Region:Middle East

Author(s):Dev

Product Code:KRAA7223

Pages:93

Published On:September 2025

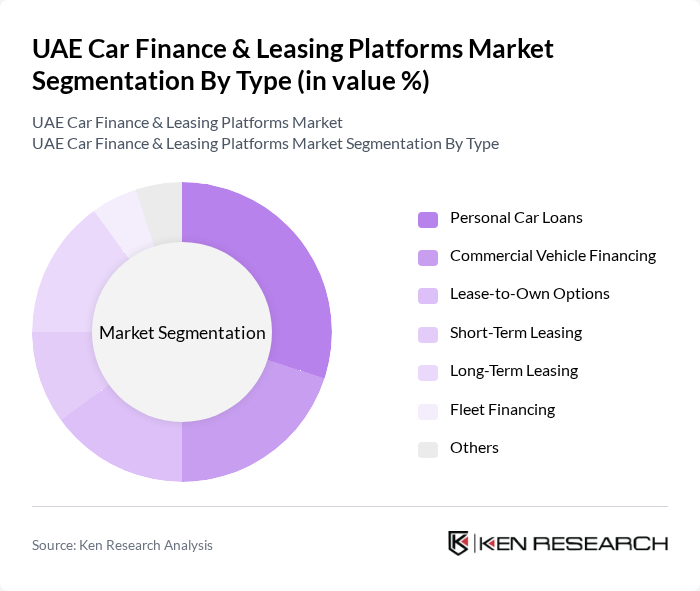

By Type:The market is segmented into various types of financing options, including Personal Car Loans, Commercial Vehicle Financing, Lease-to-Own Options, Short-Term Leasing, Long-Term Leasing, Fleet Financing, and Others. Each of these segments caters to different consumer needs and preferences, influencing their market share and growth potential.

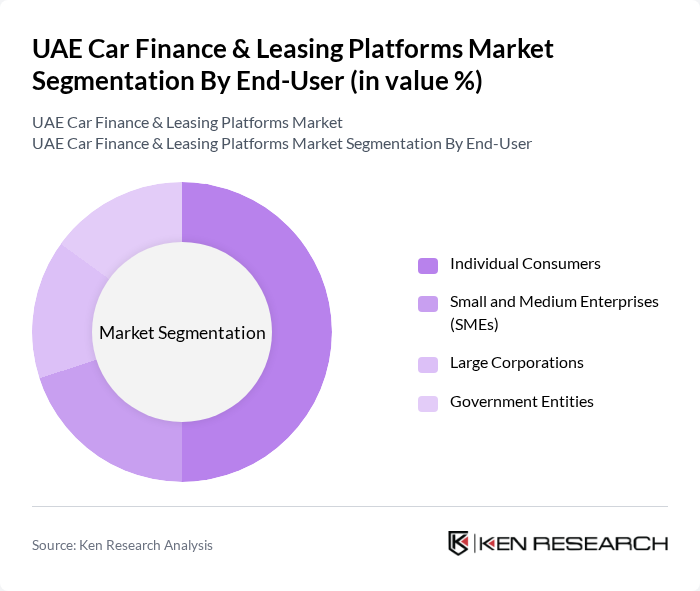

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Each segment has distinct financing needs, with individual consumers typically seeking personal loans, while SMEs and corporations may require fleet financing or commercial vehicle loans.

The UAE Car Finance & Leasing Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates NBD, Abu Dhabi Commercial Bank, Dubai Islamic Bank, Al-Futtaim Group, Al Habtoor Group, Noor Bank, RAK Bank, First Abu Dhabi Bank, Sharjah Islamic Bank, Union Insurance, Abu Dhabi Finance, Al Qudra Holding, Emirates Finance, Noor Takaful, Al-Mazaya Holding contribute to innovation, geographic expansion, and service delivery in this space.

The UAE car finance and leasing market is poised for significant transformation, driven by technological advancements and changing consumer preferences. The shift towards digital finance platforms is expected to streamline the financing process, enhancing customer experience. Additionally, the growing interest in electric vehicles will likely create new financing models tailored to eco-conscious consumers. As the market evolves, partnerships between finance companies and automotive manufacturers will further enhance product offerings, ensuring a competitive landscape that meets diverse consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Car Loans Commercial Vehicle Financing Lease-to-Own Options Short-Term Leasing Long-Term Leasing Fleet Financing Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Sales Channel | Direct Sales Online Platforms Dealership Partnerships Financial Institutions |

| By Financing Type | Fixed Rate Financing Variable Rate Financing Balloon Payment Financing |

| By Vehicle Type | Sedans SUVs Trucks Electric Vehicles |

| By Duration | Short-Term Financing Medium-Term Financing Long-Term Financing |

| By Customer Segment | First-Time Buyers Repeat Buyers Corporate Clients Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Car Financing | 150 | Car Buyers, Financial Advisors |

| Corporate Car Leasing | 100 | Fleet Managers, Procurement Officers |

| Online Car Leasing Platforms | 80 | Digital Marketing Managers, Product Managers |

| Automotive Dealership Financing | 70 | Dealership Owners, Sales Managers |

| Regulatory Impact on Financing | 60 | Policy Makers, Regulatory Affairs Managers |

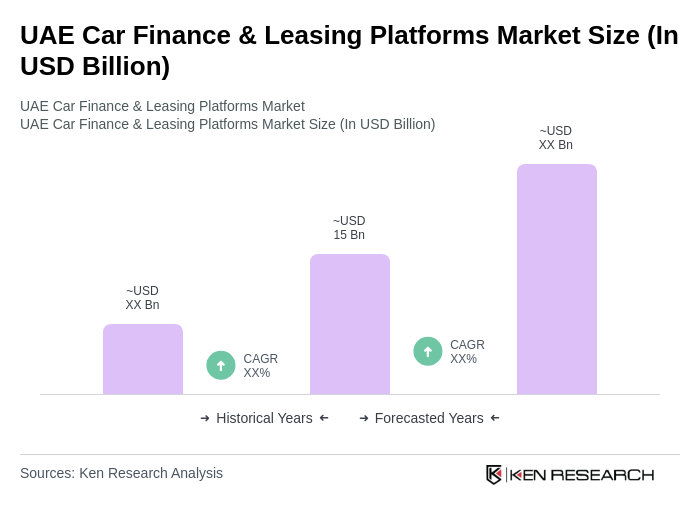

The UAE Car Finance & Leasing Platforms Market is valued at approximately USD 15 billion, reflecting a robust growth trajectory driven by increasing consumer demand for personal vehicles and favorable financing options from financial institutions.