Region:Europe

Author(s):Shubham

Product Code:KRAB5662

Pages:83

Published On:October 2025

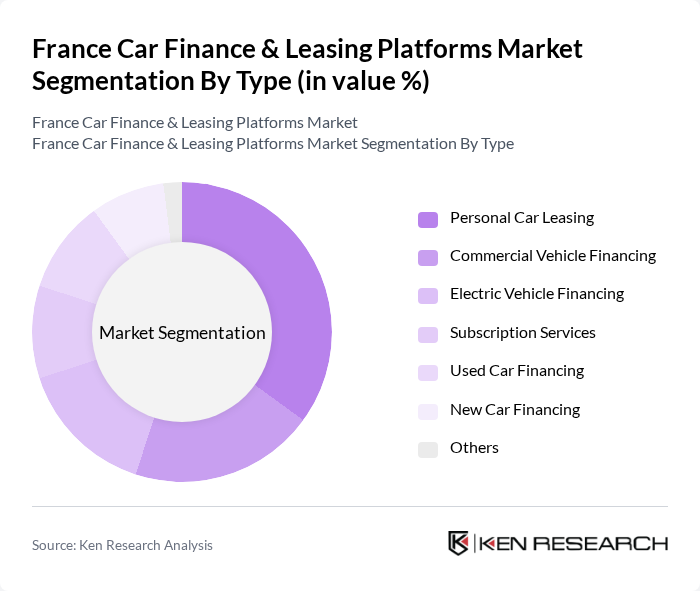

By Type:

The market is segmented into various types, including Personal Car Leasing, Commercial Vehicle Financing, Electric Vehicle Financing, Subscription Services, Used Car Financing, New Car Financing, and Others. Among these, Personal Car Leasing has emerged as the dominant segment, driven by consumer preferences for flexibility and lower upfront costs. The trend towards urbanization and the increasing number of young professionals seeking convenient transportation solutions have further bolstered this segment. Subscription Services are also gaining traction, appealing to consumers looking for hassle-free ownership experiences.

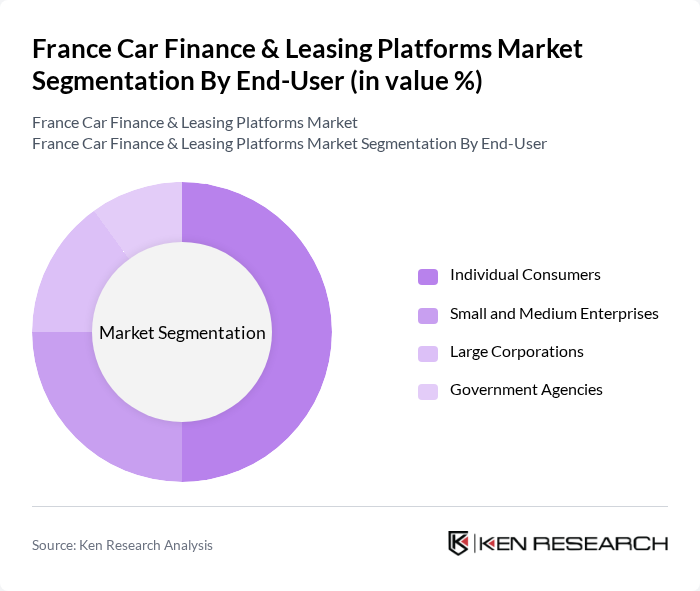

By End-User:

The end-user segmentation includes Individual Consumers, Small and Medium Enterprises, Large Corporations, and Government Agencies. Individual Consumers represent the largest segment, driven by the increasing preference for personal mobility solutions and the convenience of financing options. Small and Medium Enterprises are also significant contributors, as they seek flexible financing to manage their vehicle fleets efficiently. The growing trend of remote work has further increased the demand for personal vehicles among individuals, solidifying their position as the leading end-user segment.

The France Car Finance & Leasing Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as BNP Paribas, Société Générale, Crédit Agricole, ALD Automotive, Arval, LeasePlan, Volkswagen Financial Services, Daimler Financial Services, PSA Finance, Renault Financial Services, Toyota Financial Services, FCA Bank, BCA Marketplace, Cetelem, Oney Bank contribute to innovation, geographic expansion, and service delivery in this space.

The future of the France car finance and leasing platforms market appears promising, driven by ongoing technological advancements and a growing emphasis on sustainability. As digital solutions continue to evolve, companies are expected to enhance customer experiences through personalized financing options. Additionally, the increasing adoption of electric vehicles will likely create new financing models, catering to environmentally conscious consumers. The market is poised for transformation, with innovative partnerships and subscription-based services emerging as key trends in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Car Leasing Commercial Vehicle Financing Electric Vehicle Financing Subscription Services Used Car Financing New Car Financing Others |

| By End-User | Individual Consumers Small and Medium Enterprises Large Corporations Government Agencies |

| By Sales Channel | Direct Sales Online Platforms Dealerships Brokers |

| By Financing Model | Lease-to-Own Traditional Leasing Loan Financing Subscription Services |

| By Vehicle Type | Passenger Cars Commercial Vehicles Electric Vehicles Luxury Vehicles |

| By Duration of Financing | Short-term Financing Medium-term Financing Long-term Financing |

| By Region | Île-de-France Auvergne-Rhône-Alpes Provence-Alpes-Côte d'Azur Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Car Financing | 150 | Recent car buyers, Financial Advisors |

| Leasing Options for Businesses | 100 | Fleet Managers, Business Owners |

| Impact of Digital Platforms | 80 | IT Managers, Digital Marketing Specialists |

| Consumer Preferences in Financing | 120 | Car Buyers, Financial Analysts |

| Regulatory Impact Assessment | 70 | Policy Makers, Legal Advisors |

The France Car Finance & Leasing Platforms Market is valued at approximately USD 25 billion, reflecting a significant growth trend driven by consumer demand for flexible financing options, the rise of electric vehicles, and the increasing popularity of subscription services.