Region:Asia

Author(s):Geetanshi

Product Code:KRAA8115

Pages:93

Published On:September 2025

By Type:The market is segmented into various types, including Personal Car Financing, Commercial Vehicle Leasing, Fleet Management Solutions, Lease-to-Own Options, Short-Term Rentals, Long-Term Leasing, and Others. Among these, Personal Car Financing is the most dominant segment, driven by the increasing number of individual consumers seeking affordable financing options for personal vehicles. The trend towards ownership and the growing middle class in urban areas contribute significantly to this segment's growth.

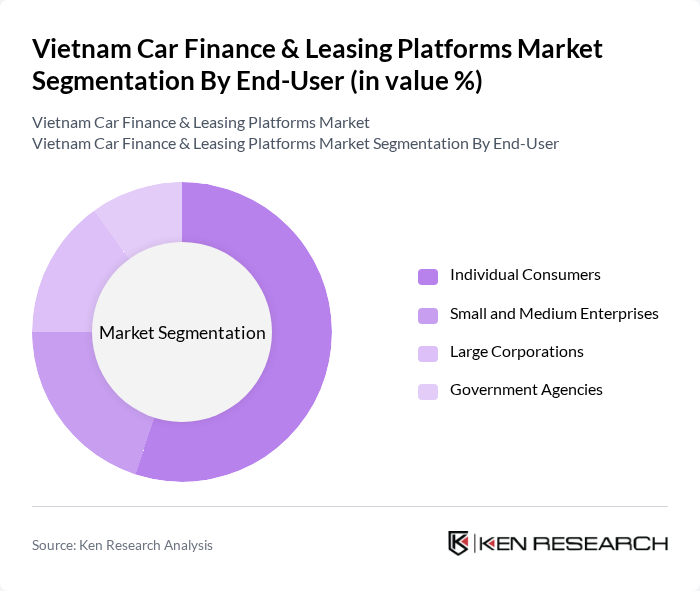

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises, Large Corporations, and Government Agencies. Individual Consumers represent the largest segment, as the growing middle class increasingly opts for personal vehicles. The rise in disposable income and changing consumer preferences towards ownership rather than public transport are key factors driving this segment's dominance.

The Vietnam Car Finance & Leasing Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as VietCapital Finance, BIDV Finance, HDBank Finance, MBBank Finance, VPBank Finance, Techcombank Leasing, Sacombank Finance, Maritime Bank Finance, Agribank Leasing, LienVietPostBank Finance, SHB Finance, ACB Finance, SeABank Finance, OCB Finance, TPBank Finance contribute to innovation, geographic expansion, and service delivery in this space.

As Vietnam's economy continues to grow, the car finance and leasing market is poised for significant transformation. The increasing adoption of digital technologies will streamline financing processes, making them more accessible to consumers. Additionally, the rise of electric vehicles will create new financing models tailored to environmentally conscious consumers. With a focus on enhancing customer experience and expanding service offerings, companies in this sector are likely to innovate and adapt to changing market dynamics, ensuring sustainable growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Car Financing Commercial Vehicle Leasing Fleet Management Solutions Lease-to-Own Options Short-Term Rentals Long-Term Leasing Others |

| By End-User | Individual Consumers Small and Medium Enterprises Large Corporations Government Agencies |

| By Financing Model | Traditional Loans Operating Leases Financial Leases Hire Purchase |

| By Payment Structure | Fixed Payments Variable Payments Balloon Payments |

| By Vehicle Type | Sedans SUVs Trucks Vans |

| By Duration of Lease | Short-Term (Less than 1 year) Medium-Term (1-3 years) Long-Term (More than 3 years) |

| By Region | Northern Vietnam Central Vietnam Southern Vietnam Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Car Financing | 150 | Car Buyers, Financial Advisors |

| Leasing Services for Corporates | 100 | Fleet Managers, Corporate Finance Officers |

| Automotive Dealership Financing | 80 | Dealership Owners, Sales Managers |

| Consumer Awareness and Preferences | 120 | Potential Car Buyers, Financial Literacy Advocates |

| Impact of Digital Platforms on Financing | 90 | Tech-savvy Consumers, Digital Finance Experts |

The Vietnam Car Finance & Leasing Platforms Market is valued at approximately USD 2.5 billion, reflecting significant growth driven by increasing consumer demand for personal vehicles and the expansion of e-commerce and logistics sectors requiring vehicle financing.