Region:Africa

Author(s):Geetanshi

Product Code:KRAA8141

Pages:84

Published On:September 2025

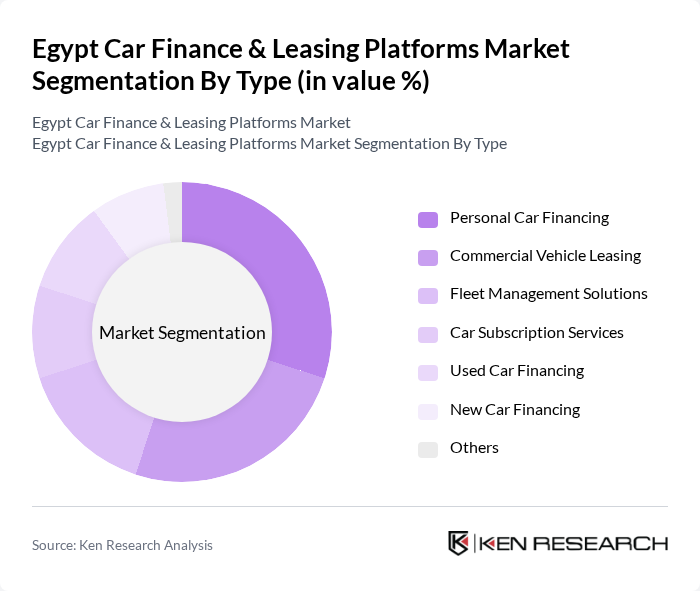

By Type:The market is segmented into various types of financing options, including personal car financing, commercial vehicle leasing, fleet management solutions, car subscription services, used car financing, new car financing, and others. Each of these segments caters to different consumer needs and preferences, reflecting the diverse landscape of car financing in Egypt.

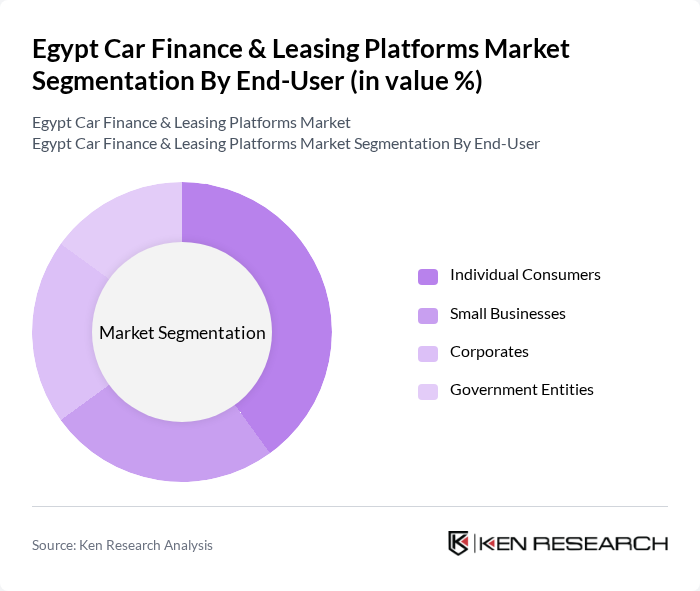

By End-User:The end-user segmentation includes individual consumers, small businesses, corporates, and government entities. Each segment has unique financing needs, with individual consumers typically seeking personal loans, while corporates and government entities often require larger financing solutions for fleet purchases.

The Egypt Car Finance & Leasing Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Banque Misr, National Bank of Egypt, QNB Alahli, CIB (Commercial International Bank), Arab African International Bank, Egyptian Gulf Bank, Banque du Caire, Faisal Islamic Bank of Egypt, Al Baraka Bank, Misr Iran Development Bank, Emirates NBD Egypt, Suez Canal Bank, Arab Bank, HSBC Egypt, Piraeus Bank Egypt contribute to innovation, geographic expansion, and service delivery in this space.

The future of the car finance and leasing market in Egypt appears promising, driven by technological advancements and a growing preference for digital solutions. As more consumers turn to online platforms for financing, the market is likely to see increased competition and innovation. Additionally, the rising interest in electric vehicles will create new financing models, catering to environmentally conscious consumers. Overall, the market is poised for growth, adapting to changing consumer preferences and economic conditions.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Car Financing Commercial Vehicle Leasing Fleet Management Solutions Car Subscription Services Used Car Financing New Car Financing Others |

| By End-User | Individual Consumers Small Businesses Corporates Government Entities |

| By Financing Model | Traditional Loans Lease-to-Own Operating Lease Financial Lease |

| By Payment Structure | Fixed Payments Variable Payments Balloon Payments |

| By Duration | Short-Term Financing Medium-Term Financing Long-Term Financing |

| By Customer Segment | First-Time Buyers Repeat Buyers Corporate Clients |

| By Region | Urban Areas Rural Areas Suburban Areas Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Car Financing | 150 | Individual Car Buyers, Financial Advisors |

| Corporate Fleet Leasing | 100 | Fleet Managers, Procurement Officers |

| Leasing Company Operations | 80 | Operations Managers, Financial Analysts |

| Automotive Dealership Financing | 70 | Dealership Owners, Sales Managers |

| Consumer Preferences in Leasing | 90 | Potential Lessees, Market Researchers |

The Egypt Car Finance & Leasing Platforms Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increasing consumer demand for vehicle ownership and the rise of digital financing platforms.