Region:Africa

Author(s):Dev

Product Code:KRAB5444

Pages:83

Published On:October 2025

By Type:The market is segmented into various types, including Clothing, Footwear, Accessories, Activewear, Formal Wear, Casual Wear, and Others. Among these, Clothing is the leading sub-segment, driven by the diverse fashion preferences of consumers and the increasing availability of local and international brands. Footwear and Accessories also hold significant market shares, as consumers seek to complement their outfits with stylish and functional items. The demand for Activewear has surged, particularly among the younger demographic, reflecting a growing trend towards fitness and wellness.

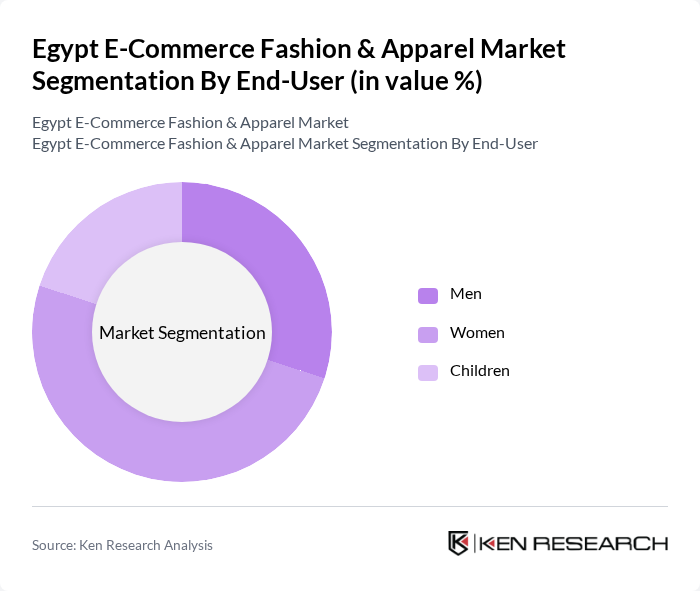

By End-User:The market is categorized into Men, Women, and Children. The Women segment dominates the market, driven by a higher inclination towards fashion and online shopping. Women are more likely to purchase clothing and accessories online, influenced by social media trends and marketing strategies targeting female consumers. The Men segment is also significant, with increasing interest in fashion and online shopping, while the Children segment is growing as parents seek convenient shopping options for their kids.

The Egypt E-Commerce Fashion & Apparel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jumia Egypt, Souq.com (Amazon), Ounass, Namshi, Basharacare, Zara Egypt, H&M Egypt, Mango Egypt, Modanisa, Shein Egypt, Adidas Egypt, Nike Egypt, LC Waikiki, Pull & Bear Egypt, Bershka Egypt contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Egypt e-commerce fashion and apparel market appears promising, driven by technological advancements and changing consumer behaviors. As internet penetration and mobile commerce continue to rise, businesses are likely to adopt innovative strategies to enhance customer engagement. Additionally, the focus on sustainability and ethical fashion is expected to shape consumer preferences, leading to a more responsible shopping culture. Companies that adapt to these trends will likely capture a larger market share and foster long-term growth in this dynamic sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Clothing Footwear Accessories Activewear Formal Wear Casual Wear Others |

| By End-User | Men Women Children |

| By Sales Channel | Online Marketplaces Brand Websites Social Media Platforms |

| By Price Range | Budget Mid-Range Premium |

| By Material | Cotton Polyester Leather Synthetic |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers |

| By Occasion | Casual Formal Sports Seasonal |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Apparel Retailers | 150 | Marketing Managers, E-commerce Directors |

| Fashion Influencers and Bloggers | 100 | Content Creators, Social Media Managers |

| Consumer Behavior in Fashion E-commerce | 200 | Online Shoppers, Trend Analysts |

| Logistics and Supply Chain in Fashion | 80 | Logistics Managers, Supply Chain Analysts |

| Market Trends and Forecasts | 120 | Industry Experts, Market Analysts |

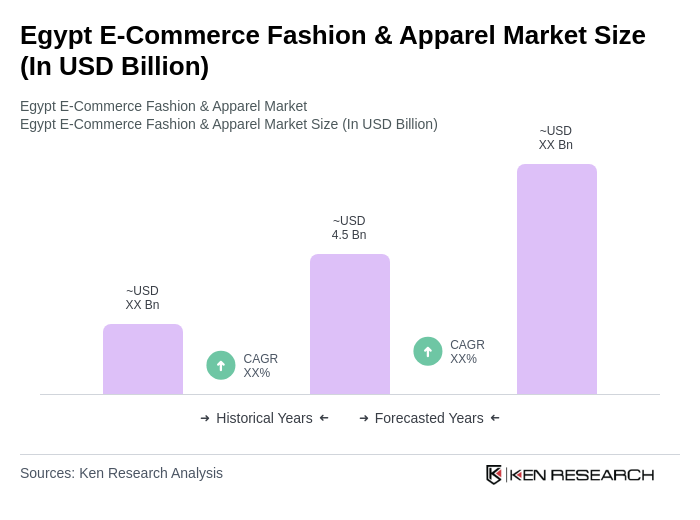

The Egypt E-Commerce Fashion & Apparel Market is valued at approximately USD 4.5 billion, reflecting significant growth driven by increased internet penetration, mobile commerce, and changing consumer preferences towards online shopping.