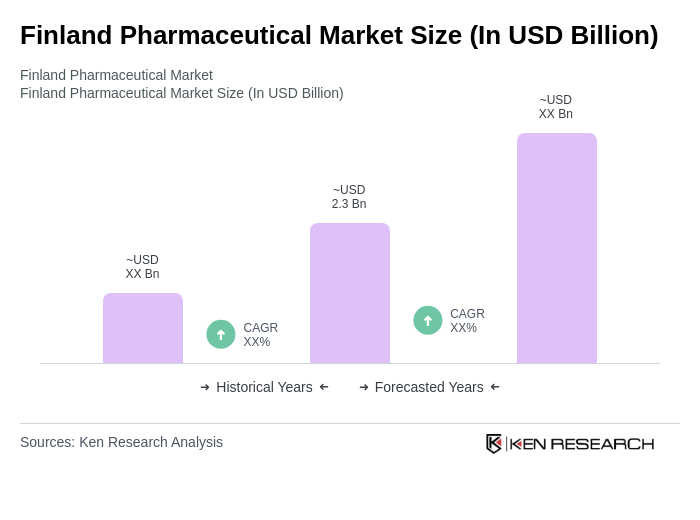

The Finland Pharmaceutical Market is valued at approximately USD 2.3 billion, reflecting growth driven by an aging population, chronic diseases, and increased healthcare spending linked to universal coverage and reimbursement frameworks.