Region:Africa

Author(s):Geetanshi

Product Code:KRAB5758

Pages:98

Published On:October 2025

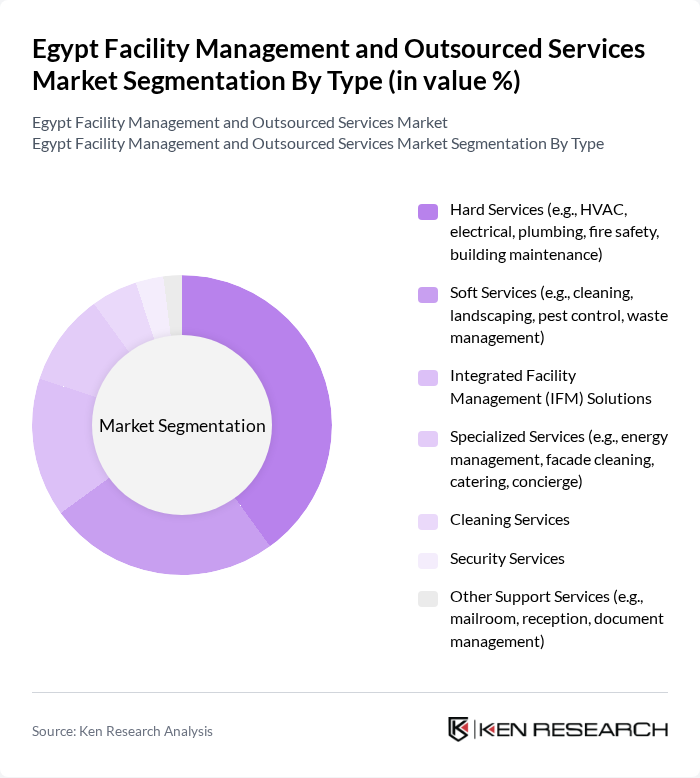

By Type:

The market is segmented into Hard Services, Soft Services, Integrated Facility Management (IFM) Solutions, Specialized Services, Cleaning Services, Security Services, and Other Support Services.Hard Servicescontinue to dominate the market, driven by the essential nature of maintenance, repair, and technical services required to ensure facility safety and operational continuity. The increasing complexity of building systems, adoption of smart technologies, and stricter compliance requirements further accelerate demand for Hard Services .

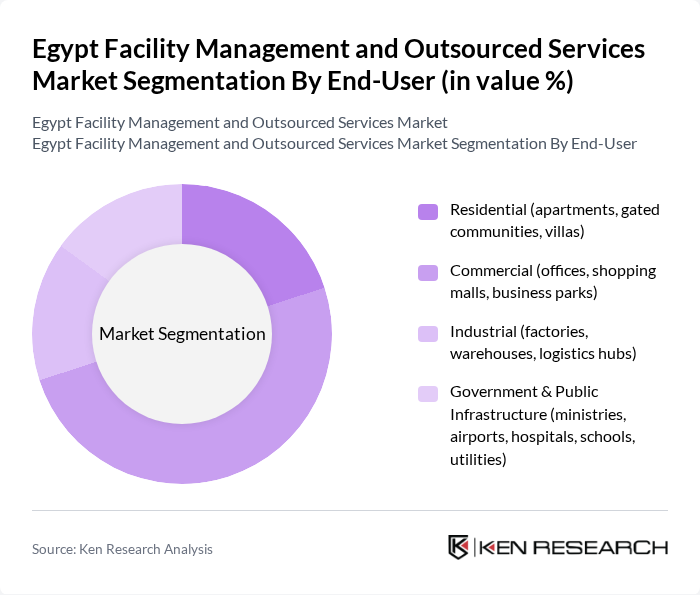

By End-User:

The end-user segmentation includes Residential, Commercial, Industrial, and Government & Public Infrastructure. TheCommercial sectorleads the market, supported by the expansion of office spaces, shopping malls, and business parks in urban centers. Demand from this segment is propelled by the need for professional facility management to ensure operational efficiency, regulatory compliance, and enhanced occupant experiences. The Industrial and Government segments also show steady growth due to ongoing infrastructure projects and modernization of public services .

The Egypt Facility Management and Outsourced Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as EFS Facilities Services Egypt, G4S Egypt, Apleona Egypt, JLL Egypt (Jones Lang LaSalle), CBRE Egypt, Enova Egypt, Sodexo Egypt, ISS Facility Services Egypt, Al Bonian Facilities Management, Egypro FME (Wadi Degla Holding), Allied Universal Egypt, Al Arabia for Facilities Management, CFM (Comprehensive Facility Management), DMG Facility Management (Mountain View Group), and Transguard Group Egypt contribute to innovation, geographic expansion, and service delivery in this space.

The future of the facility management and outsourced services market in Egypt appears promising, driven by technological advancements and a growing emphasis on sustainability. As smart building technologies gain traction, companies are expected to adopt IoT solutions for enhanced operational efficiency. Additionally, the increasing focus on health and safety standards will likely shape service offerings, ensuring that facilities meet evolving regulatory requirements and consumer expectations, ultimately fostering market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services (e.g., HVAC, electrical, plumbing, fire safety, building maintenance) Soft Services (e.g., cleaning, landscaping, pest control, waste management) Integrated Facility Management (IFM) Solutions Specialized Services (e.g., energy management, facade cleaning, catering, concierge) Cleaning Services Security Services Other Support Services (e.g., mailroom, reception, document management) |

| By End-User | Residential (apartments, gated communities, villas) Commercial (offices, shopping malls, business parks) Industrial (factories, warehouses, logistics hubs) Government & Public Infrastructure (ministries, airports, hospitals, schools, utilities) |

| By Service Model | Outsourced Facility Management In-House Facility Management |

| By Sector | Healthcare Education Retail Hospitality & Tourism |

| By Contract Type | Fixed-Price Contracts Time and Materials Contracts |

| By Geographic Coverage | Greater Cairo Alexandria Other Regions (Delta, Upper Egypt, Suez Canal, Red Sea) |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Facility Management | 90 | Facility Managers, Operations Directors |

| Residential Outsourced Services | 60 | Property Managers, Homeowners Association Leaders |

| Industrial Facility Maintenance | 50 | Maintenance Supervisors, Safety Officers |

| Healthcare Facility Management | 40 | Healthcare Administrators, Facility Coordinators |

| Educational Institution Services | 45 | School Administrators, Facility Operations Managers |

The Egypt Facility Management and Outsourced Services Market is valued at approximately USD 2.3 billion, reflecting significant growth driven by urbanization, infrastructure investment, and the demand for efficient facility management across various sectors.