Region:Africa

Author(s):Rebecca

Product Code:KRAB4185

Pages:90

Published On:October 2025

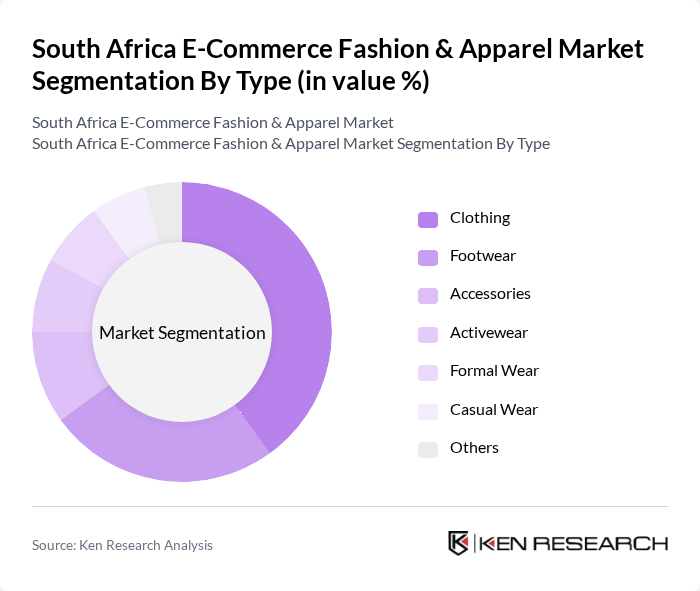

By Type:The market is segmented into Clothing, Footwear, Accessories, Activewear, Formal Wear, Casual Wear, and Others. Each segment addresses distinct consumer needs and preferences, with Clothing remaining the most dominant due to its essential role in daily life and broad appeal across demographics. Footwear and Accessories also show strong growth, supported by increased online brand launches and influencer-driven trends .

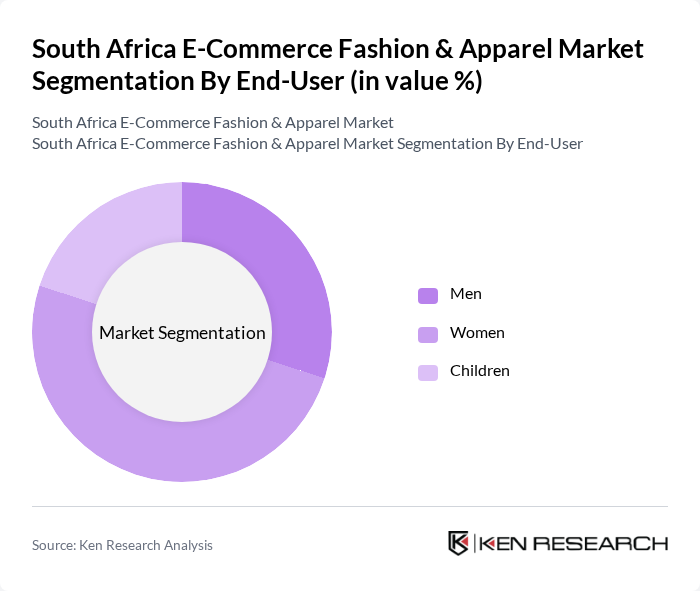

By End-User:The market is also segmented by end-user demographics: Men, Women, and Children. Each group exhibits unique purchasing behaviors, with Women representing the largest segment due to their diverse fashion choices and higher average spending in apparel. Men and Children segments are also expanding, driven by targeted marketing and increased product variety .

The South Africa E-Commerce Fashion & Apparel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zando, Superbalist, Takealot, Mr Price, Woolworths, The Foschini Group (TFG/Bash), Edgars, Truworths, Cotton On, H&M South Africa, Forever New, Nike South Africa, Adidas South Africa, Levi's South Africa, Shein South Africa, Amazon South Africa, Pick n Pay Clothing, Checkers Sixty60 (Fashion) contribute to innovation, geographic expansion, and service delivery in this space .

The South African e-commerce fashion market is poised for substantial growth, driven by technological advancements and evolving consumer behaviors. As internet access continues to expand, more consumers are expected to embrace online shopping. Additionally, the integration of advanced payment solutions and enhanced logistics will likely improve the overall shopping experience. Brands that prioritize sustainability and engage with consumers through social media will be well-positioned to capture market share, fostering long-term loyalty and driving sales in this dynamic landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Clothing Footwear Accessories Activewear Formal Wear Casual Wear Others |

| By End-User | Men Women Children |

| By Sales Channel | Online Marketplaces Brand Websites Social Media Platforms |

| By Price Range | Budget Mid-Range Premium |

| By Material | Cotton Polyester Leather Synthetic |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers Trend-Focused Customers |

| By Region | Gauteng Western Cape KwaZulu-Natal Eastern Cape Mpumalanga Limpopo Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Fashion Retailers | 100 | eCommerce Managers, Marketing Directors |

| Consumer Insights on Apparel Purchases | 120 | Fashion Consumers, Online Shoppers |

| Logistics and Supply Chain in Fashion E-commerce | 80 | Logistics Managers, Supply Chain Analysts |

| Fashion Brand Managers | 40 | Brand Managers, Product Development Leads |

| Market Trends and Consumer Behavior | 60 | Market Researchers, Trend Analysts |

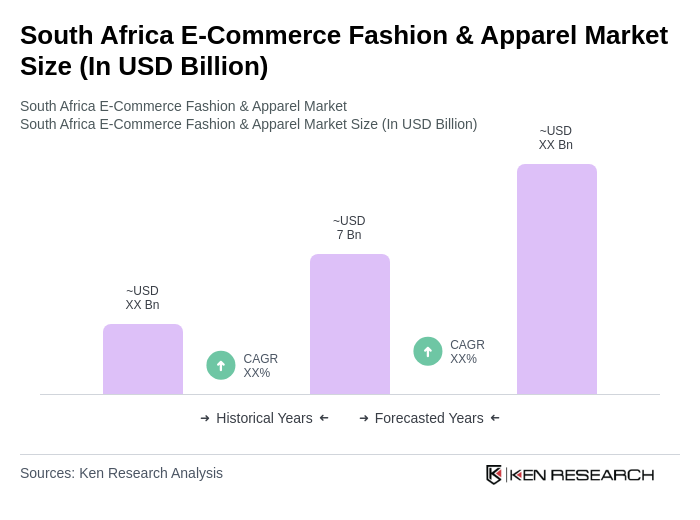

The South Africa E-Commerce Fashion & Apparel Market is valued at approximately USD 7 billion, reflecting significant growth driven by increased internet penetration, mobile commerce adoption, and changing consumer preferences towards online shopping.