Region:Asia

Author(s):Shubham

Product Code:KRAB1298

Pages:83

Published On:October 2025

By Type:The market is segmented into various types of leasing options, including personal leasing, business leasing, fleet leasing, operating lease, finance lease, short-term leasing, subscription-based leasing, used car leasing, and others.Personal leasingis increasingly popular among individual consumers seeking flexibility and lower upfront costs, whilebusiness leasingis preferred by companies aiming to optimize fleet management and cash flow.Fleet leasingis especially favored by large corporations that require multiple vehicles for operational efficiency. The market also reflects growth in subscription-based models and used car leasing, driven by evolving consumer preferences for mobility solutions and cost-effectiveness.

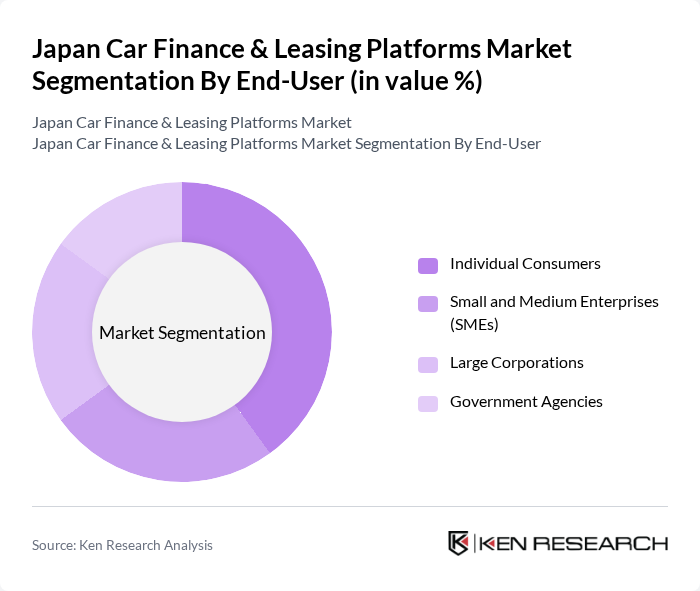

By End-User:The end-user segmentation includes individual consumers, small and medium enterprises (SMEs), large corporations, and government agencies.Individual consumersincreasingly opt for leasing as a cost-effective alternative to vehicle ownership, benefiting from lower upfront costs and flexible terms.SMEsutilize leasing to manage cash flow and reduce capital expenditures, whilelarge corporationsleverage leasing for efficient fleet management.Government agenciesalso participate in leasing to maintain operational vehicle fleets with budgetary efficiency.

The Japan Car Finance & Leasing Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toyota Financial Services Corporation, Honda Financial Services (Honda Finance Corporation Ltd.), Nissan Financial Services Co., Ltd., Mitsubishi UFJ Lease & Finance Company Limited, Aioi Nissay Dowa Insurance Co., Ltd., Sumitomo Mitsui Trust Bank, Limited, ORIX Corporation, JACCS Co., Ltd., SBI Sumishin Net Bank, Ltd., Rakuten Group, Inc. (Rakuten Car Leasing), Aozora Bank, Ltd., Mizuho Bank, Ltd., Resona Bank, Limited, Credit Saison Co., Ltd., Japan Finance Corporation (JFC) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan car finance and leasing market appears promising, driven by technological advancements and evolving consumer preferences. As digital platforms continue to gain traction, the integration of artificial intelligence and data analytics will enhance customer experiences and streamline operations. Additionally, the increasing focus on sustainability will likely lead to more tailored financing solutions for electric and hybrid vehicles, aligning with government initiatives aimed at reducing carbon emissions and promoting eco-friendly transportation options.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Leasing Business Leasing Fleet Leasing Operating Lease Finance Lease Short-term Leasing Subscription-based Leasing Used Car Leasing Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Agencies |

| By Vehicle Type | Passenger Cars Commercial Vehicles Electric Vehicles (EVs) Hybrid Vehicles Luxury Vehicles |

| By Payment Structure | Fixed Payments Variable Payments Deferred Payments |

| By Lease Duration | Short-term Leases (<1 year) Medium-term Leases (1-3 years) Long-term Leases (>3 years) |

| By Distribution Channel | Online Platforms Dealerships Direct Sales Mobile Apps |

| By Financing Source | Banks Credit Unions Non-Banking Financial Companies (NBFCs) Captive Finance Companies Fintech Platforms Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Car Financing | 120 | Recent Car Buyers, Financial Decision Makers |

| Leasing Options Analysis | 80 | Leasing Managers, Automotive Financial Advisors |

| Commercial Fleet Financing | 60 | Fleet Managers, Business Owners |

| Consumer Preferences in Leasing vs. Buying | 100 | General Consumers, Automotive Enthusiasts |

| Impact of Economic Factors on Financing Choices | 70 | Economists, Financial Analysts |

The Japan Car Finance & Leasing Platforms Market is valued at approximately USD 50 billion, reflecting the combined size of car loan and leasing segments, driven by consumer demand for flexible financing options and the growth of digital platforms.